Second Home, Investment Property Prices Surge in Top Markets

As remote get the job done prompted a lot of Us residents to relocate all through the pandemic, housing expenses soared in second-home hotspots even far more than the rest of the state, in accordance to a new report from Redfin.

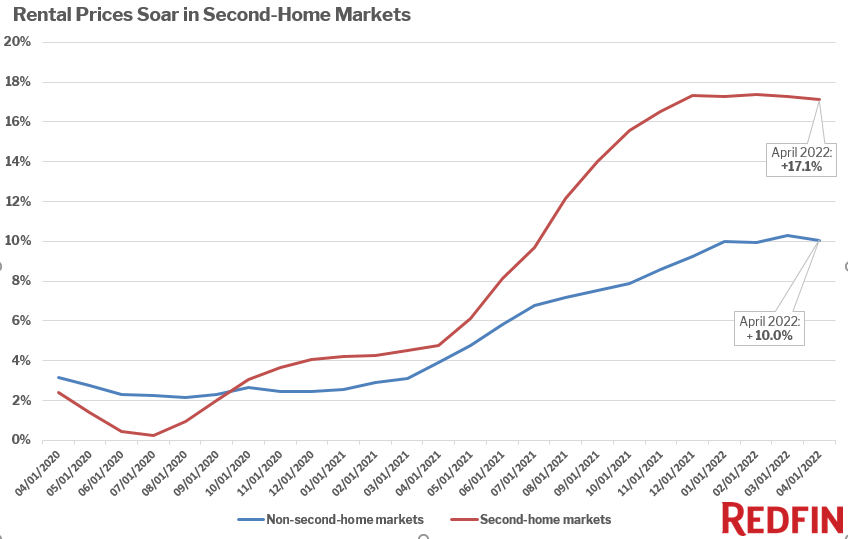

Average rental price ranges rose 17.1{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} 12 months-about-calendar year nationwide to $1,893 in popular second-household marketplaces in April. That is compared with a 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} raise to $1,484 in spots that are not regarded next-home places.

In the for-sale market, regular households in 2nd-home marketplaces bought for a document $516,423 in April, up 19.9{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} yr-more than-calendar year. In non-2nd-residence marketplaces, prices elevated 14.8{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} to a document $389,156. Despite the fact that the chaos bordering the housing market place is slowing, rates have skyrocketed since the starting of the pandemic.

Top 5 Next-Dwelling U.S. Marketplaces:

- Phoenix

- Cape Coral, Florida

- Naples, Florida

- Myrtle Beach front, South Carolina

- Las Vegas

Rental rates have increased by 25{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} 12 months-over-12 months or more in four of all those 5 places —excluding Myrtle Beach— and sale selling prices have elevated by at the very least 25{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in all 5.

Rates commenced increasing speedier in 2nd-household destinations at the end of 2020 as numerous affluent People sought to relocate and migrate absent from chaotic metros. Home finance loan-price locks for 2nd houses spiked in June 2020, remaining elevated via the commencing of 2022, achieving a peak of 88{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} previously mentioned pre-pandemic concentrations in March 2021.

“The popularity of holiday cities has despatched housing fees as a result of the roof, generating it tougher for a lot of locals to manage living in their hometowns,” claimed Redfin Deputy Chief Economist Taylor Marr. “The next-house growth is ending as many holiday-home customers are priced out of the marketplace due to historically higher rates and higher mortgage rates–but those similar components have already pushed locals to the sidelines. Locals in preferred seashore towns and trip places have put in the final two several years competing for a limited quantity of households with rich second-dwelling seekers–and normally dropping.

One vibrant spot for locals who currently possess houses in getaway cities is that growing prices also suggests household fairness has amplified substantially.

“Many of the locations exactly where charges soared partly due to pandemic-pushed next-house purchases and migration are likely to see price tag growth sluggish quicker than other sections of the region as the sector cools down,” said Marr. “The outsized value growth is unsustainable, particularly as need for next homes drops.”

Phoenix is a fitting example of how the next-residence boom has impacted the regional housing market. In Phoenix, in which there are more second households than anywhere else in the country, rental prices grew 32.8{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} 12 months-around-yr to $1,946 in April, and residence prices rose 25.3{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} to $495,000.

“We experienced even more 2nd-residence consumers than typical final 12 months from the West Coast, Midwest and Canada. It had a big impression on local prospective buyers, a lot of of whom don’t have the money to compete with persons coming in with a whole lot of income from out of city,” said Phoenix Redfin agent Heather Mahmood-Corley. “A good deal of out-of-towners ended up able to pay out in all cash, make substantial down payments, waive the appraisal contingency, and/or bid up prices–something local purchasers generally really don’t have the resources to do.”

Price ranges have also greater sharply in Cape Coral, Florida and Naples, Florida —the subsequent-most widespread next-residence markets— exactly where rental costs grew 41{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and 37.7{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, although sale prices rose 38.2{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and 37.6{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}.

Mortgage programs for next residences in Phoenix greater 23{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} from 2018-2019 to 2020-2021, and they increased even more in Florida: 59{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in Cape Coral and 75{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in Naples. Purposes had been up 38{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} general in Myrtle Seaside and 16{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in Las Vegas.

To perspective the full report, which include charts and methodology, simply click right here.