Why I Stopped Buying Rental Properties To Buy REITs Instead

Feverpitched

I come from a family of genuine estate business owners and investors.

As a result, I have been in authentic estate virtually my complete lifetime and so when it arrived time to invest, it felt normal to get a rental house.

I bought my initially one at the age of 18 and I continue to don’t forget the quantities.

It was a condo in Germany. It was for sale at close to €38k, I managed to negotiate it down to about €33k, and its anticipated rent was about €400 per thirty day period. I also had access to low-priced credit card debt to improve the returns on equity.

On the floor, this was a no-brainer.

The returns on equity had been 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}+ for every 12 months and that was in advance of even accounting for any future appreciation.

I believed that even with conservative estimates the returns would be considerably far more desirable than what I could get paid in the inventory industry.

But I was incorrect!

Later on, I went on to work in private equity actual estate and I swiftly realized that my calculations ended up way off.

And I am not by itself to make these issues.

In truth, I would argue that the bulk of rental property investors vastly overstate their returns by miscalculating them. After you appropriately account for all costs, the returns might nevertheless be interesting, but most typically, they are inferior to all those of REITs (VNQ), and which is on leading of taking a lot better challenges.

Allow me demonstrate that to you:

Calculating the returns of rental attributes: 101

The easy math that every person is executing is the following.

Rents + appreciation – desire expense / down payment = return on equity

With this calculation, you can often get 30{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}+ once-a-year returns.

But even pretty new investors will fully grasp that this is commonly deceptive.

Taking it a move more, buyers will generally replace rental revenue with net functioning profits, which eliminates property expenditures like utilities, taxes, insurance policies, etcetera.

Web functioning earnings + appreciation – fascination price / downpayment = return on equity

Below already, the returns get started to decline substantially. The internet functioning cash flow is typically just 50 {d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of the rental profits if you properly account for all property bills.

So let us say that the returns now fall to 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}+ every year.

Even now really very good, proper?

Properly, we nevertheless haven’t accounted for the most essential charges… which are typically neglected by buyers.

Calculating the returns of rental attributes: Continued

Some buyers may possibly include a renovation reserve cost in the calculation of their web working profits, but most possible, it won’t address big restore expenses that happen not often, or at minimum, it is not going to thoroughly account for them.

As soon as in a although, you will have a terrible surprise. It is literally inevitable and it desires to be accounted for when calculating returns.

If you get again to my to start with rental property, a single repair monthly bill could have drained yrs of rental money. To get an instance, think about that the apartment flooded and endured important h2o harm. Your coverage may possibly cover some factors if you are fortunate, but most very likely not all the things. The repair service invoice could very easily be a couple a long time or rental money.

But you will also have other destructive surprises. It is not just residence repairs, but also other matters like a tenant who refuses to pay back the hire… or trashes your locations… or even sues you.

To acquire a different instance: let us presume that some mold experienced been growing in your rental property simply because of weak air flow, and your tenant decides to sue you right after he or she finds out that she formulated bronchial asthma.

You will have to employ the service of a law firm to protect oneself and this could drag into the courts for months or even yrs, costing you a whole lot of money (and time… far more on that later).

The issue below is that terrible surprises are inescapable, they are really highly-priced, and they want to be accounted for in your return calculations.

So let us revisit the past calculation:

Net operating income + appreciation – interest expense – reserve for bad surprises / downpayment = return on fairness

So now, your return drops to let’s say 15-20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} annually.

But this is where factors really get messy mainly because we even now have not accounted for the value of your have time and work.

Obtaining and taking care of a rental house is closer to operating a small business than creating a passive investment. It is a good deal of get the job done and your time is not absolutely free. You could just as well operate on one more work and make a income so we will need to account for this expenditure.

1st, we will need to estimate how lots of hrs for every thirty day period you will do the job on your house. This is dependent on several factors, but assuming you personal a number of properties that you control your self, it could be one thing like 15 several hours for each thirty day period. In this estimate, I incorporate also all the time put in on buying houses. Some months, you will work 30 several hours. Other months, you will only do the job 5. We are making use of 15 several hours as an typical.

Then, we will need to figure out what is actually the worth of your time. This will also depend on a person human being to another. If you operate a standard position, let’s say your worth is $25 per hour.

So the value of you functioning on your rental house (as an alternative of your common job) is $25 x 15 = $375 just about every month.

Internet running money + appreciation – desire expenditure – reserve for undesirable surprises – value of your function / downpayment = return on fairness

Now your returns may fall somewhere near 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} for each yr.

Still, it really is not undesirable, but we are significantly from the 30{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}+ talked over early on, and our estimate is still fairly conservative.

Now assume that you are a lawyer and your time is worth is $300 for each hour.

Then the monthly expense of you placing several hours into your rental property is $4,500.

Are your returns large more than enough to justify this cost?

No, it is not. Your time is considerably better put in doing work your key task and investing that dollars in passive investments like REITs than functioning on a rental property, which at the finish of the day, is ordinarily a great deal much less fulfilling.

The better your profits potential, the worse your returns are going to be once you appropriately account for the value of your time.

Why REITs Make Bigger Returns Than Rental Qualities In Most Situations

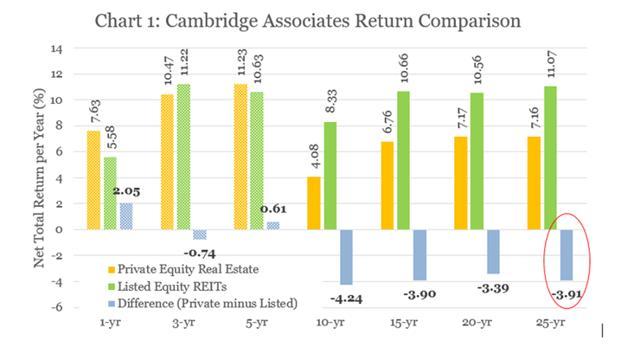

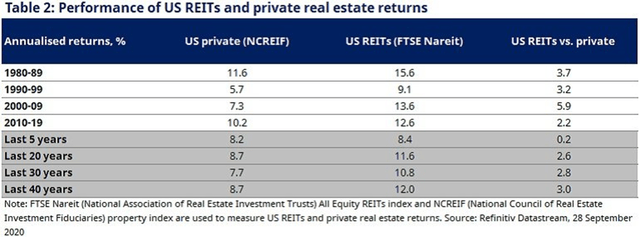

Various scientific tests have demonstrated that at the time you account for all bills, publicly mentioned REITs make better returns than personal real estate investments.

Right here are three of those people reports:

REITs outperform personal real estate REITs outperform non-public true estate (Cambridge) REITs outperform private actual estate (NAREIT)

How could this be?

We shown 10 causes in a previous report that you can read by clicking here.

In limited:

- 1) REITs Do Unfold Investing to Compound Quicker

- 2) REITs Can Enter Real Estate Related Corporations to Raise Returns

- 3) REITs Can Develop Their Have Houses

- 4) REITs Can Do Sale & Leaseback

- 5) REITs Enjoy Important Economies of Scale

- 6) REITs Get pleasure from More powerful Bargaining Electrical power With Tenants

- 7) REITs Make use of The Best Expertise in Serious Estate

- 8) REITs Have a Overall Return Tactic

- 9) Most REIT Professionals Are Well-Aligned With Shareholders

- 10) REIT Traders Pay No Transaction Expenses

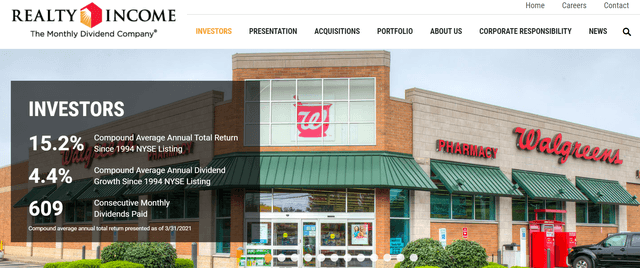

This points out how REITs like Realty Profits (O) have managed to provide 15{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}+ regular once-a-year returns given that its IPO in 1994:

Realty Money generates 15{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}+ annual returns (Realty Revenue)

And Realty Money is not an exception. Numerous other REITs like American Tower (AMT), Prologis (PLD), Community Storage (PSA), and so on. have obtained comparable final results in excess of time…

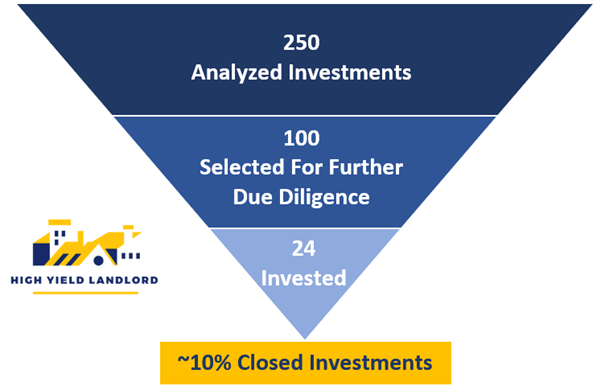

And if you are an energetic REIT trader who can cherry-choose the best alternatives and may possibly increase your returns even further.

That is what we goal to do at Higher Generate Landlord. We only make investments in the finest REIT alternatives to increase returns:

Significant Produce Landlord assortment (High Produce Landlord)

This has traditionally resulted in even much better outcomes for us. We have managed to compound returns at 15{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}+ per calendar year and we also receive greater dividends with an normal produce of 6{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}.

Finally, this is what led me to quit investing in rental qualities to make investments in REITs in its place.

They allow me to generate equivalent or better returns than rental houses, but importantly, I generate these returns with significantly reduced risk and very little hard work.

I set a ton of perform upfront to make the suitable choice, but outside of that, I just observe my investments, accumulate profits, and wait patiently for extensive-term appreciation.