How the Fed is ‘collapsing’ real estate activity with higher interest rates

U.S. genuine estate has gone through a extraordinary slowdown in transaction activity in the months considering that the Federal Reserve began jacking up desire fees.

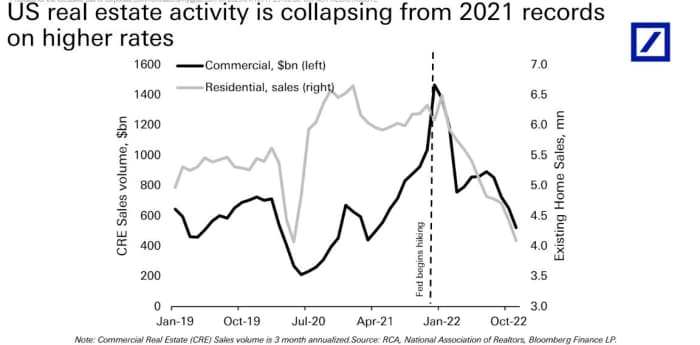

Income of present residences plunged from peak pandemic stages to about 4.1 million in November (see chart) from over 6 million units offered per calendar year in 2021 as the Fed has radically raised desire charges to tame inflation.

U.S. genuine estate transaction quantity has collapse with higher prices

Deutsche Lender, RCA, Nationwide Association of Realtors, Bloomberg Finance

Likewise, the chart demonstrates industrial real estate transactions dropping off a cliff after they rose 40{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} increased than their prior peak in 2019, according to a new shopper be aware from Deutsche Bank investigation.

“Real estate is one particular of the crucial levers the Fed can use to slow the overall economy higher costs are significantly cutting down US authentic estate exercise,” a Deutsche analysis team led by Ed Reardon wrote in a weekly market place briefing.

They also mentioned that property finance loan premiums of about 6.5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in both sectors will let the Fed “to unwind some exuberance” in the housing marketplace, exactly where charges climbed about 40{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} considering the fact that March 2020 and around 30{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in commercial actual estate.

Connected: The occasion is more than in professional genuine estate. Here’s what to expect in 2023.

The Fed started fast increasing its plan desire price from in close proximity to-zero in March to assist convey inflation that peaked above a 9{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} yearly rate this summer time nearer to its 2{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} goal. Its federal cash level was increased to a 4.25{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} to 4.5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} vary in December, the optimum given that 2007, with yet another level bump envisioned in February.

Before this week, San Francisco Fed President Mary Daly claimed she expects the central bank to raise desire costs earlier mentioned 5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} to get inflation down. A new monthly update on consumer inflation due Thursday is envisioned to clearly show inflation slipping for 6 months in a row to a 6.5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} yearly amount.

U.S. stocks have staged a modest rally to commence 2023 as some investors interpret retreating price pressures and moderating wage gains as indicators that the economic system may possibly nevertheless keep away from a economic downturn, even though central bankers hold expressing to hope high prices until finally inflation deeply recedes.

Examine: Inflation is slowing, CPI to show. But is it slowing quick sufficient for the Fed?

The S&P 500 index

SPX,

was up .7{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} on Wednesday ahead of Thursday’s inflation reading through, when the Dow Jones Industrial Ordinary

DJIA,

was up .4{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and the rate-delicate Nasdaq Composite Index

COMP,

was 1.1{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} higher, in accordance to FactSet.