Opinion: These 2 numbers sum up why the housing market won’t get back to normal for a long time

Final week I obtained a letter in the mail.

Like you, I’m stunned this still exists as a practice but determined moments phone for desperate actions:

Courtesy Ben Carlson

Now I would like to believe our property is just that beautiful, but I really don’t assume we’re the only ones who been given a letter from this Realtor. I’m positive there were numerous properties in numerous neighborhoods that received the exact same point.

I showed my spouse this letter and joked we should inquire for a 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} quality in excess of the present benefit. It is a massive spherical number but it’s primarily useless.

Why?

We have to reside someplace!

Even if we were being capable to secure a much higher advertising selling price, it wouldn’t seriously aid us all that a great deal.

We presently have a 3{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} house loan amount locked in. We have a decent chunk of equity in the household. And as our desperate Real estate agent alluded in their letter, it would be almost unattainable to obtain a different property suitable now to buy.

The combination of rising dwelling charges, low mortgage loan rates that are locked in by current owners and low provide can make it unappealing to sell your property and seem for a further just one correct now.

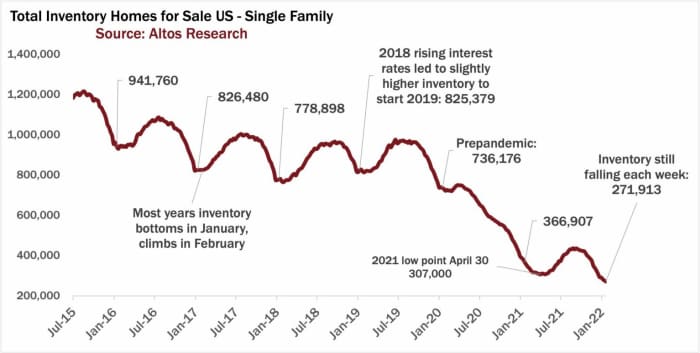

Mike Simonsen from Altos Research has a chart that demonstrates just how dire the housing provide condition is proper now:

Altos Research

That is 271,913 properties for sale in the full state proper now!

We’re in a housing marketplace in which we have document substantial demand and document small provide. If you want to know why rates are 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} greater than they have been a year back this is the simplest clarification.

But there’s extra likely on below.

Simonsen was lately on the Odd Tons podcast with Tracy Alloway and Joe Weisenthal where he explained how several owners are doubling up on their genuine-estate investments:

It’s like a doubling up. The house owner goes to purchase the subsequent dwelling, move up or shift down. And for the reason that mortgages are so low cost, it’s a actually very good time to keep the initial one particular as a rental unit. And so just about every 12 months I go to purchase a future just one and I continue to keep my to start with 1. And so which is one major phenomenon. And all of a sudden I’m a serious-estate trader. And at the very same time, institutional money’s been low cost. There is a ton of information about the major private-fairness funds getting up residences, but it is really the people today who are driving most of it. So in the past 10 years we have taken 8 million homes out of the resale cycle and moved them into the financial commitment rental component of the pool. And that’s, you know, 9{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of all the solitary-relatives households.

I know anyone wants to complain about BlackRock buying all of the households in this state, but 90{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of residential rental models are owned by people today in the United States.

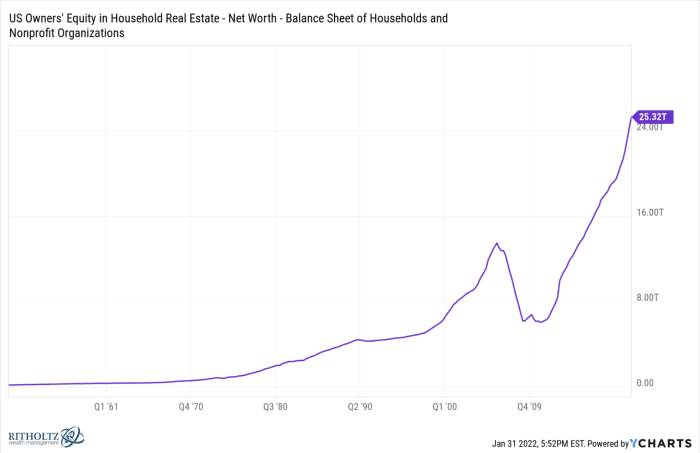

And this quantity is increasing for the reason that of an abundance of property fairness, the power of client harmony sheets and the prevailing minimal mortgage loan costs.

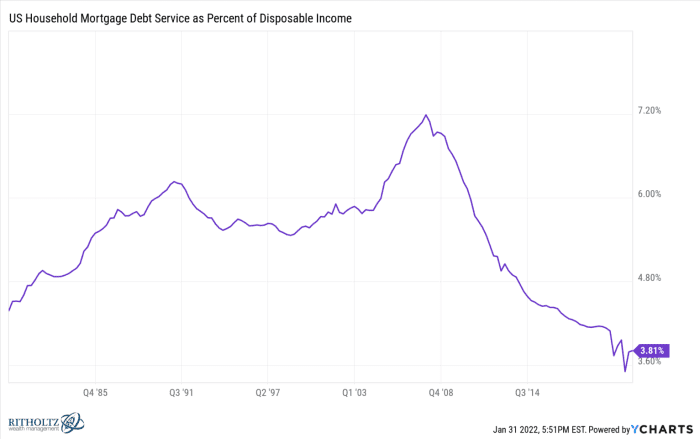

Small home loan costs have designed regular payments as cost-effective as they’ve ever been:

House fairness has skyrocketed from climbing housing rates:

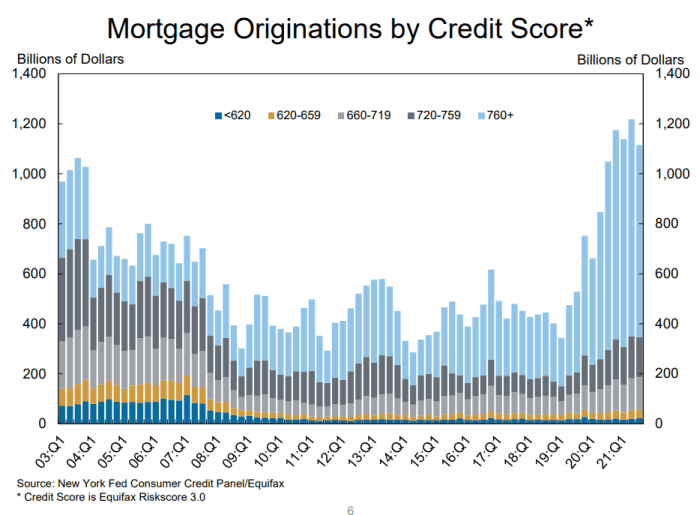

Plus search at the credit score-worthiness of homebuyers these days:

The individuals shopping for homes now have exceptional credit score scores. This was not the situation in the subprime boom of the early-to-mid aughts when the greater part of consumers came from persons with small credit score scores.

Just envision you’ve owned your property for 5 many years or additional. By now you’ve certainly refinanced at the very least two to three moments and very likely have a borrowing price of 3{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} or fewer. You’re also sitting on some pleasant fairness as a result of a mixture of principal payments and growing selling prices.

It absolutely sure does not appear like housing selling prices are going to halt rising any time before long and rents are also on the rise, so it helps make feeling individuals are picking to hold on to their primary property even immediately after buying something new. They can basically demand ample lease to protect the home loan, insurance policy and taxes and however come out ahead by gradually paying out down a inexpensive mortgage loan and viewing their house go up in value.

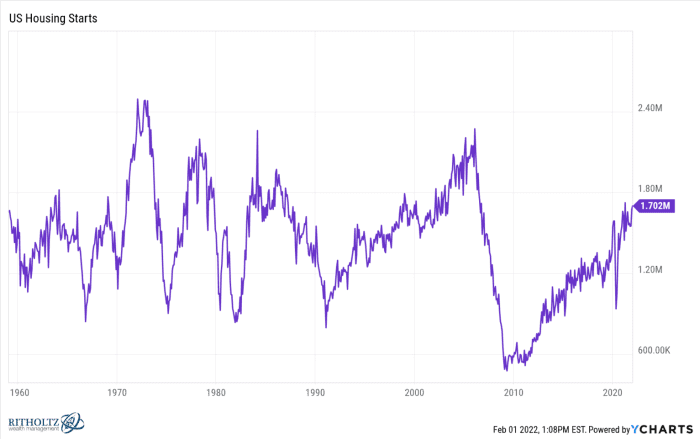

If I had to guess it’s heading to be a long time right up until we see anything at all approaching a “normal” housing market place. We simply just did not make adequate houses following the past housing crash to meet up with the need coming from millennials reaching their residence development yrs.

Points are last but not least buying up, but we have many years and many years of underbuilding to make up for. And it’s not like the provide-chain difficulties, federal government restrictions and COVID are generating it any simpler to make households any a lot quicker.

In the meantime, growing prices could sluggish issues a little bit if mortgage loan prices get higher enough. Rising housing costs and higher borrowing costs would at the pretty least make it not as appealing for individuals to keep onto their old houses and rent them out.

Nonetheless, rising costs would also very likely hold a lid on housing offer for the reason that so a lot of people have locked in minimal costs. Why provide to acquire a home for a larger cost with better borrowing prices?

Naturally, individuals will nevertheless go for new employment or family or a change of scenery or any of the other good reasons men and women determine to offer.

But it is probably likely to acquire a lengthy time till we see some kind of equilibrium amongst source and desire in the housing market.

Also from Ben Carlson: Really should I offer my shares so I can pay hard cash for a house?

Ben Carlson is the writer of the investing web site “A Prosperity of Frequent Feeling,” in which this was initial posted. It is reprinted with authorization. Follow him on Twitter @awealthofcs.