Why You Shouldn’t Buy Rental Properties In 2023

Feverpitched

Rental qualities are some of the most preferred investments of unique buyers.

It makes perception.

The concept of buying a house with the bank’s cash and then obtaining a tenant reimburse your house loan for you, and proudly owning the house absolutely free and apparent in a several a long time, is a very persuasive concept.

If you composition things very well, you may well even get paid funds stream along the way and delight in tax advantages.

Eventually, it will also diversify your portfolio and secure a portion of it from the significant stock industry volatility.

So on the area, it seems like a no-brainer…

Rather very low chance… Large returns… And plenty of income.

I have invested in rental properties in the previous and thought that this plan was so powerful that I sooner or later went to do the job in non-public fairness true estate.

Even then, I assume that rental attributes are these days some of the worst investments that you could make.

Let me reveal why…

There are 5 key good reasons:

Explanation #1: The Returns Are Not As Large As You Consider

When you first begin to master about the strategy of investing in rental properties, you will probably conclude up on some blog site or YouTube channel wherever a real estate guru will educate about serious estate investing, but will also probably try to promote you on some course or something else.

In a natural way, they will want to make it sound as compelling as achievable to catch your notice and will greatly overstate the returns, saying you will make 20, 25, or even 30{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} once-a-year returns.

But these figures usually are not remotely shut to reality in most conditions.

Warren Buffett turned the richest man on earth by compounding the returns of Berkshire Hathaway (BRK.B) at 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} for each year, so I can assure you that aspect-time newbie rental traders are not compounding at far more than him. We would have a lot of extra real estate billionaires if not!

As an alternative, these folks are only miscalculating their returns.

The two most widespread blunders are the following:

1) They understate their genuine fees: The expenses of possessing a residence are extremely sizeable and they are usually underestimated mainly because several of these expenditures only occur as soon as in a when when something key breaks down. To give you an example, if your roof has a leak, and it isn’t caught early on, your household could suffer water problems that prices $30,000 to take care of. That could be 3 years’ well worth of web running revenue. You want to account for an average once-a-year price tag for significant mend products like this and it materially lowers your returns. A superior rule of thumb is that your net running cash flow is about 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of your gross rental money and even that may well not address all these repair service items around time.

2) They overlook to account for the value of their possess time/work: This is the greatest misunderstanding when it will come to rental properties. Men and women will set a massive sum of get the job done/several hours into acquiring their rental assets, negotiating it, financing it, renovating it, advertising and marketing it, managing it, and so forth. but they will suppose that their operate is worth when calculating returns when in truth, each and every hour has a value considering that you could use this time to do anything else that is successful. You could have just as effectively labored additional hrs at your most important work or worked a second career and attained $30 per hour of do the job. If you deduct all of that from your rental money, you will frequently obtain that you did not obtain an investment, you just purchased a second position. The returns from the financial investment are pretty low and you are just earning a “income” on your do the job/time.

When you adequately work out returns, you will commonly conclude up with 8-15{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} annual returns. That’s still extremely great, but it is nowhere around the 20-30{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} returns that are frequently touted to new buyers. True estate is a fairly uncomplicated, minimal-margin enterprise, with a large amount of competition.

Explanation #2: The Pitfalls Are a Lot Higher Than You Consider

Men and women will typically envision that rental houses are safe and sound investments mainly because they are immune to the volatility of the inventory sector. In comparison to shares, they experience like safe and defensive investments and this is especially correct when the inventory marketplace is as risky as today. Additionally, all people will constantly have to have a roof above their head, no matter if we go into a economic downturn or not.

But this is incredibly short-sighted.

The hazards are in fact pretty significant and in point, a ton increased than all those of investments in the stock market place.

When you invest in a rental residence, you will need to recognize that you are earning a private, illiquid, concentrated financial commitment with superior leverage, social risks, and unlimited liability in several instances.

Even if you use an LLC or insurance, you will continue to typically need to indication personally on the financial loans, and if factors go improper, the tenant will also sue you personally, not just your LLC. It is not just your returns that could be ruined, but also your individual everyday living for the reason that these points could guide to substantial pressure and sleepless nights, which is probably the greatest hazard of all.

Aside from, even the belief of “small volatility” is a myth. Just since you are not getting a every day quote does not signify that your residence price is just not risky.

If you tried using to provide your assets, you would get unique presents each working day, which proves my position that its benefit would be extremely unstable. And considering that rental buyers frequently use substantial leverage, the worth of your fairness (which is what’s traded on the inventory marketplace), would be incredibly risky.

If you are 80{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} leveraged, and you received an provide at a 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} lessen cost, that is a 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} fall in your equity worth. So the actual “hidden” volatility is truly big, but you just do not know about it. Any setback that could take place could result in a sizeable drop in your fairness price.

Reason #3: It Handicaps Your Main Supply of Revenue

Your main supply of revenue is your occupation. This should be your major target.

You want to progress in your vocation and increase your profits so that you can spend extra and inevitably established your self no cost.

But if you buy a rental residence, enable on your own quite a few of them, this will noticeably handicap your potential to progress in your profession.

It will get a good deal of your time and vitality, and will also tie you to a unique location simply because you will be more unwilling to transfer somewhere else considering the fact that you would go away back all your houses and the area sector expertise that you have formulated.

This could lead to substantial indirect prices since you may perhaps not get the pay back increase that you would have gotten if you had the time, vitality, and liberty to emphasis on your principal supply of money.

This is especially accurate for greater earners due to the fact investing time and electrical power in rental attributes (a small margin business) is time taken away from your remarkably gratifying routines. Feel about a lawyer taking his time that’s well worth $100s every hour to get the job done on rental qualities… It is not reasonable.

Purpose #4: It Also Handicaps Your Life style

Life isn’t just about funds.

I would a lot somewhat get paid pressure and operate-absolutely free 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} return which presents me total freedom than a function-intensive 12{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} that ties me to a distinct location and effects in occasional sleepless evenings.

Proudly owning rental properties will hurt your way of life because it is time-consuming, and electrical power-draining, cuts down your flexibility of movement, and will eventually also direct to social difficulties as perfectly.

You will question getting extensive visits. You will get phone calls from your tenant or house manager about issues when you desire that you could just rest. And worst of all, you could get threats from your tenant, leading to you to drop snooze at night or even worse. It could virtually influence your health!

Cause #5: There is a A lot More simple and Better Option: REITs

Even irrespective of all of what I described earlier, true estate can still be a terrific expenditure if you find the right property at the appropriate price.

But why trouble when you could just commit in publicly shown real estate financial commitment trusts (“REITs”) (VNQ) as an alternative?

REITs make it possible for you to make investments in actual estate with the additional rewards of:

-

Diversification

-

Qualified management

-

Restricted liability

-

Liquidity

-

Overall liberty.

They allow you to continue to keep focusing on your main resource of earnings, which is your vocation, and they would not damage your life style. On the opposite, they give you overall freedom given that you have specialist administration groups that perform for you, and the management is significantly additional successful because REITs get pleasure from substantial economies of scale.

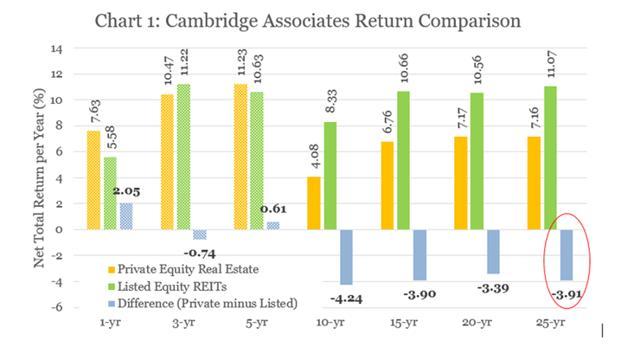

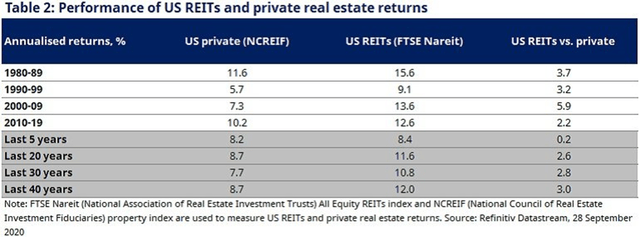

This is a person of the good reasons why REITs have traditionally outperformed private authentic estate investments by 2-4{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} for every yr. Their scale presents them a major expense gain in not just administration, but also all other costs.

Here are a few scientific tests that examine the returns of REITs to personal real estate investments:

EPRA Cambridge NAREIT

So, why would you make investments in rental houses when you could make investments in REITs, and make increased returns with reduce possibility and considerably less hard work?

This is specifically genuine right now since REITs are seriously discounted relative to the worth of the authentic estate they individual.

To give you an example: BSR REIT (OTCPK:BSRTF) owns a portfolio of condominium communities in Texas, and its internet asset benefit per share is $22.35, but its share price tag is just $12.50. So, you get to invest in its actual estate at 60 cents on the dollar.

The lower valuation offers a major margin of protection and future upside probable as REIT valuations ultimately get well.

I would want to acquire REITs around rental homes even if the valuations have been equivalent, but at today’s discounted, I just are not able to make any sense of getting rental attributes.

Bottom Line

I was as soon as a rental investor, but I am now a converted REIT investor.

I consider that rental properties are weak investments in most instances since buyers overstate returns, understate dangers, and are unsuccessful to acquire into account the adverse impression that it will have on their careers and way of life.

Other than, REITs provide far better returns with decreased possibility and a lot less hard work, so why hassle?

Editor’s Take note: This report discusses 1 or a lot more securities that do not trade on a big U.S. exchange. Remember to be aware of the hazards affiliated with these shares.