Investors are pulling back from the housing market, Redfin says

Traders are slinking away from the serious-estate current market as property-selling price growth slows and the possibility of value drops seems on the horizon.

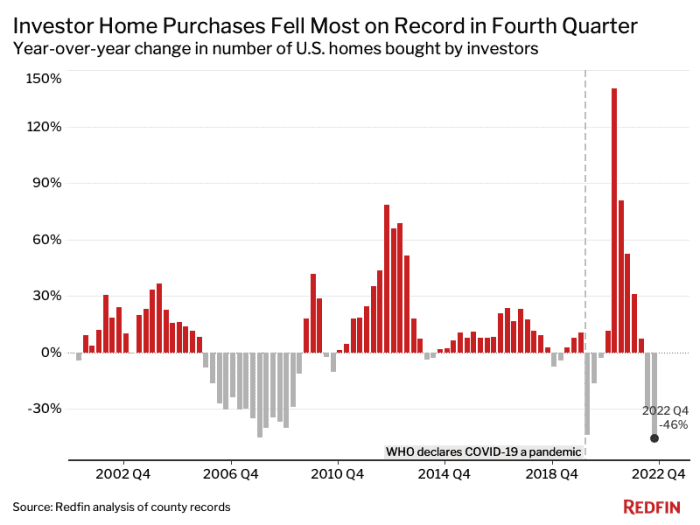

The last time trader purchases dropped so considerably was in 2008, throughout the subprime house loan crisis, when they fell 45.1{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, Redfin explained.

In the fourth quarter of 2021, buyers acquired 89,396 houses in metropolitan regions tracked by Redfin. In the fourth quarter of 2022, investors only acquired 48,445 properties in those regions.

The overall drop in mortgage charges and a feasible bottoming-out of home prices may lure investors back again into the industry, but “it’s unlikely that investors will return with the exact same vigor they had in 2021,” said Sheharyar Bokhari, senior economist at Redfin.

“That’s fantastic information for personal consumers, who are nevertheless grappling with high housing fees but no more time shedding bidding war soon after bidding war to traders,” he extra.

Throughout the pandemic, many property purchasers were being outbid and overshadowed by traders who were being equipped to scoop up houses with all-income features. The issue above the plight of initially-time household customers prompted Democratic lawmakers to convene a panel to seem into achievable predatory actions by institutional investors.

In its study, Redfin appeared at residence income amongst January 2000 and December 2022.

Residence purchases by investors fell in 2022. The last time such purchases dropped as drastically was in 2008.

Redfin

For the study, an investor was described as a purchaser whose identify incorporated at the very least a person of these search phrases: LLC, Inc., Have faith in or Houses. Buyers were being also viewed as to be buyers if their possession code on a house deed integrated key terms like “association,” “corporate trustee” or “company.”

Though buyers have pulled back on purchasing homes, it does not imply their market share has dropped, due to the fact person household prospective buyers have also slowed their action. Home loan costs are nevertheless elevated and house charges have not however dropped drastically, which means that lots of men and women are acquiring it challenging to find the money for to buy a dwelling ideal now.

According to Redfin, investors’ share of the industry in all the metropolitan places tracked by Redfin was 17.8{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in the fourth quarter.

In other terms, traders acquired that proportion of all households bought in the 40 most populous U.S. metro locations, as tracked by Redfin. Past yr, buyers bought 19.4{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of all homes in all those locations.

The cost of a usual property ordered by an investor was all around $425,926.

Investors flee pandemic boomtowns

In pandemic boomtowns like Las Vegas, Nev., and Phoenix, Ariz., buyers are operating for the hills, the info clearly show.

In accordance to Redfin, household purchases by buyers fell the most in Las Vegas, dropping 67{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in the fourth quarter about the exact period of time of the past calendar year.

Las Vegas is also the metropolis that saw residence values fall the most amongst the prime 50 marketplaces tracked by Zillow Group

Z,

another true-estate tech enterprise. Household values there fell 1.23{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in January as opposed with December.

Traders also hit the brakes in Phoenix, in which house purchases by investors dropped 66.7{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in Nassau County, N.Y., where they fell 63{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} Atlanta, where they fell 62.8{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and Charlotte, N.C., exactly where they dropped 61.9{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}.

“A large amount of traders are on hold since they even now see residence costs declining,” claimed Elena Fleck, a Redfin agent based mostly in Palm Beach, Fla.

The only metro place amid these analyzed by Redfin that observed an boost in trader purchases was Baltimore, Md.

Buyers still experienced the highest sector share in Miami Jacksonville, Fla. Atlanta Anaheim, Calif. and Charlotte, Redfin noted.

Home loan costs have crept again up as the current market weighs extra fascination-rate hikes from the U.S. Federal Reserve, which proceeds its struggle against inflation. In consequence, potential buyers have also pulled back again.