Could This U.S. Housing Market Crash Be Worse Than 2008?

Mauricio Graiki

In a matter of months, the pandemic housing boom has turned into a rapidly spreading bust. Incredibly, recent reporting shows that home prices are now falling faster than they did during the run-up to the 2008 financial crisis.

- Prices are falling as much as 4{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} per month in some formerly red-hot markets.

- 30-year fixed mortgages are at 7.3{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and rising after the Fed meeting.

- Mortgage applications for purchases are considered to be the best leading indicator of future sales that will close in the months ahead- they’re down 42{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} year-over-year and continue to fall each week.

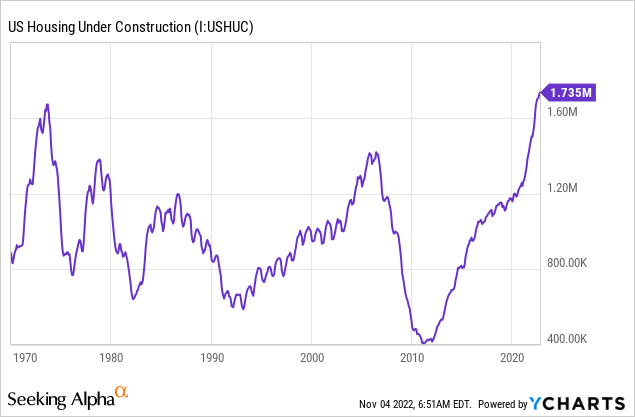

- Decreased demand comes just as a tsunami of new supply is about to hit the market, with over 1.7 million privately owned homes currently under construction. This smashes the all-time record set in 2006.

Economic models will tell you that compared with sluggish wages and skyrocketing interest rates, home prices are as much as 75{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} overvalued in formerly hot housing markets. And the Fed is telling you what’s about to happen if you read between the lines (and maybe even that they want/need it to happen).

The housing market was very overheated for a couple of years after the pandemic, as demand increased and rates were low. The market needs to get back into a balance between supply and demand (emphasis mine).

–Jerome Powell, Nov. 2 FOMC Meeting.

The developing crash in housing prices has profound implications for anyone looking to buy a house, as well as for investors in housing stocks. The iShares Home Construction ETF (BATS:ITB) is down a bit more than 30{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} for the year, but if the situation on the ground is as bad as it appears, then it might be headed a lot lower. ITB is the worst of the worst when it comes to this kind of interest rate shock, because homebuilders borrow a lot of money to build, and in turn, they sell to their customers who borrow a lot of money to buy. This crash has been a long time coming as prices got further and further from fair value. Now that huge declines are rolling down the tracks, there’s not much that can stop it. If you already own a house with a low mortgage rate and didn’t buy it during the bubble, then no worries. But if you’re looking to buy a house now, think twice!

A Tidal Wave Of Housing Supply Is Coming

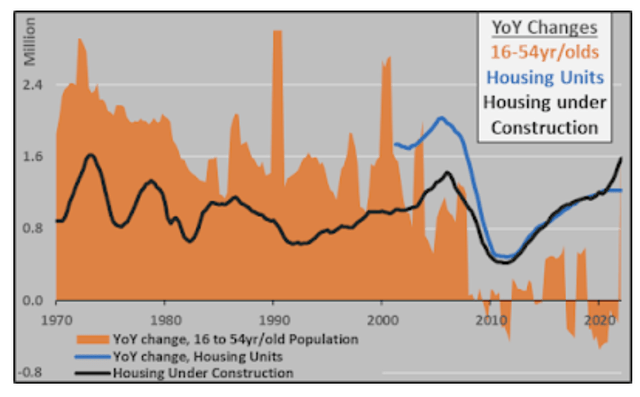

1.7 million homes are presently under construction in the US, the highest level ever. The peak in 2006 was around 1.4 million homes in various stages of construction. This obscures the fact that the US population was growing by nearly 3 million people per year in 2006, whereas the population now is only growing by somewhere between 500,000 and 1 million people per year.

At the average of roughly 2.5 people per household, that implies a need for nearly 1.2 million housing units built in 2006, but only 400,000 units in 2022 if we assume we gained a million people in population. There are reasons to believe that population growth could be even lower going forward, as declining inflation-adjusted wages and declining life expectancy (coronavirus, opiates, general malaise, etc.) take their toll. With mortgages over 7{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} now and population growth flatlining, who is going to buy all of these homes?

Of course, there’s a continual toll of obsolescence for homes (mostly homes in rural areas and the Rust Belt where people abandon them and move to greener pastures). This is thought to be about 300,000 homes per year. All-in, demographics imply the need for around 700,000 housing starts per year. We’re adding about twice as many houses as demographics imply we need to the construction pipeline on an annualized basis.

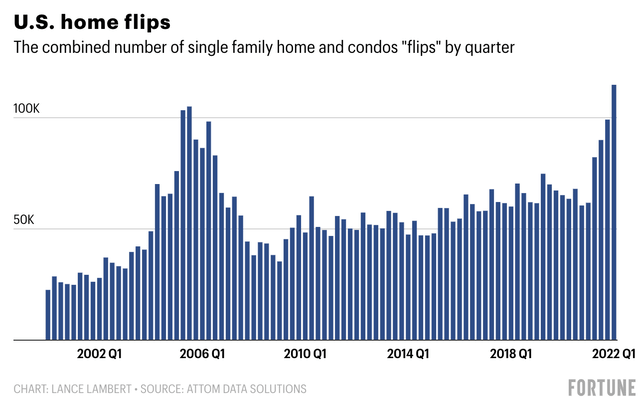

By contrast to the changing demographic picture, house flipping has been at an all-time high, with investors often selling to other investors.

Flip or Flop? (Fortune)

The Rental Market Is Reversing

Interestingly, a much higher percentage of units under construction than in the last cycle are multifamily units, either as condos for sale or apartments for rent (about 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}). Rents went crazy during COVID, but there’s actually a simple explanation for why they did, and why things may be about to reverse.

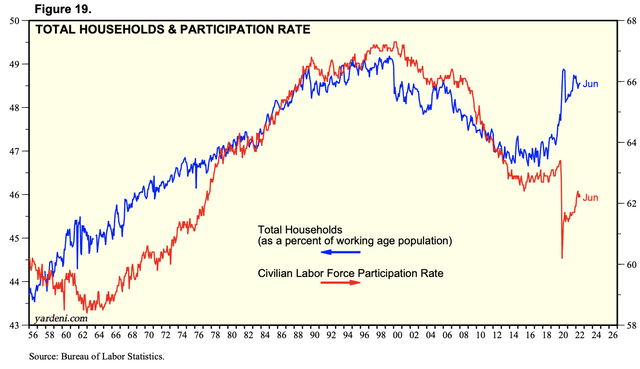

- The eviction and foreclosure moratoriums allowed millions of people to live rent-free, massively choking the supply of housing while they were in effect. As I’ve written previously, the pandemic was the first time in the post-WW II era when fewer people worked but more people were occupying housing. Not normal! This is bound to revert to the mean, either millions more people are going to have to start working, or they’re not going to be able to pay rent/mortgage payments. In the vast majority of cases, people with insufficient income to support their current housing situation will just ride out their current leases and then not renew. They’ll move in with family, get roommates, or move to cheaper accommodation until supply and demand are balanced. When this data is updated next, I expect to see a lot of demand destruction.

Labor Force Participation Vs. Occupied Housing (Yardeni Research)

2. Price-fixing in the rental market. What’s not widely known is the effect that software used by large landlords may have had on the pandemic rental market. A recent class-action lawsuit alleges that a ubiquitous leasing software called YieldStar allowed large landlords to effectively form a cartel by letting a common algorithm set rental and lease renewal prices for all users. The software essentially used an algorithm to automatically coordinate pricing with thousands of other landlords, largely to avoid competing on price. Of course, the founder of YieldStar previously was forced to settle a case with the Justice Department for creating illegal price-fixing software for airlines. You can’t make this stuff up!

The evidence presented in the lawsuit is quite damning, and the fact that the main class action is being filed in Southern California means that this has the potential to be one of the largest class action payouts in US history. It’s very fashionable for people and politicians to blame rising prices on “greedy corporations,” and in many cases, it’s off-base. Here though, there’s evidence that using this software truly gave large landlords sufficient control over certain rental markets to extract monopolistic profits from tenants.

However, the theory will tell you that the free market will eventually respond to this sort of oligopoly, which is why we’re now seeing a huge boom in multifamily construction to cover for this artificial shortage. With some antitrust enforcement and letting the free market work, rents should actually fall over the next few years, which will help cool runaway inflation, albeit not nearly enough to bring inflation back to 2{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} by itself. In fact, asking rents have already begun falling.

The Demographic-Driven Housing Shortage Was Mostly A Myth

Though prices have skyrocketed, housing units per capita exceed the levels seen in 2008 in many markets. This doesn’t mean that housing isn’t scarce due to booming demand or too expensive, but what it does mean is that supply has easily kept up with demographics, albeit not speculative demand from investors, flippers, and second/third homeowners. The big spikes here below every 10 years are from one-off census adjustments, but the data shows that the US population aged 16-54 is actually falling.

Demographic Problems With Housing (Economica)

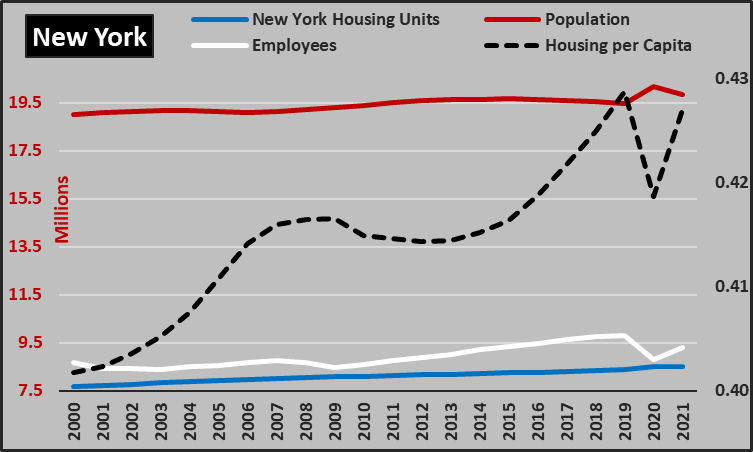

We see this when comparing the housing stock to the population. For example, construction in New York has continually increased the amount of housing stock available per capita (again note that the jagged lines in 2021 are from a census adjustment). This is the free market at work.

New York Housing Market (Economica)

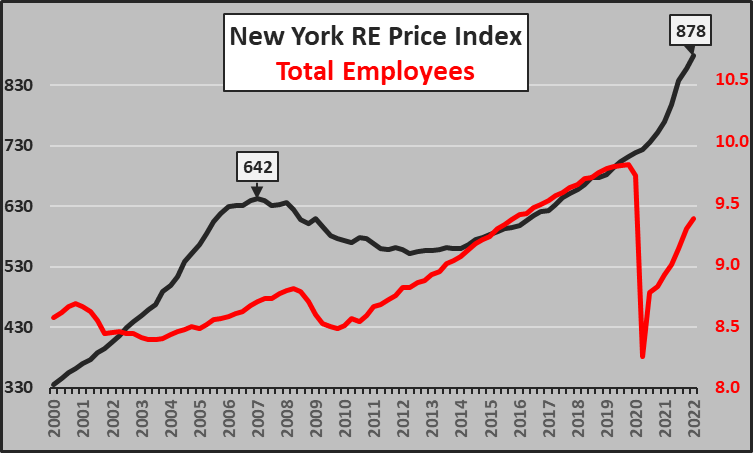

However, prices have surged, even while employment remains well below pre-pandemic levels. This is not the free market since 2019, instead, it was from interest rate suppression. Now that rates are skyrocketing, this is a huge shoe to drop.

New York Housing Market (Economica)

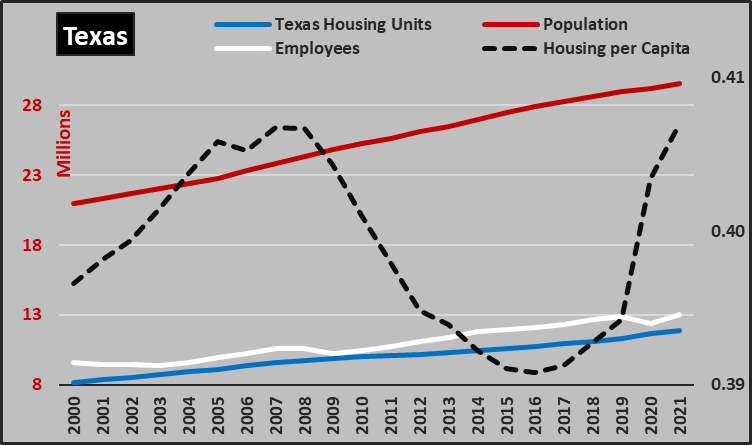

Texas also is an extremely interesting housing market to look at, because a lot of people are moving there, fueling the narrative that prices should automatically surge. But contrary to popular belief, construction in Texas has kept pace with migration trends, yet prices have skyrocketed. The most recent real-time data from Realtor.com shows that the Texas market is now among the leaders of the deepening housing market correction that started on the West Coast.

Texas Housing Market (Economica)

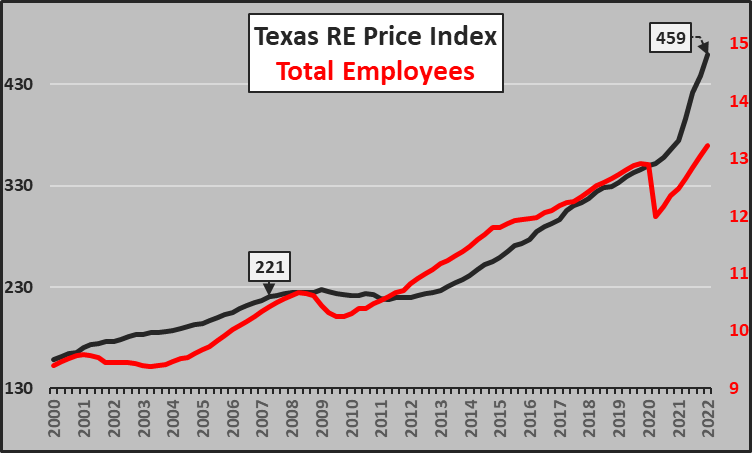

Surely prices should rise in line with supply and demand, but the degree of price rises while construction keeps pace with demographics should not happen. Note that while employment superficially looks better in Texas than in New York, median salaries are much lower while housing prices have surged far more.

Texas Housing Market (Economica)

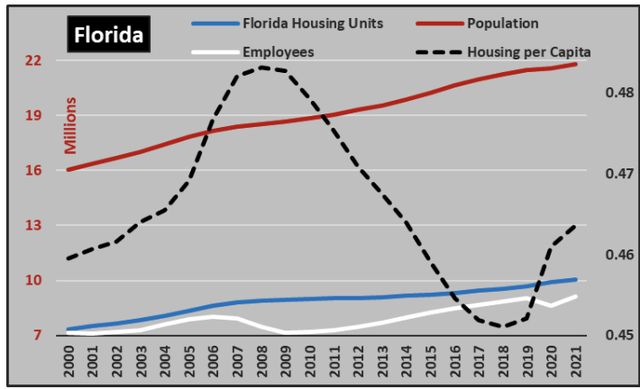

Construction hasn’t yet kept pace with migration in all markets. The author of the Economica blog noted that states like Florida, Nevada, and Washington had underlying demographic demand that could soak up homes if prices were to fall from their presently overvalued state. Still though, as hot as the real estate market is, Florida’s median income has increased something like 5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} post-pandemic, while housing prices increased about 60{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}. Debt, debt, and more debt! Florida’s housing per capita has actually increased since bottoming in 2018 though when prices were almost half of where they are now. Also, a disproportionate amount of new housing supply will be coming online in sunbelt markets like Florida.

Florida Housing Market (Economica)

Demographic reality (i.e. wages) doesn’t square with the enormous boom in home prices, which is why many economists believe home prices are substantially overvalued. What’s really at play here is that housing prices have done nothing but go up because interest rates have done nothing but go down, fueling round after round of speculative buying.

But with an ongoing construction boom well in excess of population growth, the question is who will live in all these homes – five years from now, 10 years from now, and 30 years from now? 2008 showed that even markets with good long-term fundamentals tend to see crashes just the same because they receive a disproportionate amount of speculative investment flows. Tarrant County, in the Dallas-Fort Worth metro area, saw 52{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of all home sales go to investors in 2021! That’s the height of insanity.

These figures imply that in a county with over 2 million people, less than half of homebuyers actually intended to live in the houses they were buying. This is after in the last 10 years, median income in Texas rose 29{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, while the median mortgage payment on a new home purchase rose 280{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}. Home price gains of this magnitude are created by borrowing, not actual wealth. And while this article focuses on the US, I’d be remiss not to mention the other enormous housing bubbles globally, chiefly in Canada, Australia, and New Zealand.

The 20th Century housing market was boosted by steady population growth and a steady pace of urbanization, so prices went up. But with the process of urbanization complete in Western countries and population growth effectively at zero, continually adding supply should continually lower prices. This already has happened in parts of Europe where prices are well below 2007 inflation-adjusted peaks. In the long run, this can actually be a good thing because it means consumers get more for less, but it’s bad if you went all-in on housing with debt too early.

And Mortgage Demand Is Tanking

In the 2000s housing market bubble, America and much of the world had a cultural moment where real estate was praised as the only real way to build wealth. And after the 2008 crash, many of these same people got disillusioned and decided the juice of being a homeowner wasn’t worth the squeeze. From late 2019 to early 2022, a similar frenzy took hold. Now, demand is truly tanking again.

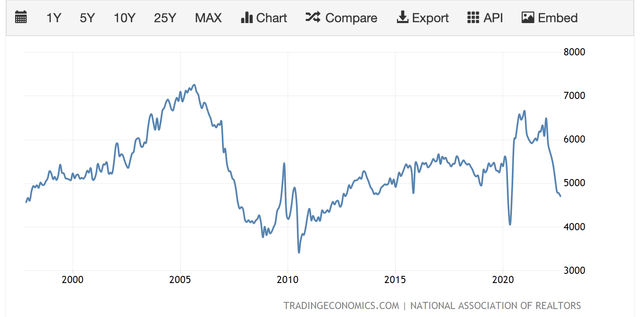

With mortgage rates over 7{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and prices up substantially since the pandemic, this is perhaps the worst time to buy a house in our lifetimes. This comes 10 years after the best time to buy a house in our lifetimes, and likely 2-3 years before a similar time may come again. Mortgage applications are down 42{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} year over year. That’s simply stunning, considering how people were getting into bidding wars mere months ago.

There’s a famous economics paper from 2007 called Housing IS The Business Cycle. In it, the author argues that by setting interest rates to manage inflation and unemployment, the Federal Reserve had inadvertently inflated a housing bubble and would be forced to cause a housing bust to keep inflation from spiraling out of control. Instead, the argument is that the Fed should start hiking rates earlier in the business cycle to keep the housing market from becoming speculative chaos. Does this sound familiar at all? The key idea here: The later the Fed is in hiking interest rates (or doing quantitative tightening) during the boom, the less ability they have to help during the inevitable downturn.

Notably, the paper was written in the middle of the 2000s crash at a point where buyers and sellers were in a similar standoff to today where sellers refused to sell and buyers could not or would not buy, so there also was a very interesting (wrong) prediction in the paper that prices would not crash but transactions would grind to a halt. Of course, prices went on shortly after to crash the most since the Great Depression. Here we are again, with leading indicators for future sales falling off a cliff.

US Existing Home Sales (Trading Economics)

One reason for this is – if I sell a house to buy another one, that’s not net housing supply. But if someone passes away and their kids put the house up for sale, or if a couple gets divorced and rents, or if investors sell because they realize that they’re not going to make money- that’s net supply. Unemployment is a huge driver of net supply over time, so if the unemployment rate begins to rise in the US, foreclosures and short sales hitting the market could have an unprecedented impact on the state of speculative demand.

The Fed May Need The Housing Market To Fall

The key difference between 2007 and now is that the Fed was far more behind the curve this time. In contrast to 2007-2008 when the government actively tried to help stabilize the housing market, the Fed is likely unable or unwilling to put a floor under housing prices, because they’re overpriced and they can’t waste money fighting the market. To this point, in light of the amount of arbitrary redistribution of wealth that the current housing boom has created, the housing market crashing from dizzying heights may be an intended feature of Fed policy, not a bug.

This isn’t my lifelong crusade. If housing prices fall 30{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and you can get a mortgage under 5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} (i.e. to historical norms vs. wages), I’d tell you that buying a house is a solid long-term investment. Similarly, if the stock market retreats to a more attractive valuation, you should buy it. If someone bought a house in 2017 and ends up being breakeven in price appreciation seven years later after the market crashes, that’s fine because they bought at fair prices and saved rent along the way in a similar fashion to investors getting dividends. But if someone bought a house in 2021 or 2022 for far above the house’s fundamental value, they’re in a ton of trouble, especially new construction buyers who locked in purchase prices at signing but had to wait to lock bank financing at completion (when mortgages soared from 3{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} to 7{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} or more). New buyers likely had no idea what they were getting into.

Buyers who are taking sellers’ asking prices right now are dramatically overpaying based on market fundamentals. This is why so few people are buying homes right now compared with the recent past, and why so many homebuyers are canceling their contracts with builders. Like it or not, the 21st Century real estate market has been a wild carnival ride – redistributing years and years of salary income to winners from losers. If you make a bad decision regarding housing, it can negate the earnings from a six-figure salary for a decade or longer. The market is speaking right now if you’re willing to listen, and what it’s telling you is that the unhealthy US housing market is in a twice-in-a-lifetime amount of trouble. Investors in housing-sensitive stocks like homebuilders should pay attention to the macro picture with the real estate market and consider selling their positions as well.

Bottom Line

Will this housing market crash outdo 2008? It’s yet to be seen. A key reason behind the 2008 housing crash was a rise in the rate of unemployment. If unemployment stays relatively low, then home prices may just grind downward. But if unemployment rises to 6{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, 7{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, or more, millions of motivated sellers will hit the market with relatively few takers due to the changing demographic reality of America and the amount of demand that was already pulled forward during the pandemic. And in 2008, houses were objectively cheap, drawing capital in from institutional investors. If home prices were to fall something 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}-20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} from here, valuations would still be higher than fundamentals suggest they should be. Those declines would only take us back to 2021 prices, with rates dramatically higher. For these reasons, it’s very possible for this crash in housing prices to exceed 2008’s in magnitude.