Top Picks For 2023 – Part 2: Investment Property Stocks

AnthonyRosenberg/iStock via Getty Images

Introduction

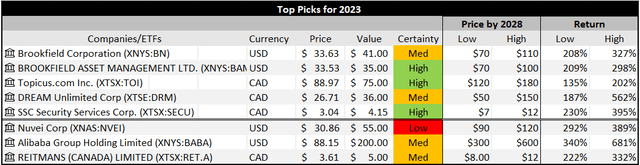

Part 1 focused on “Home Stocks,” meaning those that I would be happy to buy now and hold indefinitely, like a home. They were Brookfield Corporation (BN), Brookfield Asset Management (BAM), Dream Unlimited Corp. (DRM)(OTCPK:DRUNF), Topicus (OTCPK:TOITF), and SSC Security Services Corp. (SECU)(OTCQX:SECUF). These are stocks commonly referred to as “compounders,” meaning they grow reliably, profitably, and over long periods of time. If the stock market were to close for ten years, Home Stocks I would not worry about.

Like those stocks, “Investment Property Stocks” are growing profitably, but have some sort of drawback and that make them less attractive over the long term. This drawback is made up for by a large, temporary dislocation between price and value, providing an attractive risk/reward that could result in a large return over a relatively short period, anywhere from one to five years. When the stock’s price gets close to its value, I’ll consider selling for a nice gain. Thus, they are Investment Property Stocks, not Home Stocks.

Currently, I find Nuvei Corp. (NVEI), a Canadian mid-sized e-commerce payments company, Alibaba (BABA), China’s pre-eminent internet stock, and Reitmans (RET)(RET.A)(OTCPK:RTMAF), a Canadian women’s fashion retailer, to be attractive Investment Property Stocks. All have something going against them which dissuades me from holding over the long term, but enough going for them and a large enough margin of safety that I believe they can make very nice gains in the next one to five years.

Investment Property Stocks

Nuvei Corp.

Nuvei Corp. is a mid-size Canadian fintech (~$4-5B market-cap) specializing in merchant services; it essentially has a top-of-the-line modular “everything platform” for merchants. I go into greater detail here but a shorter version follows.

Nuvei specializes in payment solutions for online regulated gaming (gambling and sports betting), a fast-growing segment as Canadian provinces and US states legalize the industry, and e-commerce generally, which represents almost 90{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of their revenue. Nuvei is quickly diversifying however, most recently they acquired Paya Payments, a B2B payments provider, the details of which I cover here. In addition, the CEO owns 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of shares, and upon its IPO employees each received a stake in the company worth $100,000, creating significant insider-ownership. Management projects sales to grow at 30{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} annually over the next few years with adjusted EBITDA margins increasing up to 40-50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, a call that was recently reiterated in a press release. Nuvei has competitive technology, huge growth in sales and margins, and owner-operators; it meets my normal qualifications of a quality stock.

Nuvei’s growth outlook (Nuvei’s Q3 Earnings Report)

Despite these positives, Nuvei trades at 11x trailing free cash flow. The reasons for this are not perfectly clear, but here are a few possibilities.

Payments companies generally are down huge due to recession fears caused by interest rate hikes and inflation. Companies operating in cyclical sectors like e-commerce and online gaming are even more affected. Nuvei was also exposed to crypto payments, which crashed hard in 2021, bringing Nuvei’s share price with it. The exposure is not huge, but the mere association was enough to hurt the stock.

Additionally, Nuvei was one of the prime beneficiaries on the pandemic bubble, a lot of its growth was brought forward, and its share price skyrocketed beyond what anybody could consider reasonable, and thus became the target of a short seller’s report. Many of the allegations were rebutted, but the share price didn’t recover. More concerning is the CEO’s relative youth, reflected in how much he pays himself (a lot), and that Nuvei pays presumably large amounts to sponsor an F1 team. I fail to see how such a sponsorship benefits shareholders, but doesn’t break my thesis on the company, though it is inconvenient.

Nuvei’s return since its IPS – Not pretty! (Seeking Alpha)

Lastly, bringing forward growth also had the effect of creating impossible comps year over year, indeed Nuvei’s sales this year are up only single digits over last year. Considering they doubled sales in 2021, simple staying flat is quite the feat, and puts management’s forecasted 30{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} medium-term sales growth seem far less ambitious than it appears. It also probably didn’t help that they converted their net cash position to a net debt position to acquire a company; it isn’t the market for that. Overall, I view most of these factors as temporary impairments to the stock, and therefore signify a potential opportunity.

Most importantly for me, and why this stock is not a long-term hold, is competition. In the payment services world, a company is only as good as its technology developers and sales team; there is no moat, or even picket fence, keeping others out of the business castle. Nuvei’s peers are Stripe (STRIP), Block (SQ), Europe-based Adyen (OTCPK:ADYEY) and to a lesser extent online payments companies like PayPal (PYPL). All are worth 10s of billions and with significant resources; competition is clearly formidable.

That said, Nuvei is currently much smaller than they are so need to take less market share to see gains, has competitive technology, is building a direct sales team with a former Mastercard exec at its head, has a niche and early movers advantage in online gaming payments, and is priced for the apocalypse, while its competitors are priced for a recession. The lack of durable competitive advantage is made up for by these redeeming factors, but especially by valuation.

A cursory glance at the stock suggests it is expensive because it has a high PE ratio, but if we skip to the cash flow statement, we see that Nuvei gushes free cash flow. Gross margin is above 80{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, operating cash flow margin is regularly above 40{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and free cash flow around 35{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}. Due to operating leverage, where little capital is required to provide more services, margins even have room for expansion. These are levels are profitability beyond even Microsoft.

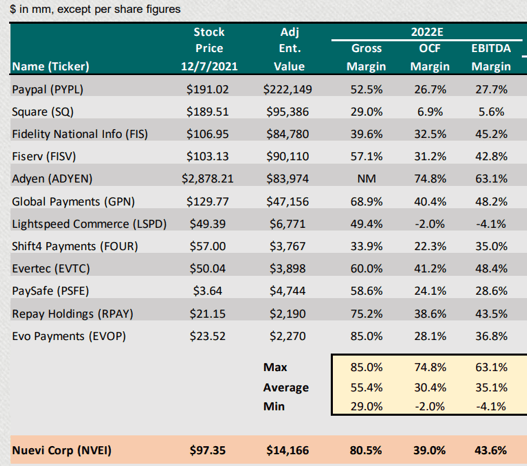

To be honest, my “too-good-to-be-true” sense is tingling, and I’m not the only one. In the short seller’s report, they made a list of comparable fintechs and their profitability. Most of the report was, from my perspective, ad hominem hearsay, but the following breakdown was useful:

Note to Canadian investors, Lightspeed gets more press than Nuvei, but isn’t even profitable. (Short Seller’s Report)

A close look will reveal that Nuvei is about as profitable as a fintech can be and far above average. This could be concerning, but comfortingly for me, there are other companies that are similarly profitable so Nuvei is not a clear outlier. Adyen for example, its closest peer, has operating cash flow and EBITDA margins much higher. This chart is useful for industry comparisons as well, which I’ll leave to the reader to peruse. In my opinion, the probability that Nuvei is cooking the books is low, though I am wary.

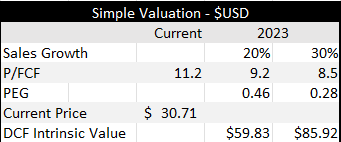

Nuvei is tremendously profitable, and, as the table below shows, the market is strongly discounting this fact, assigning it an 8-9x forward P/FCF multiple, half the average of information technology stocks according to Seeking Alpha. Nuvei should perhaps demand even more than average as it is a quickly growing fintech stock with huge margins and operating leverage.

Two different growth scenarios and their impact on the valuation of Nuvei. Both suggest Nuvei is substantially undervalued (Author’s Calculations)

As we can see, the stock is at least 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} discounted from conservative fair value, assuming management’s medium-term outlook of 30{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} annual sales growth is high by 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} a year. If it’s not, and Nuvei does manage to grow sales at 30{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} annually while maintaining or growing current margins, the stock is potentially 66{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} undervalued. Furthermore, a PEG ratio of 1 is generally considered a fair price to pay, and Nuvei trades at half or a quarter of that, lending further support to our DCF values. Should the market get bullish and payment stocks demand higher multiples (the current model assumes 20), upside is even greater.

Nuvei is certainly not a Home Stock, in that it doesn’t have a moat and there are some smaller concerns, but the price and business model are far too discounted; a disaster is being priced in. If business doesn’t flop and/or the Great Depression doesn’t happen, Nuvei is going upwards. The main catalyst is lapping 2021’s financials making for easier comps, and new customer wins.

I’m a buyer at $30-$35 USD and would consider selling at $90-$120, though I wouldn’t make this an out-sized position as the company hasn’t been public long so it’s hard to get a sense of its track record.

Alibaba (BABA)

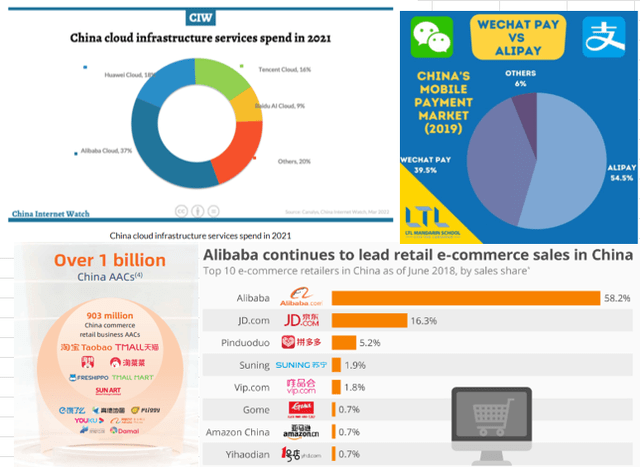

Alibaba is the pre-eminent Chinese internet stock. 60{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of Chinese e-commerce goes through one of its platforms, 37{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of the fast growing cloud market is captured by Alibaba, almost every single Chinese person (and 300M outside China) are annual active consumers on its platforms, and, through its one third stake in Ant Financial, BABA owns Alipay, the payment platform through which 56{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of Chinese payments flow (with more volume than Visa, Mastercard and Amex combined) and Yu’e Bao, the second largest money-market fund in the world with over $170B under management. Alibaba has an ocean for a moat.

In addition, they have fast growing segments, like international e-commerce and domestic groceries, both of which alone could be bringing in more annual sales by 2033 than the entirety of Alibaba generated in the last twelve months. Alibaba is more than just the Microsoft (MSFT) or Apple (AAPL) or Amazon (AMZN) of China, it’s all of them, combined.

Visuals to aid readers in understanding Alibaba’s moat (China Internet Watch, Mandarin School, Alibaba 2022 Annual report)

Since it IPO’d in 2014 at $92.70 a share, Alibaba has 15x the revenue, 5x the EBITDA, 4.5x the free cash flow, and 3.5x the operating income. Somehow, we can buy it at IPO prices; Alibaba is tremendously undervalued. Tom Hayes describes it as a submerged balloon, waiting to rocket to the surface.

Alibaba’s return since its IPO (Seeking Alpha)

The dislocation of price to value is caused by the Chinese government locking down the economy in an attempt to prevent Covid from spreading and cracking down on its tech companies, which it deemed were becoming too powerful (perhaps justifiably). Things have changed recently however, the CCP bought shares in BABA, has re-opened the economy, is stimulating the consumer, and generally seems to be working with and through its tech companies as China’s leaders’ personal and national self-preservation instinct has kicked in. Headwinds have shifted to tailwinds.

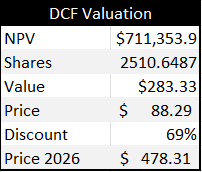

I’m putting up my sails to catch that wind, as Alibaba, were it to return to normalized multiples on normalized earnings, is worth at least $500-$600 a share three years from now. This plan appears to be on track. In their most recent earnings, Alibaba bought back significant amounts of stock well below intrinsic value, somehow grew revenue 2{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} despite the most recent quarter being under lockdown, and, significantly, increased free cash flow 15{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} year over year despite sales staying flat. This means that Alibaba found a way to become much more profitable in a very short amount of time. Once sales growth starts to kick back in, combined with increased profitability, BABA shareholders could see results well beyond normalized earnings, and therefore have much more upside.

Valuation of Alibaba assuming its free cash flow margins and multiples paid for that FCF returns to historic averages (Author’s Calculation)

Moreover, Chinese savings are twice the historic average, so if they can spend at normal levels, upside could be even higher, considering the market currently expects a conservative 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} annual growth of sales over the next few years for BABA. Shareholders of Alibaba have a significant margin of safety at current prices, and massive upside should anything go right.

I’m an active buyer and will continue to accumulate under $100 a share for as long as the market lets me. I’ll consider selling when it reaches that $500-$600 mark but will reassess when we get there. If international expansion is going well, BABA might turn into a long-term hold.

I did a longer article on Alibaba here.

Reitmans (OTCPK:RTMAF)(RET.A:CA)(RET:CA)

Reitmans is a century-old Canadian women’s fashion retailer, including the brand’s Reitmans, Pennington’s, and RW & Co. The Reitmans family still owns most voting shares (RET:CA), and senior management positions. Donville-Kent, a Canadian small-cap investing firm whose newsletter, the ROE Reporter, alerted me to the opportunity here. Their treatment is in-depth and can be read here.

Reitmans historically was a reliable dividend payer with sluggish growth in the Canadian retail space, like Canadian Tire in this respect. After years of deterioration however, Reitmans almost didn’t survive the pandemic and was forced to enter bankruptcy to survive. In so doing they laid off thousands of employees, renegotiated better lease terms, paid off creditors at 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} on the dollar, shut down unprofitable locations and brands, and re-listed from the TSX to the TSXV.

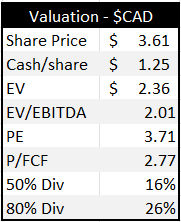

Re-emerging from bankruptcy, the company looks remarkably different, financially. Returns on equity are over 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, debt is paid off and they have $1.25 of cash/share (a quarter of the company’s market cap is cash). In the last nine months alone, Reitmans has generated $67M in free cash flow on $588M of sales, for a margin of 11{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, an excellent number for a retailer. Using just the last nine months numbers, they currently trade at around 2x EV/EBITDA, 4x net income and 3x free cash flow, well below historical averages for their own company specifically and retail generally.

Remarkably undervalued. Priced like it’s going bankrupt again (Author’s Calculations)

If Reitmans were to pay out 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} to 80{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of that free cash flow as a dividend (which they have historically), the stock would yield 15{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} to 25{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}. If that isn’t enough, the headquarters and distribution centre owned by Reitmans are worth more than the market cap of the company. The value is clear.

Like BABA, there is a large overhang on the stock causing its price to be severely depressed, but the facts are pointing to this overhang being temporary.

The new Reitmans could continue to be the dog it was in the 2010s, but if its last fiscal year is anything to go by, this doesn’t appear to be the case. Indeed, the current overhang from bankruptcy and Reitmans reputation is providing a margin of safety and likely an opportunity. Shareholders will need catalysts to continue gains though.

Reitmans has several potential catalysts. First, the company could buy back a significant amount of stock with just the cash on the balance sheet. Second, it could reinstate the dividend, which I’m sure the Reitman family are eager to do as it’s been a few years since they got the cheque they’ve been receiving for almost a century. Third, they could list back onto the TSX proper, where fund managers can buy their stock. Fourth, the family could buy the land under their headquarters and fulfilment centre and lease it back to the company, unlocking a pile of cash. Fifth, when earnings are reported in April, we get our first full year of financials for the new Reitmans, and potential announcements regarding any of the first four points made here. Reitmans is already up significantly, but there are more catalysts that could cause it to go even higher.

Long-term holder are likely non-existent (Seeking Alpha)

Over the last 10 years, Reitmans was a value trap, with slowing sales and decreasing margins and thus traded at very low multiples, around 7-8x free cash flow (which is still twice as expensive as today). However, sales are not slowing anymore, its brands are proving resilient, and margins have expanded significantly coming out of bankruptcy. 8-10x EV/EBITDA and/or 8-10x FCF are perhaps more appropriate conservative expectations of multiples going forward, compared to the current 2.3x EV/EBITDA and 3x FCF. This suggests that Reitmans is likely a double from ~$3.50-$4.00 on valuation alone, with more potential should the catalysts mentioned earlier happen. Donville-Kent expects the price to reach around $8 if the company doesn’t sell the land to the family, and $12 if they do.

If the outlook remains rosy, the company proves quality and the dividend is reinstated, I might find myself a long-term holder. To put it in perspective, with an 80{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} payout ratio, I’ll be receiving upwards of 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} yield on my current cost-basis; a 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} annual cash return is hard to say no to. This should result in price upside as well, as 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} yield from a quality company will not last long; I could see a more justifiable yield of around 6-8{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, implying the price could increase another two or three times, like Donville-Kent suggested.

In any case, I see a double minimum with potential for RET.A to triple or quadruple, while I eventually collect a significant dividend yield that I could choose to hold for the longer term. Reitmans is an ideal Investment Property Stock.

Conclusion

Reitmans, Alibaba, and Nuvei are all promising stocks into the medium-term. Though they have long-term drawbacks, namely low growth at Reitmans, ageing demographics and an autocratic home government for Alibaba, and no durable competitive advantage for Nuvei, the market is pricing their stocks at unreasonably low levels. To re-value their stocks, Reitmans could reinstate the dividend and go back up to the TSX, Alibaba could benefit hugely from government stimulus and domestic cloud growth, and Nuvei will be lapping tough 2021 financials, leading to some pleasing year of year numbers. All are quality businesses down for temporary reasons, and have catalysts to revive investor interest.

If worst-case scenarios don’t happen, all these stocks could be doubles in a relatively short period (a couple years or less), and perhaps more into the medium-term (3-5 years). I’m in all of them at allocations I feel are appropriate and am excited to see what the future brings. I would love to become a long-term holder but will reassess later. For now, these make for great Investment Property Stocks.

Below is a final summary for all the Top Picks for 2023:

Summary of top picks in the last two articles, including fair values and return potential (Author’s Calculation)

Please feel free to comment, especially dissenting thoughts.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.