We make $180k per year and live in a 3-room HDB flat. Should we save to buy an investment property, upgrade to a condo, or larger flat?, Lifestyle News

Hello,

We’ve read with interest on your advice columns, and we especially appreciate the effort and detail put into the responses.

My wife and I are in a bit of a dilemma.

We live in a 3-room HDB flat in Clementi Ridges which we bought for close to $400k. Our MOP is up in April this year. We’re in our mid-30s and together we make $15,000 gross a month, with no debts other than our HDB loan. We don’t plan to have kids.

Our goal is to have a retirement nest egg; the question is how best to go about building it. We’re not sure if our next move should be to:

(1) Upgrade to a freehold condo – we’re only interested in one located in Districts 9, 10, 11, 20, or 21;

(2) Save up to buy an additional investment property; or

(3) Upgrade to a larger HDB through resale/2nd BTO.

Sincerely hoping you could share some insights to help in our decision-making. Thank you very much!

1) Outstanding loan – $238,000

2) CPF used plus accrued interest – $128,000 from me + $36,000 from my wife

Hi there!

Thanks for reaching out to us!

It’s always good to start the retirement planning process early, as there is a lot you can do to build that nest egg from now till then. With so many possible pathways to take, it can be difficult to decide on the best option.

We will do our best to shed some light on the possibilities and hopefully, it will make your decision-making process a little easier. Let’s start by looking at affordability.

Affordability

These are some of the recent 3-room transactions for Clementi Ridges:

| Date | Block | Level | Size (sqm) | Price |

| Oct 2022 | 312B | 19 to 21 | 69 | $615,000 |

| Sep 2022 | 312A | 19 to 21 | 69 | $660,000 |

| Sep 2022 | 312B | 16 to 18 | 69 | $660,000 |

| Aug 2022 | 312A | 13 to 15 | 69 | $608,000 |

| Jul 2022 | 312A | 13 to 15 | 69 | $565,000 |

| Jul 2022 | 312A | 13 to 15 | 69 | $638,000 |

| Jul 2022 | 312A | 22 to 24 | 69 | $642,800 |

Source: HDB

We will use the average selling price of $626,971 for calculation purposes.

| Description | Amount |

| Selling price | $626,971 |

| Outstanding loan | $238,000 |

| CPF used plus accrued interest | $164,000 |

| Cash proceeds | $224,971 |

Affordability (For a private property)

| Description | Amount |

| Maximum loan based on a fixed monthly income of $15K and ages 35 | $1,728,055 (30 years tenure) |

| CPF funds | $164,000 |

| Cash | $224,971 |

| Maximum affordability based on CPF and cash of $388,971 | $1,555,884 |

| BSD based on $1,555,884 | $46,835 |

| Estimated affordability | $1,509,049 |

Due to the available amount of CPF and cash that make up the 25per cent downpayment, you will not be able to take the maximum loan

Affordability (For an HDB)

| Description | Amount |

| Maximum loan based on a fixed monthly income of $15K and ages 35 | $852,536 (25 years tenure) |

| CPF funds | $164,000 |

| Cash | $224,971 |

| Total loan + CPF + Cash | $1,241,507 |

| BSD based on | $34,260 |

| Estimated affordability | $1,207,247 |

Option 1: Upgrade to a freehold condo in D9, 10, 11, 20 or 21

With a budget of $1.5 million, you’ll most likely be looking at a 1 + Study or a two-bedder in these locations. As you do not plan to have children, this should suffice but as most of these units are rather compact, it may take some getting used to from a 3-room HDB flat which is typically bigger in comparison.

If you were to do a quick search online, you’ll see that the current pickings are rather slim, and the majority of the developments that fall within this price range are boutique projects.

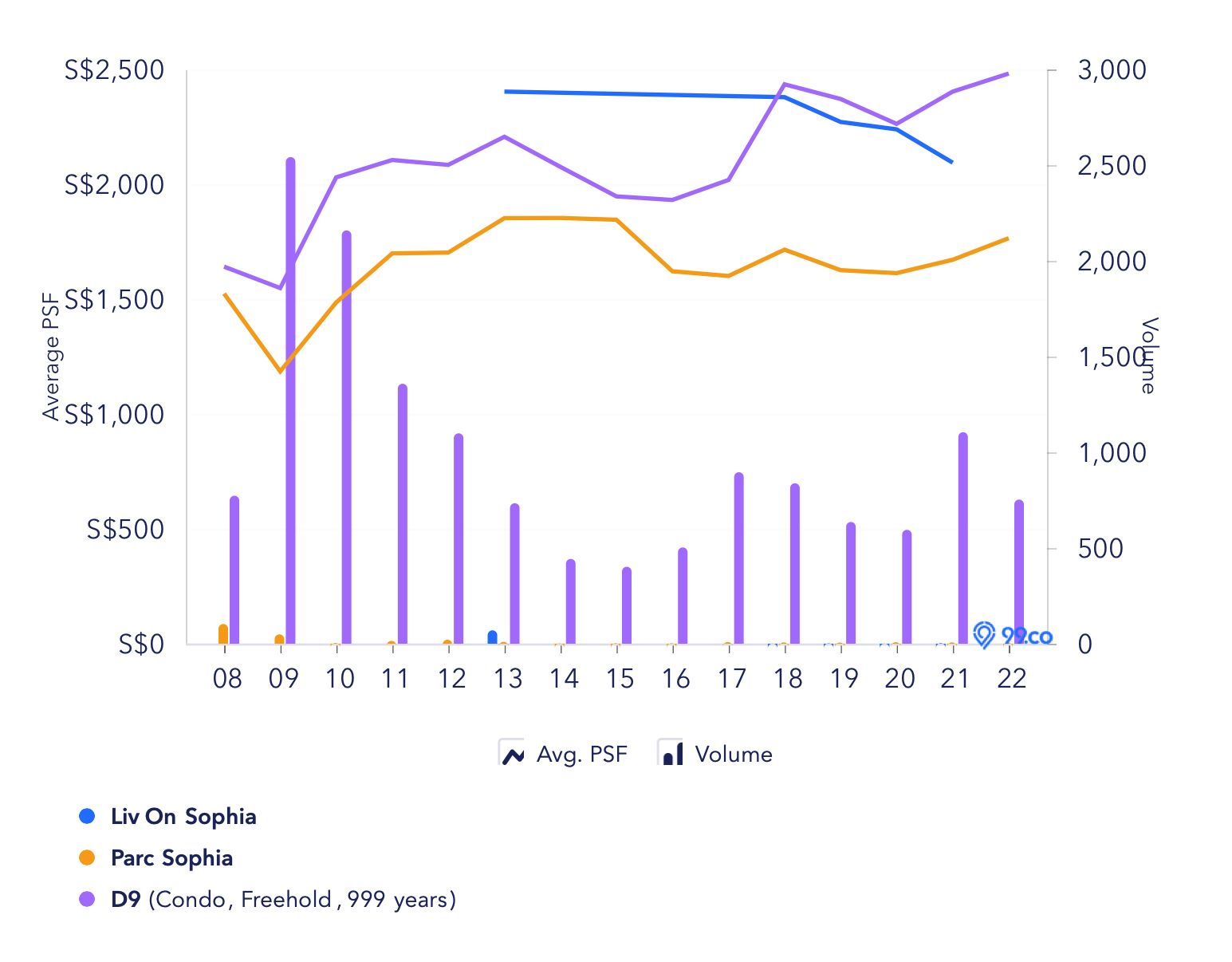

District 9

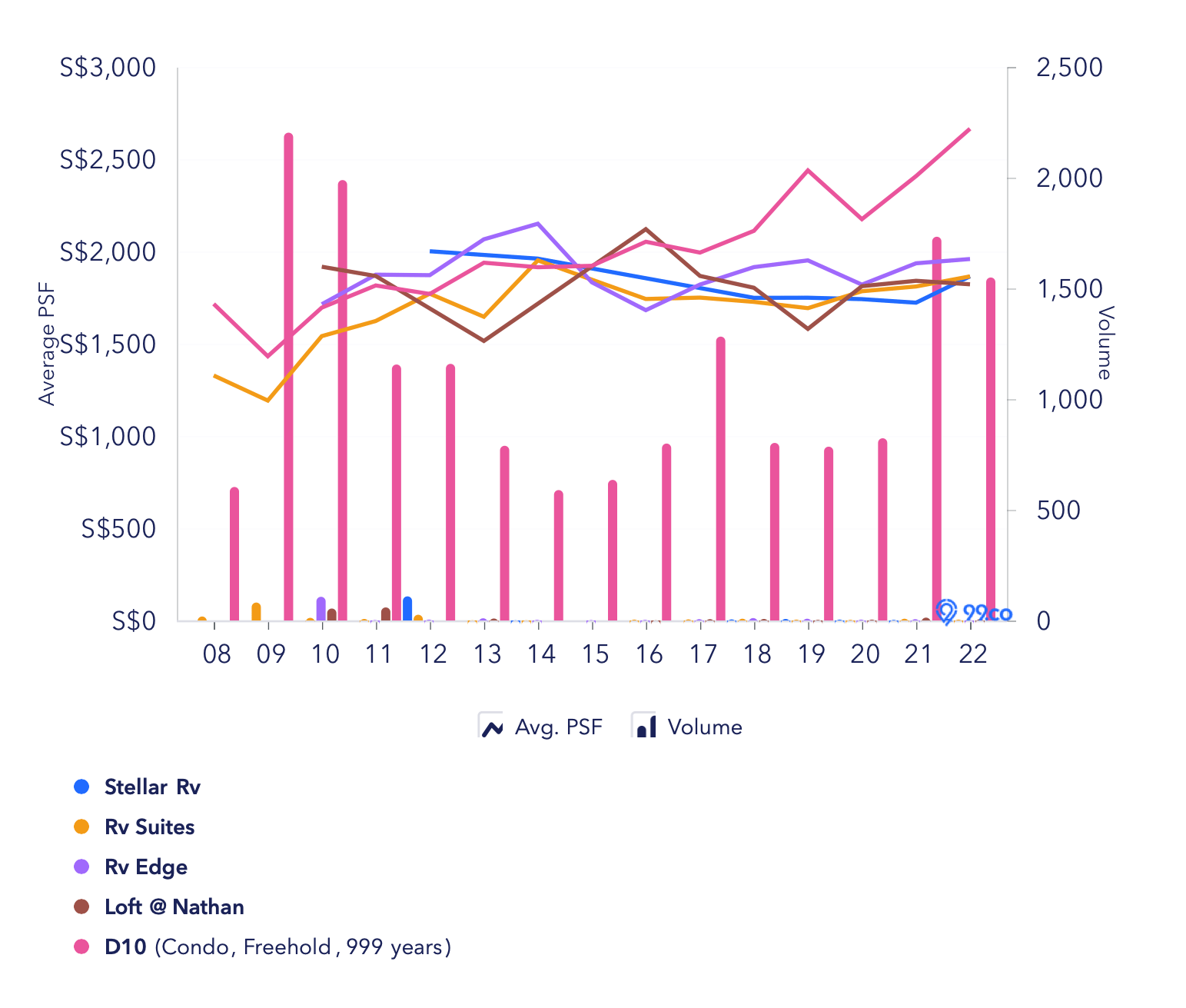

District 9  District 10

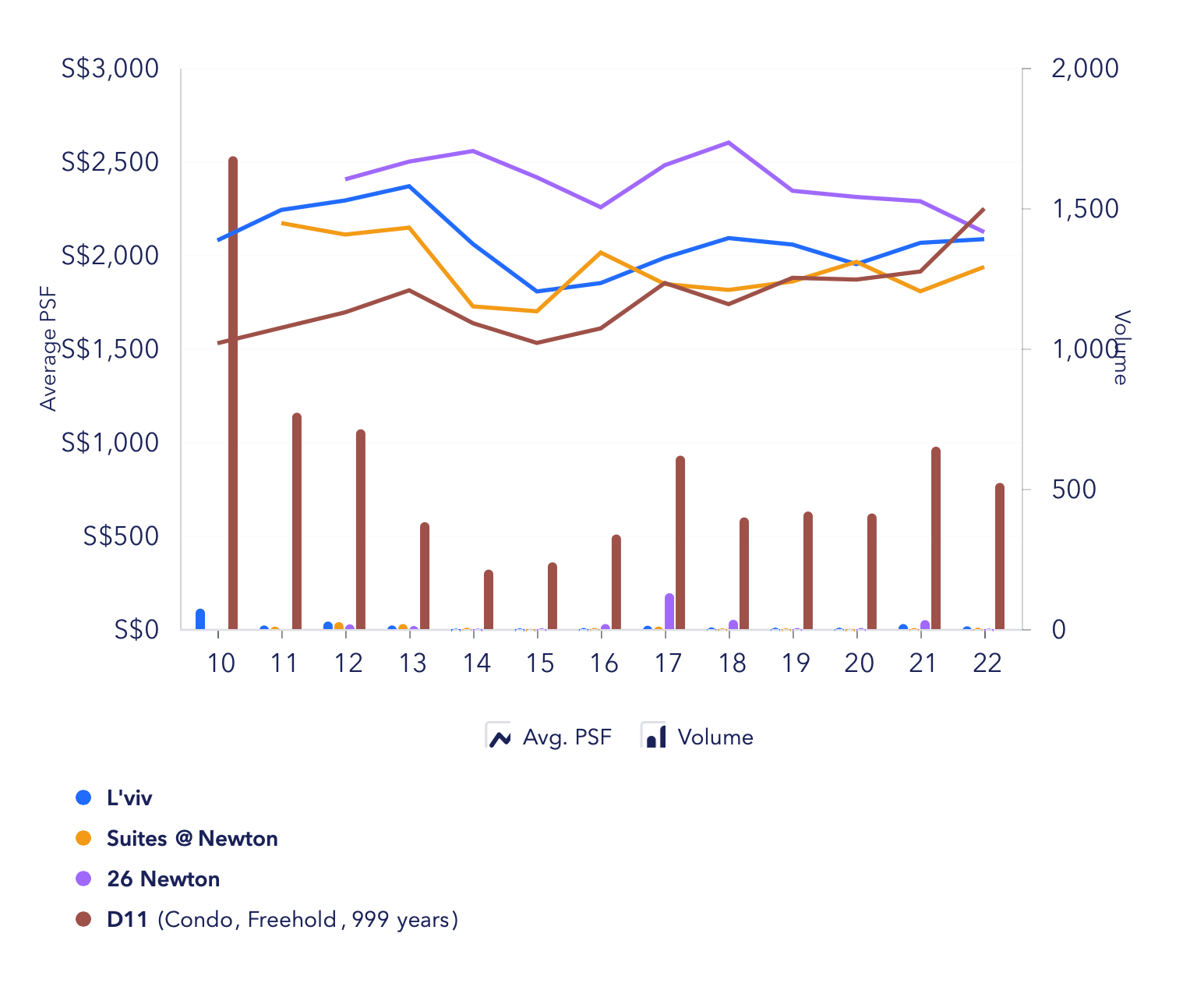

District 10  District 11

District 11  District 21

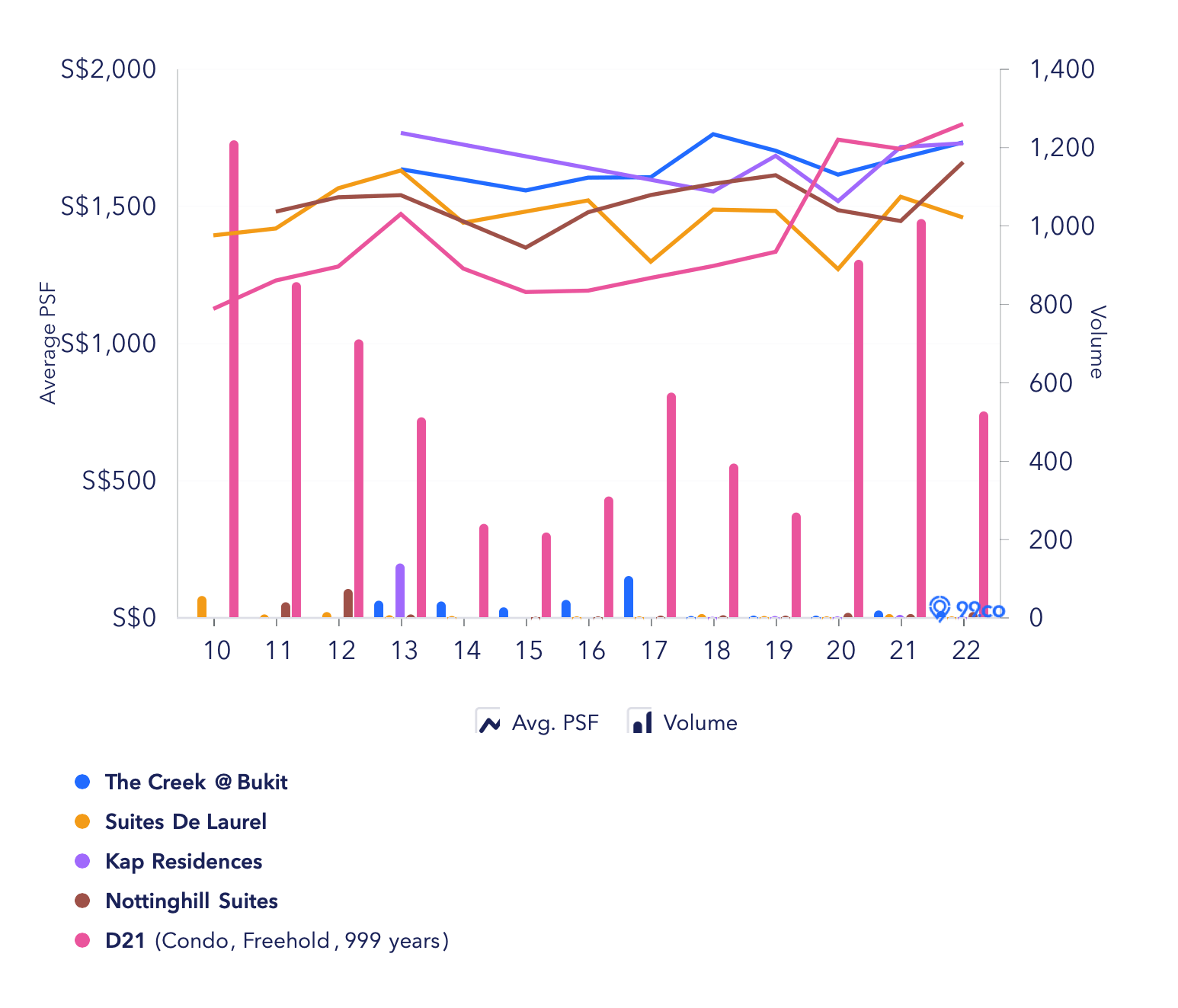

District 21

The developments shown above are those with available units that match your affordability. You’ll notice that after the launch, their transaction volumes are generally low, resulting in the trend lines appearing somewhat volatile. This is a usual concern with boutique developments because if the turnover rates are low, it is difficult for prices to move since banks value a property based on recent transactions. You can see from the graphs that prices are relatively stagnant for most of the projects, as compared to other freehold condos in the same district.

Also, many of these developments are made up of predominantly one and two- bedders which are catered more towards investors since the barriers to entry are lower. This is another issue as investors usually go wherever the money is, so if they find a better investment opportunity, they are less hesitant to let go of their units (even at a loss). This differs from genuine homeowners, who may be emotionally attached to their properties. It is advisable to get a development with a good unit mix, which caters to both homeowners as well as investors as prices are generally more protected.

Compared to an HDB flat, these projects are usually a better potential store of value. This is especially so in the long run as there is no lease decay issue. But if you’re looking for capital appreciation in the short to medium term, these may not be the best options.

That being said, we do believe there is potential for growth in the CCR provided you select the right properties.

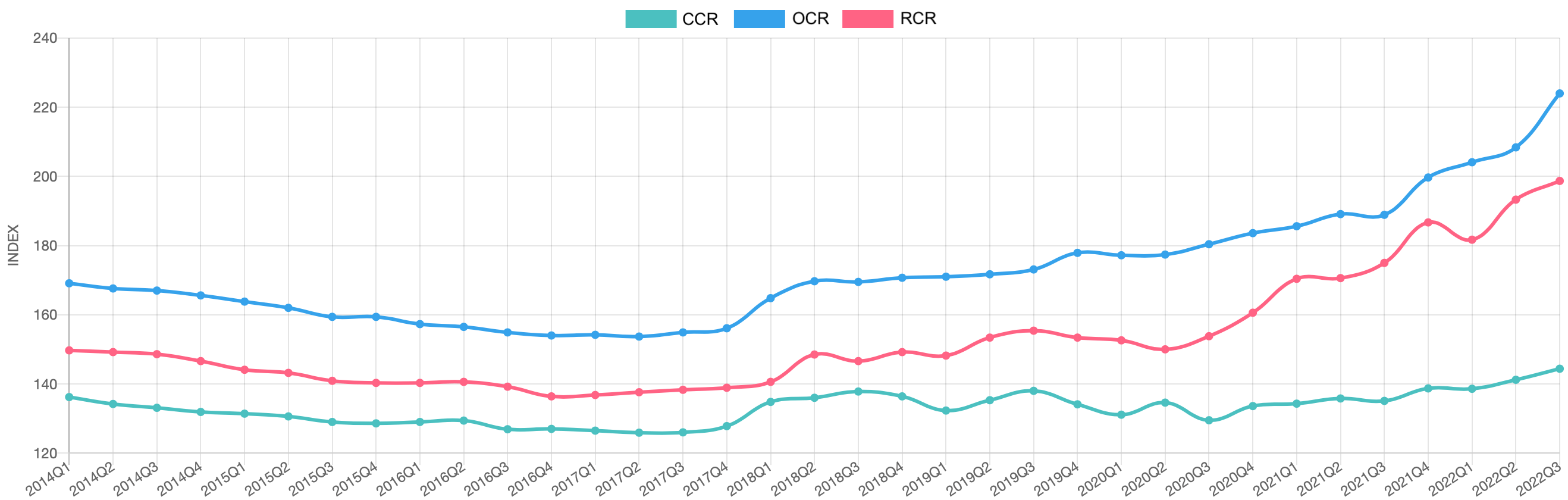

Property Price Index (PPI) of non-landed residential properties in the different regions

Property Price Index (PPI) of non-landed residential properties in the different regions

| Price Indices | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | 2022 (Flash) |

| QoQper cent change | QoQper cent change | QoQper cent change | QoQper cent change | YoY per cent change | QoQper cent change | QoQper cent change | QoQper cent change | QoQper cent change | YoY per cent change | |

| Overall PPI | 3.3 | 0.8 | 1.1 | 5.0 | 10.6 | 0.7 | 3.5 | 3.8 | 0.2 | 8.4 |

| Landed | 6.7 | -0.3 | 2.6 | 3.9 | 13.3 | 4.2 | 2.9 | 1.6 | 0.5 | 9.5 |

| Non-landed | 2.5 | 1.1 | 0.7 | 5.3 | 9.8 | -0.3 | 3.6 | 4.4 | 0.1 | 8.0 |

| CCR | 0.5 | 1.1 | -0.5 | 2.7 | 3.8 | -0.1 | 1.9 | 2.3 | 0.5 | 4.6 |

| RCR | 6.1 | 0.1 | 2.6 | 6.7 | 16.3 | -2.7 | 6.4 | 2.8 | 2.6 | 9.2 |

| OCR | 1.1 | 1.9 | -0.1 | 5.7 | 8.8 | 2.2 | 2.1 | 7.5 | -2.6 | 9.3 |

Source: URA, Propnex Research

Drawing from the Property Price Index (PPI) in the different regions, we can see that prices in the RCR and OCR have appreciated significantly more than in the CCR in recent years. We do expect that prices in the CCR will eventually right themselves and the growth rate will catch up. We have recently also written a piece about the narrowing gap between prices of new RCR and CCR projects, which you can read here.

If CCR prices pick up can we expect prices of these boutique developments to pick up too?

Option 2: Save up to buy an additional investment property

Given that you currently own a flat, which we assume is under both your names, and have an outstanding housing loan, there are several things to take into consideration when purchasing a second property.

Loan-To-Value ratio (LTV)

When purchasing your first property, depending on your income, you may be eligible to loan up to a maximum of 75 per cent of the property value (for a bank loan). However, if you’re purchasing a second property while still repaying an existing mortgage loan for the first one, the LTV drops to 45 per cent of the property value.

Higher downpayment

As the LTV for a second property is reduced, naturally the downpayment increases. The downpayment is split into two portions; minimally 25 per cent needs to be paid in cash and the remaining 30 per cent can be paid using your CPF should you have sufficient funds.

Additional Buyer Stamp Duty (ABSD)

The current ABSD rate for Singaporeans buying a second property is 17 per cent which is on top of the regular BSD. Do note that when purchasing a private property, the stamp duty has to be paid in cash first, as this has to be done within 14 days after you have exercised the Option to Purchase (which isn’t enough time to apply for the withdrawal from CPF), and if you have sufficient funds in your CPF to pay for it, the cash will be reimbursed to you afterward.

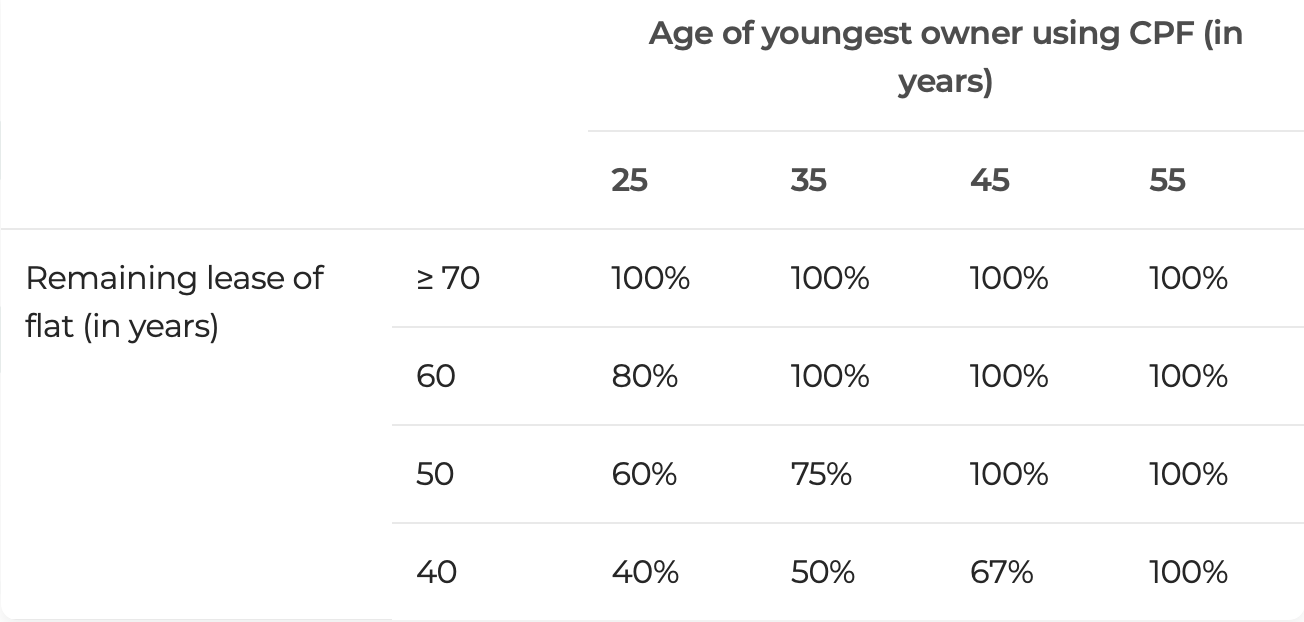

CPF requirements

When buying a second property, you will need to set aside the following before you can utilise your CPF funds for the purchase:

- The latest Basic Retirement Sum (BRS) if you have at least one property bought using CPF or the property that you are buying can cover you till age 95*

- The latest Full Retirement Sum (FRS) if you do not have any property that can cover you till age 95

* If you subsequently sell the property that can cover you till age 95, you will need to set aside the FRS instead.

Also, the maximum amount of CPF that can be used for your second property depends on whether the remaining lease of this property can cover the youngest owner up to the age of 95.

Source: CPF

Source: CPF

Let’s say you were to purchase a second property at $1 million for the sake of simple calculations:

| Description | Amount |

| Purchase price | $1,000,000 |

| 25per cent cash downpayment | $250,000 |

| 30per cent CPF/cash downpayment | $300,000 |

| BSD | $24,600 |

| ABSD of 17per cent | $170,000 |

As we can see from the calculations above, the cash outlay required in order to purchase a second property is pretty substantial and it will likely take a long time to save up.

We’ve written a detailed piece on the merits of paying for the ABSD for an investment property, but in short, it’s not what we’d typically recommend.

Option 3: Upgrade to a larger flat (resale/BTO)

Being able to buy a BTO is a Singaporean privilege, and since we have two chances at it, most individuals/households will try for the second time if they are eligible. Of course, it’s much tougher the second time around given that only two to five per cent of BTO launches are set aside for second-timers. Also, the income ceiling to apply for a BTO is $14,000 which your household has unfortunately (or fortunately) exceeded so you are no longer eligible.

As you’ve mentioned you’re looking to build your retirement nest, buying a flat may not be the best investment choice. It is no doubt a good stepping stone for buyers looking to upgrade since you’d likely make some profits if you bought a BTO, or if you purchased a resale and managed to gain from the CPF Housing Grants.

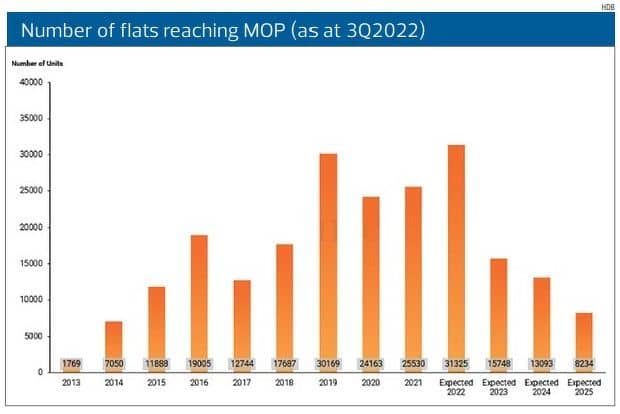

Given the reduced supply of newer MOP flats coming onto the resale market in the next couple of years, prices of HDB prices could still hold up in the short term. But even so, it is public housing after all; prices are regulated by the government in order to keep them affordable for the masses.

Alternative option

We’ve said this many times before, but a freehold property does not necessarily mean it’s better than a leasehold, and there are many other factors that contribute to the performance of a property besides its tenure. Perhaps instead of looking at freehold options in the districts you’ve identified, you can look at leasehold options instead, which will give you more choices to choose from. And if you were to open up to other locations, you’d have even more options.

These are some available 99-year leasehold units on the market that is within your affordability:

| Project | District | Completion year | Unit type | Size | Asking price |

| Sophia Hills | 09 | 2018 | 2b2b | 689 | $1,482,000 |

| The Panorama | 20 | 2019 | 2b2b | 797 | $1,488,888 |

| Thomson Impressions | 20 | 2019 | 2b2b | 764 | $1,500,000 |

| Sky Vue | 20 | 2017 | 2b2b | 678 | $1,380,000 |

| Daintree Residences | 21 | 2023 | 2b2b | 679 | $1,399,999 |

These projects are picked out based on the fact that they are in your preferred districts, and for their age, so they may or may not be the most suitable for you. We would suggest you consult with an agent for further analysis.

In the ideal situation, you’ll stay in this property for the short to medium term and if it does appreciate well over the next few year, you can then upgrade again; perhaps to a bigger unit or a freehold development, which you can then live in for the longer term. You can eventually cash out for your retirement while you right size to a smaller unit.

Conclusion

Let’s do a quick recap of the options:

For the first option of buying a freehold condominium in District 9, 10, 11, 20, or 21, your choices are rather limited and the available developments are mostly boutique projects (which as mentioned, we do have some concerns over). You will have to pick carefully, as a freehold property definitely doesn’t always mean it will be a good investment.

The second option of saving up to purchase a second property for investment will require a huge cash outlay, which may take a considerable amount of time to save up for.

As for the last option of upgrading to a bigger HDB, unfortunately, your household is no longer eligible to apply for a second BTO due to your income. Regardless, buying an HDB is not the best investment tool given that it is after all a regulated market.

We will suggest looking at some younger leasehold developments that still have the potential for growth which will open you up to more choices. You can stay in this property while you wait for it to appreciate and from there, move on to a bigger unit or a freehold development where you can stay for the long term. As you’re only in your mid-30s, you’re able to maximise the loan tenure. We get that moving might be a pain, but it’s inevitable if you wish to cash out on your property which will go towards building your retirement nest.

ALSO READ: We make $15k per month and live in a 4-room HDB flat. Should we upgrade to a condo now once interest rates drop?