Here’s one more sign of cooling in Seattle’s hot housing market

Seattle’s housing sector could really feel pink warm, but try telling that to dwelling potential buyers in Phoenix, San Diego, Tampa and Dallas.

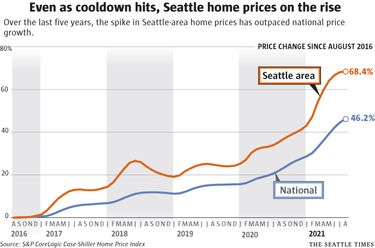

After months as the 3rd-most popular housing market in the nation, the Seattle place slipped to fifth place in a position of single-household residence selling price advancement launched Tuesday. The position is just one far more indicator that a fall cooldown has arrived in the Puget Seem region, with price ranges leveling off, purchasers experiencing much less bidding wars, and sellers supplying occasional value drops.

Even now, residence rates below are up about 24{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} over final yr, in accordance to the S&P CoreLogic Case-Shiller Household Cost Index. Which is a sharper uptick than in New York, Los Angeles, Portland and San Francisco, among the other cities.

The index, which uses a three-month rolling common of household prices, displays areas of King, Snohomish and Pierce counties. The evaluate lags by two months, so this week’s details displays dwelling revenue by means of August.

For the 27th consecutive thirty day period, Phoenix topped the record, this time with a 33{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} yr-over-calendar year boost.

Nationally, house selling prices are up almost 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in contrast to last yr. That is about stage with the improve in July, suggesting “that the expansion in housing charges, even though nonetheless extremely robust, may possibly be commencing to decelerate,” explained S&P Handling Director Craig Lazzara in a assertion.

CoreLogic Deputy Main Economist Selma Hepp referred to as the figures a indicator that “buyer exhaustion is location in, specially among increased-priced households.”

Housing marketplaces all about the country heated up quickly right after the pandemic strike previous yr, pushed by a mix of minimal interest premiums attracting a lot more purchasers, potential sellers holding onto their households hence restricting the variety of houses for sale, and buyers and millennials attempting to get into the marketplace.

The spike in prices is creating homeownership far more challenging — and not just due to the fact of bidding wars.

With increasing rates, mortgage loan payments for new homebuyers are climbing, also. For prospective buyers placing down a 5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} down payment in the Seattle area, the median regular monthly home finance loan payment previous month was up 12{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in contrast to a calendar year before, in accordance to Redfin.

As distant get the job done has taken maintain, nearby prospective buyers have faced some of the stiffest levels of competition outdoors big towns this kind of as Seattle.

In King County, for example, median household price ranges in August had been up 26{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} on the Eastside, 16{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in Southwest King County and 18{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in Southeast King County as opposed to 2020, according to individual information introduced previously this month by the Northwest Many Listing Services.

In Seattle, the $850,000 median house value was up 4{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in excess of the identical time in 2020. In Bellevue east of Interstate 405, the $1.3 million median property rate final thirty day period was up 29{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} when compared to a calendar year earlier.

Areas of Snohomish and Pierce counties have come to be far more competitive for dwelling consumers, claimed Zillow senior economist Jeff Tucker.

“Demand has surged in these towns thanks to the declining relevance of commute periods, as much more staff members be expecting to only pay a visit to their offices often, if ever, and are now emotion self-assured ample to obtain a residence based mostly on that expectation,” Tucker mentioned in a assertion.