Housing market experts forecast limited inventory, high home prices through 2024: Zillow

A new Zillow study of housing authorities forecasts 9{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} countrywide household value advancement in 2022 thanks to substantial acquire desire and minimal stock. (iStock)

Irrespective of hopes that growing home finance loan rates will cool off the aggressive serious estate current market, housing supply and listing price ranges it may not return to pre-pandemic ranges at any time quickly.

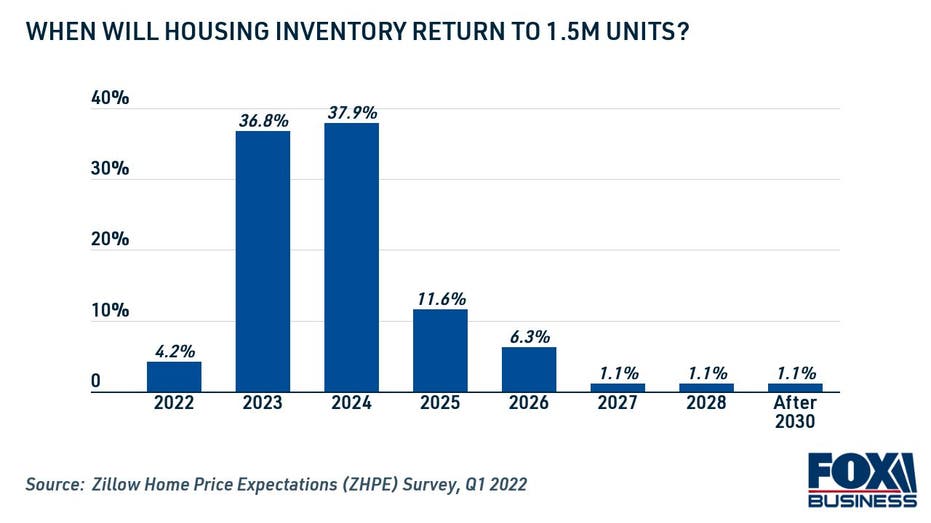

Serious estate specialists polled in the most current Zillow Home Cost Anticipations Survey (ZPHE) think that housing stock will not return to a every month common of at minimum 1.5 million readily available models right until the conclusion of 2024. Economists also concur that property cost appreciation will sluggish down but go on to mature in excess of the next numerous several years.

THE METRO Spots In which Us residents MOVED TO — AND Absent FROM — IN 2021

“We are viewing new listings returning to the market, gradually, as we enter the most popular advertising season of the year, but this source deficit is heading to get a extensive time to fill,” Zillow Senior Economist Jeff Tucker said.

Keep studying to master more about Zillow’s most recent housing marketplace forecast. And if you might be looking at shopping for a house or refinancing your property finance loan this yr, you can take a look at Credible to compare fascination fees for free of charge without impacting your credit score score.

NEW Home loan PAYMENTS Leap 8{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} IN FEBRUARY AMID SOARING Costs, Residence Prices

Household value appreciation fees may slow, but yearly will increase to keep on being significant

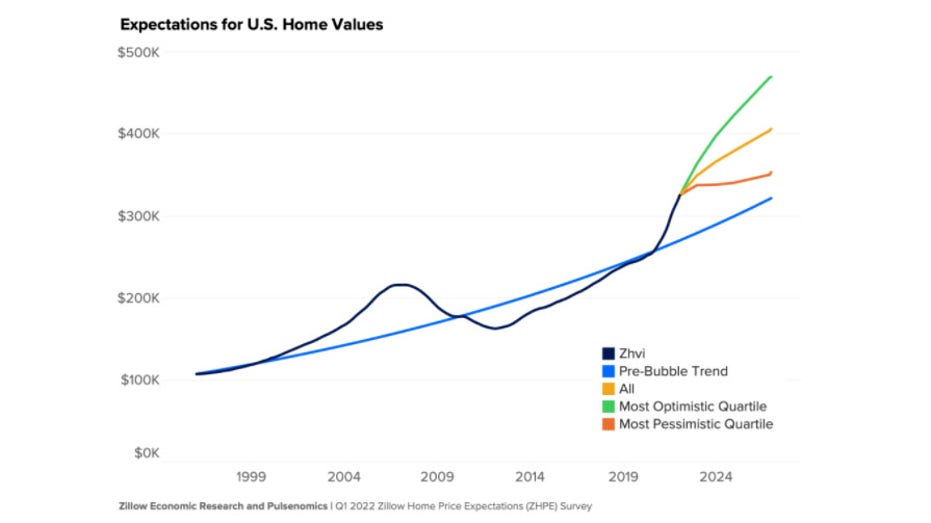

Household value appreciation was 19{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in 2021 owing to confined provide coupled with sturdy demand from customers from homebuyers seeking to consider edge of minimal house loan prices. And though surging fascination rates may well cause need to gradual down, gurus surveyed by Zillow still assume median prices to continue on soaring 9{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in 2022 as inventory struggles to rebound.

On average, survey respondents forecast 26.8{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} residence selling price gains about the next 5 years. The most bullish respondents assume property selling price gains of 46.5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} by the end of 2026, while conservative estimates forecast a 10.3{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} amount of appreciation in that time.

Greater Academic Accomplishment Will increase HOMEOWNERSHIP Chances

Despite the fact that this might appear intimidating for to start with-time consumers, this healthful prolonged-time period progress forecast features a glimmer of hope for these who are enthusiastic plenty of to get a property in modern competitive market place.

“Inventory and mortgage rates will identify how far and how quick household rates will rise this year and outside of,” Tucker claimed.

If you might be looking at getting a household when mortgage charges are edging higher, it can be significant to store all around across multiple lenders. You can compare home finance loan rates on Credible to discover the least expensive amount probable for your economical circumstance.

FANNIE MAE TO Look at ON-TIME Rent PAYMENTS WHEN UNDERWRITING Mortgages

Recent house owners may well profit from amplified household fairness

Homebuyers usually are not the only shoppers who really should be using notice of soaring residence values. Recent property owners may take into consideration getting gain of report-superior home fairness with a cash-out home finance loan refinance.

Cash-out refinancing is when you get out a larger home loan sum than what you at present owe, pocketing the variance in cash. This might let house owners to spend off substantial-interest debt or finance residence renovations at a reduced fascination level than what is actually offered by an unsecured personalized personal loan.

It truly is significant to take note that refinancing a house loan arrives with closing charges, normally in between 2{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and 5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of the total mortgage total. Furthermore, you are going to want to make sure you are equipped to even now get a competitive mortgage loan amount compared with what you are presently paying.

While home finance loan desire fees are on the rise, some home owners may perhaps however benefit from refinancing. You can see existing mortgage charges in the desk down below to decide if refinancing is worthwhile. Plus, you can get in touch with a well-informed personal loan professional at Credible to establish if property finance loan refinancing is the appropriate financial strategy for you.

FREDDIE MAC TO Bolster Reasonably priced HOUSING Application

Have a finance-associated question, but really don’t know who to question? E-mail The Credible Funds Skilled at [email protected] and your concern may possibly be answered by Credible in our Money Skilled column.