Amid inflation prices Americans turn to DIY home improvement projects

As significant home rates and home loan fees force many property owners to stay place rather than trade-up, a whopping 90{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of owners are hunting to make their current dwelling space more comfy this yr, in accordance to a new survey.

But as inflation continues to drive up material expenses, many are turning to Do-it-yourself initiatives to preserve funds.

For occasion, even though the consumer-price tag index, a measure of inflation, moderated to 6.4{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in January from a year before, the value of flooring coverings rose 13.1{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, and the selling prices of resources, hardware and materials went up by 11.8 {d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, in accordance to info introduced before this week by the Labor Division.

How are house owners handling increasing fees of home enhancement assignments?

In a survey of nearly 3,700 American property owners by Today’s Homeowner, almost 28{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of respondents stated they have been arranging to commit “significantly” a lot less as opposed to very last calendar year, 90{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of homeowners mentioned they were being preparing to tackle at the very least just one home renovation project this yr.

“If you preferred to get new furnishings or if you preferred to paint your residence, or if you preferred to set new siding up outdoors, if you required to make a deck, seriously everything linked to enhancing your residence, we uncovered that this category, was about 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} a lot more expensive,” Hailey Neff, a researcher on the study explained to United states of america These days. “For a large amount of home owners, DIY challenge has develop into a extra extra economical way of accomplishing it.”

Property owners in some states are tightening their purse strings much more than other folks. A lot more than 60{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of owners in four states (Connecticut, Wisconsin, New Mexico, and Nebraska), 60{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} reported they system to minimize their investing on home improvement projects in 2023.

With these assignments, lots of property owners are frequently on the lookout to enhance their residing room. Approximately 69{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of respondents listing this as a main rationale for seeking to full their prepared property enhancement projects in 2023. The future-most common cause for seeking to full one particular or much more renovations is to repair a little something damaged (53.1{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of respondents).

Only about 13{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of house owners listing renovations prior to listing a residence for sale as a person of their key factors for using on improvement assignments.

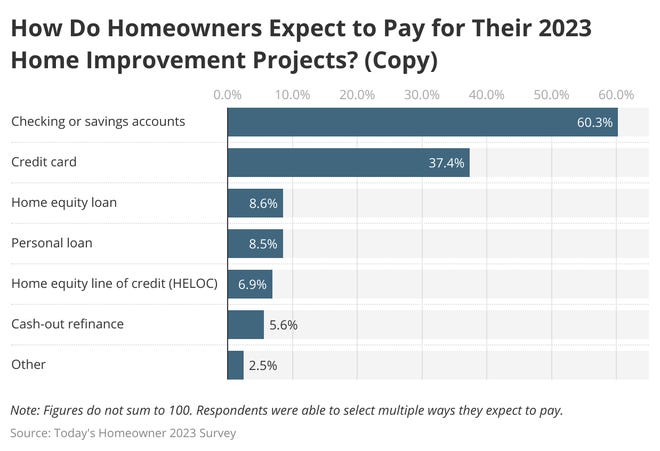

How are house owners paying out for home enhancement tasks?

Around 60{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of respondents stated they expect to pay out for initiatives applying cash from examining and cost savings accounts (60{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}). On top of that, 37{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of owners cite credit rating playing cards as a single of the means they will spend for enhancement initiatives.

Less property owners anticipate to switch to financing solutions, and of these, practically 9{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} report residence equity and personal loansas their most popular selections.

Owing to volatile and elevated mortgage charges, fewer home owners are intrigued in a residence equity line of credit history (HELOC) or hard cash-out refinancing as means to fund their residence enhancement. In a HELOC, desire costs are normally variable, that means that homeowners may perhaps be on the hook to shell out a higher fee if curiosity costs keep on to rise. In the meantime, a funds-out refinance is only advantageous when existing mortgage rates are lower than the existing fee, which may well not be the case for several owners these days, in accordance to Today’s Home-owner.

Do it yourself your property enhancement job?

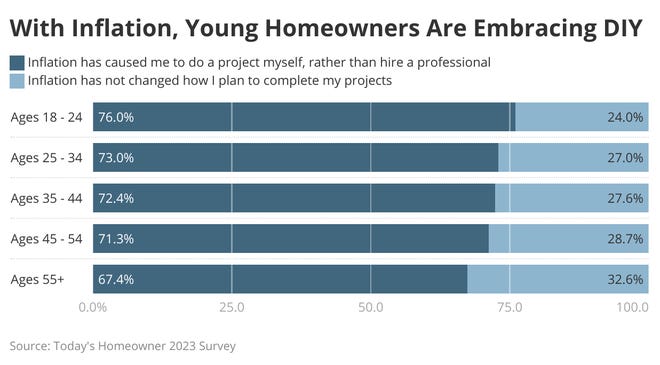

About 71{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of home owners say that inflation has caused them to do a challenge by themselves rather than use a experienced.

The craze is even more pronounced for Gen Z and Millennials. Around 76{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of homeowners amongst the ages of 18 and 24 are performing a job on their own alternatively than selecting a contractor due to inflation. For people under 44, that selection is shut to 73{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}.

The survey also found that property owners in distant parts appear to be to desire Do it yourself, possibly indicating a trouble in discovering nearby industry experts. 8 of the top 10 states with the most Diy-leaning owners in this analyze have a population of five million or significantly less.

Swapna Venugopal Ramaswamy is a housing and financial system correspondent for United states Now. You can follow her on Twitter @SwapnaVenugopal and signal up for our Daily Money newsletter here.