Ottawa real estate: A return to a more balanced market

Actual estate price ranges and the stratospheric income that have dominated discussions and newscasts for the earlier two yrs are surely slowing down.

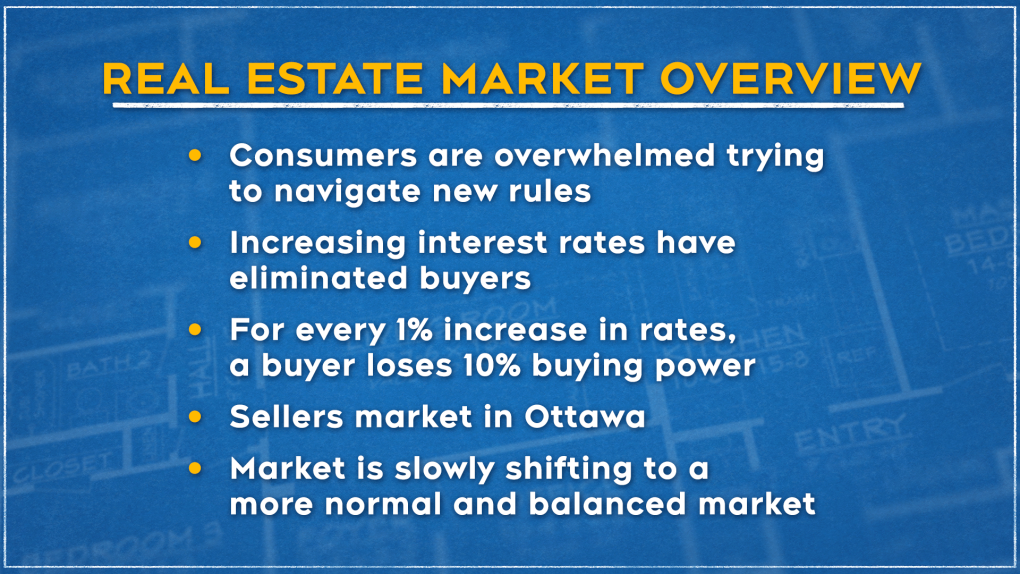

“The current market is little by little shifting to a more standard and balanced market,” states Ottawa real estate agent and founder of Bennett House Store Realty, Marnie Bennett.

Increased interest costs are absolutely a issue contributing to the cooling off, suggests Bennett.

The lower charges produced the wild trip for dwelling customers and people in the market.

“These exceptionally reduced curiosity premiums propelled residences charges far more than 60 per cent more than the final two several years – file breaking product sales across Canada,” Bennett explains.

“In the past two months, we have witnessed so many improvements in the general current market. Customers are overcome and making an attempt to navigate by all the new guidelines.”

Bennett suggests the maximize in interest fees has removed many buyers, specially with another charge increase coming on June 1.

For just about every one per cent raise in prices, a consumer loses 10 per cent purchasing ability.

Bennett, who has been in the genuine estate organization for much more than 4 many years, thinks back to a spectacular time.

“In 1980, curiosity rates were being 22 per cent. We are at 4.1 per cent correct now with an additional 2 for every cent strain examination qualifier.”

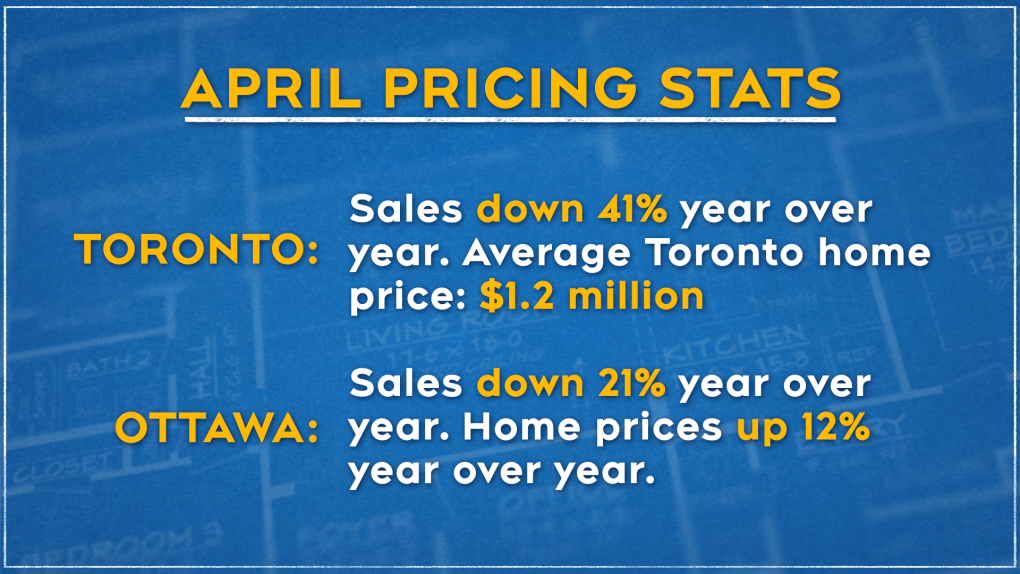

Bennett looks to the Toronto current market for an total photograph.

“In Toronto, the premier serious estate sector in Canada, income had been down 41 for each cent calendar year-above-yr.

“The profits price for properties in Toronto, as in contrast to March 2022 for the 1st time residences selling prices, ended up down by nine for each cent in Toronto and, in the GTA, approximately 7 to eight per cent.”

Bennett explores regardless of whether this is a pattern or an aberration.

“Average Toronto home rates in March 2022 ended up $1.3 million. They dropped in April to $1.2 million for the average household,” Bennett suggests.

“Ottawa product sales were down 21 per cent yr-more than-calendar year, but costs were being up in Ottawa calendar year-more than-yr by 12 for every cent.

“The housing industry has been a major focus of the federal govt and provincial governments around the very last couple of months. Canada has a intense scarcity of residences around 3 million are wanted.”

Bennett examines what is going on:

- Inflation proportion of 6 for each cent is the highest on document in the past 30 a long time

- In Early 2020, the Lender of Canada dropped fascination charges to practically zero to cushion the financial blow of the pandemic

- These exceptionally reduced fascination premiums propelled households charges extra than 60 per cent around the final two many years, with document breaking sales throughout Canada

- 48 for each cent of millennials now possess homes, 24 per cent of renters acquired homes, when it is typically only 6 for each cent

- About 30 for each cent of houses procured in the past two years have been from investors

What is happening in Ottawa?

The ordinary profits value in Ottawa for a residential home is $829,318, an increase of 11 for every cent year over yr. The normal home value in March 2022 was $743,309, an raise of around $86,000 month-to-month.

The common income value in Ottawa for a condominium apartment $473,702, up 11 for each cent calendar year-above-yr. March 2022 Ottawa apartment prices have been $426,874, an maximize of about $47,000.

OTTAWA NEIGHBOURHOOD Price ranges APRIL 2022 VS APRIL 2021

- NEW EDINBURGH – Up 63.5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} – $1,614,000

- ALTA VISTA – Up 42{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} – $1,070,806

- GREELY – Up 33{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} – $1,120,782

- HUNT CLUB – Up 29{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} – $877,715

- BARRHAVEN – Up 14{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} – $842,082

- STITTSVILLE – Up 11{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} – $916,000

- ORLEANS – Up 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} – $765,081

VALLEY Cities APRIL Costs APRIL 2022 VS APRIL 2021

- ARNPRIOR – Up 14{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} – $606,500

- CARLETON Position – Up 21{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} – $707,000

- ALMONTE – Up 27{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} – $730,667

- ROCKLAND – Up 9{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} – $638,362

- KEMPTVILLE – Up 18{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} – $766,143

Bennett concludes, in a phase on CTV Information at Midday, that it is still a seller’s industry.

There is just in excess of a month’s provide of stock for sale in Ottawa.

There are about 1,800 properties are for sale in Ottawa. Five many years ago, there had been a lot more than 6,000 for sale.

Bennett says sellers will have considerably less capable purchasers to offer to and there will be several features and fewer various presents.

“There will be conditional product sales, and for a lot less than asking, but households that are current and well-preserved will offer for far more than asking.

“The market place is bit by bit shifting to a more regular and well balanced market place.”