What to expect from the housing market now that the Fed has signaled rate hikes

Program to obtain a household in 2022? The very good news is that ailments will not quickly get out of manage the way they did past year. The terrible news is that source stays tight and rates are nevertheless on an upswing — and the probability of greater mortgage prices looms on the horizon.

Actual estate pros say the true estate marketplace this year will not match the fever pitch it achieved in 2021, and the pace of property sales this 12 months will be significantly much less frenzied. “As we transfer via the 12 months, we will see slower revenue exercise,” explained Lawrence Yun, main economist at the Nationwide Affiliation of Realtors. “Intense several-provide times are over… persons can choose their time.”

“There’s no expectation that charges will drop, but our forecast suggests that cost appreciation will slow,” mentioned Doug Duncan, senior vice president and chief economist at Fannie Mae. Duncan predicted that even though prices will not repeat the meteoric 18 {d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} increase they sustained previous calendar year, they will nonetheless rise somewhere in the neighborhood of 7.5 per cent. “That’s not much of a breather, especially for the reason that fascination premiums will be mounting at the similar time,” he pointed out.

There’s no expectation that prices will slide, but our forecast suggests that price appreciation will sluggish.

Other gurus have a little bit reduced projection for rate appreciation, but no just one sees a reversal any time soon. “We haven’t witnessed the fundamentals transform to point out that rates are going to come down,” claimed Robert Frick, company economist for Navy Federal Credit score Union. “Prices are continue to going to go up this calendar year,” he mentioned, despite the fact that he also stated the fee of boost is possible to amazing immediately after very last year’s torrid double-digit jumps.

As soaring need sent price ranges into the stratosphere last calendar year, would-be homebuyers generally found themselves in bidding wars, or were compelled to make a snap conclusion on the most important economical determination of their life. The success of a December study propose that home-hunters have tempered their optimism, or could possibly choose to remain on the sidelines for the around upcoming: The Fannie Mae Residence Purchase Sentiment Index discovered that while 76 p.c of all those surveyed reported the current is a very good time to market a house, just 26 p.c reported it is a superior time to get. By comparison, 52 percent of respondents experienced characterized the present-day market place as a fantastic time to invest in a property a calendar year before.

“There’s nonetheless a lack of houses for sale, so it is a seller’s current market, but the residences that are overpriced are tending not to transfer,” reported Ralph DiBugnara, CEO of Property Certified, an on the internet authentic estate details and lending useful resource.

“I believe for the property sellers, they need to understand the days of double-digit value appreciation are over,” Yun reported. If persons are mulling a sale, he additional, “They should do it based mostly on regular aspects somewhat than trying to speculate on large price gains.”

Residence sellers require to understand the times of double-digit rate appreciation are in excess of.

These changes are unfolding towards a backdrop of fascination charges rising as the Federal Reserve targets inflation in a major way. Earning it additional expensive to borrow tamps down demand in the combination and can assist rein in inflation, but what can be great for the economy on a macro level can be unpleasant for unique consumers, who will discover on their own paying out a lot more to provider their mortgage debt.

As a end result, some experts have predicted that before the marketplace normally takes a breather this 12 months, there will be a sturdy 1st quarter as people test to lock in lessen house loan pricing. The charge for a conventional 30-year mortgage loan is currently hovering all over 3.5 percent. Many authentic estate professionals forecast that this will rise any where from a half to a entire proportion level by way of 2022.

“It’s seriously dependent on what the Fed states and does,” Duncan said. The central bank’s contribution to greater mortgage charges is partially mainly because of a increased Federal Resources level, but extra importantly, it is a purpose of the Fed paring back its pandemic-period economic support.

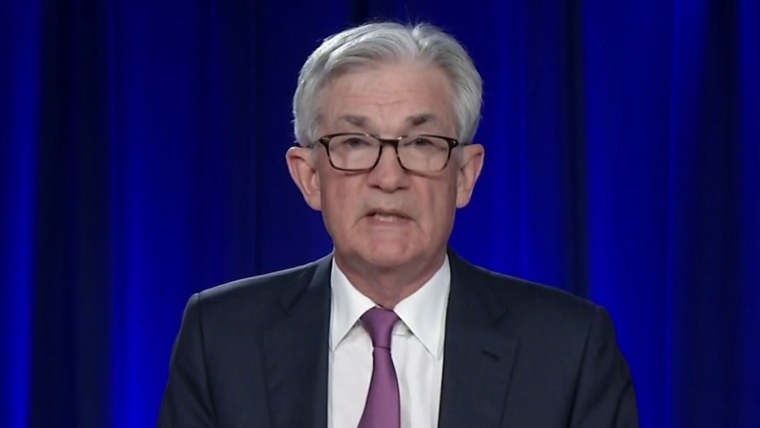

This support bundled getting billions of dollars in mortgage bonds every single month, purchases that will terminate by March. In a press convention final week, Fed Chair Jerome Powell explained officers expect to talk about before long how to shrink that part of the Fed’s portfolio. Marketplace members will be on the lookout to policymakers for extra guidance on regardless of whether the Fed elects to simply just not repurchase new house loan securities as the types on their balance sheet experienced, or actively seems to be to promote some of all those holdings — an acceleration of the sector exit that would be likely to have a additional abrupt impact on borrowing rates.

“They could call for far more yield,” Duncan explained of the more bottom-line oriented home finance loan financial debt buyers that will continue being adhering to the Fed’s exit. “The Fed is a policy purchaser, not an financial consumer.”

“From a property finance loan pricing perspective… I would say there is going to be a more robust effect from the exit of the bond purchases,” explained Steve Kaminski, head of residential lending at TD Financial institution. “We don’t know wherever prices will conclusion up, but we do have a clear indicator that the Fed intends to improve rates right here,” he stated.

As the Fed tempers its before prodigious appetite for property finance loan-linked personal debt, the current market will have to modify accordingly. “Their prepare is to exit the house loan-backed safety current market by March. I do assume the March-April time frame for that level boost to be a small extra obvious,” Kaminski reported.

If there is a slowdown in homebuying exercise this yr, one particular silver lining for debtors is that the similar number of mortgage loan creditors will be hunting for business enterprise among the a lesser pool of consumers, Duncan mentioned. “A tiny little bit of a moderator on the charge rise will be the simple fact that house loan loan companies …. will compete and the profit spreads they’ll take will shrink,” he mentioned.

But on equilibrium, professionals say the challenges remain acute for to start with-time customers. “The issue for first-time homebuyers is there are not more than enough residences for sale at competitive selling price factors. They’re seeing bidding wars on most houses. Very first-time homebuyers have to be eager to compromise,” DeBugnara explained, whether that indicates on square footage, spot or other characteristics.

Buyers — both of those first-timers as very well as people today in search of to downsize — will also continue to face levels of competition from institutional potential buyers, which have aggressively targeted the so-termed starter house market in purchase to hold individuals qualities and hire them out. And with house charges as effectively as rents increasing, it will become much more tricky for folks who want to possess and dwell in their personal households to split in to the marketplace.

“You have corporate entities shopping for homes to rent, which is further reducing the availability of homes… 17 percent of new residences are likely to be corporate-owned to hire,” Frick stated. “We’re obtaining shut to a stage where by 1 in 5 houses is essentially staying taken off the ownership marketplace for lease,” he stated.

We’re finding near to a position where a person in 5 residences is effectively becoming taken off the possession market place for lease.

“We’re going to see for confident the prices of rents expanding for the up coming handful of years. A great deal of these more substantial cash are scooping up solitary-relatives homes in bulk,” DiBugnara said. “I’m deciphering that as they believe there’s heading to be very large demand from customers for single-family members homes.”

When new residences are remaining designed, experts say it isn’t occurring speedy more than enough. Even ahead of the pandemic, new house development was failing to retain rate with demand from customers, and Covid-19 has saddled builders with a mix of shortages and climbing fees for the two supplies and labor.

For a longer period time period, experts say the offer pipeline is improving. “We expect that in the new household house, begins will increase about 7 p.c,” Duncan stated. “The builders are accomplishing anything they can. If they can get the land, labor and lumber, they’ll build.”

“I’m inspired that we’re heading to see numerous a lot more new homes designed in this year,” Frick stated. “Some of the source constraints are easing as significantly as materials go. The other matter which is essential is that builders are purchasing a whole lot of land,” he explained. But until the sector reverts to a point out that extra intently resembles historical norms, and right up until additional new stock is available at major scale, Frick warned that the desire of homeownership is fading for households on the margin.

“We have to remember, for middle-income people, their most important way of accumulating prosperity is homeownership,” he reported. “Home rates are pushing homeownership absent from 1st-time and decrease-income homebuyers at an alarming rate.”