Why Warren Buffett Doesn’t Buy Rental Properties

Paul Morigi

Rental houses are some of the favourite investments of individual traders.

The strategy is simple: you invest in a house with the bank’s money and then let the tenant pay out off your home loan, all even though the assets keeps attaining benefit. You may perhaps even earn added dollars flow alongside the way and enjoy tax gains if you construction issues perfectly.

It looks like a excellent tactic.

But if it is so outstanding, do you at any time marvel why legendary investors like Warren Buffett never commit in rentals?

He sure could: he has the cash, the abilities, the connections and obtain to expertise. And still, he decides not to invest in rentals.

Why is that?

Fortuitously, around the yrs, he has specified us some clues in his Berkshire Hathaway (BRK.B / BRK.A) shareholder letters and televised interviews.

In what follows, we highlight the 3 main explanations why Warren Buffett does not obtain rentals, and we then existing a much better choice for most traders.

Discover

Cause #1: Rentals need a ton of perform

Rentals are usually perceived to be passive investments. Persons envision that you only purchase a home, rent it out, and allow the passive revenue pile up when you play golf.

But the reality is extremely distinctive, and Buffett understands this. In an interview in 2012, he describes that if there was an productive way to spend in rentals, he in all probability would, but the management would make it extremely hard. In a prior report, I shared the subsequent list of jobs, which is not in depth:

- Studying distinctive markets and sub-marketplaces.

- Having to know what is actually truthful value and what is not.

- Hunting for the appropriate house and meeting with brokers.

- Negotiating, negotiating, and then negotiating a bit far more.

- Finding funding and closing on the home.

- Determining what to fix, interviewing contractors, and obtaining bids.

- Checking the maintenance is effective and complaining about factors not being accomplished thoroughly. Receiving a different round of repairs…

- Promoting the property to locate a superior tenant.

- Interviewing tenants…

- Environment up a company and a lender account for the home.

- Having the right insurance coverage.

- Accumulating rental revenue and paying out all property expenses.

- Executing some a lot more repairs…

- And so on.

And, cumulatively, which is a large amount of perform! In a feeling, a rental is far more comparable to a aspect-time job than a passive financial commitment. Specific buyers will typically do the job on their rental assets and fail to account for the benefit of their time.

Buffett-form folks are extremely conscious of the truth that your time and work have benefit and once you account for it, the returns of rentals are somewhat disappointing in most instances.

Explanation #2: Being familiar with your circle of competence

Buffett is quite superior at knowledge his circle of competence and sticking to it. He designed his fortune by investing in purchaser products, retail and coverage businesses. He understands those corporations genuinely nicely and has a competitive benefit in excess of other traders.

But he also understands that this will not apply to authentic estate. While he unquestionably has some techniques and in all probability understands a lot more about genuine estate than most of us, he is still set at a disadvantage when in contrast to REITs (VNQ) and other non-public fairness players like Blackstone (BX) and Brookfield (BAM).

In this article is what Charlie Munger, Buffett’s suitable-hand man, pointed out at a preceding yearly meeting:

“We really don’t have any aggressive advantage about knowledgeable authentic estate investors… We have no distinctive competence in the area and that usually means that we spend virtually no time wondering about it. And then this kind of actual estate that we have in fact owned, I’d say we have a weak document at it.”

REITs and personal equity players are experts, and they have access to remarkable assets. Buffett understands that he merely cannot contend with them.

Rationale #3: Difficult to find options

Buffett is a worth investor. He appears to be for mispriced chances to generate outstanding returns.

But regretably, there usually are not numerous such prospects in the genuine estate sector. In a past job interview, he clarifies that:

“Less than most disorders, it is difficult. It is a incredibly aggressive globe. Authentic estate is extra precisely priced most of the time.”

This helps make feeling when you believe about it.

True estate is not a commodity, but it is closer to staying just one than a regular organization. You have four partitions and a roof, and you then get paid rental income by renting it out. It is reasonably easy to understand. The money move is steady and predictable, and the good value can be quickly determined, at the very least relative to a business enterprise.

As a outcome, there are less mispricings and opportunities for price traders like Warren Buffett. Most real estate buyers purchase homes at all around industry price and then make returns by holding them for the very long operate.

A Superior Choice: REIT Investing

Buffett may perhaps not spend in rental properties, but he often invests in genuine estate financial commitment trusts (“REITs”), which are publicly outlined genuine estate financial investment firms.

Just to give you a couple illustrations, he has earlier invested in Tanger Outlets (SKT), Typical Development Properties, Vornado (VNO), ((now Brookfield (BAM)), Seritage Progress Properties (SRG), and Store Money (STOR), which was recently purchased out by Blue Owl Money (OWL). To be apparent, REITs nevertheless usually are not a significant element of Berkshire, which is comprehensible offered its dimension, but he appears to have traditionally invested a good deal much more in them than rentals.

Why is he favoring REITs around rentals?

It is simply just that REITs turn the weaknesses of rentals into strengths:

- Weak point #1: rentals demand a ton of get the job done, but REITs are entirely passive. They are managed by pros and they are hugely value-successful many thanks to their large scale.

- Weak spot #2: rental investing requires expertise and resources that you may possibly not have. REITs can employ the service of the most effective talent and spend them generous salaries, though however staying value-economical presented their scale. If you simply cannot contend with them, you could as well sign up for them.

- Weak spot #3: rentals are hardly ever mispriced, but REITs typically give wonderful chances. Not like rentals that are reasonably stable, REITs are hugely risky simply because they are publicly traded. As a outcome, REITs will typically be mispriced, like shares, given that most traders focus far too significantly on quick-term results. Today, REITs are significantly heavily discounted, investing at 20, 30, 40 or even 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} reductions relative to the price of the real estate they have. Buffett is a price trader, and he prefers to acquire great real estate that is skillfully managed at a discount to reasonable benefit.

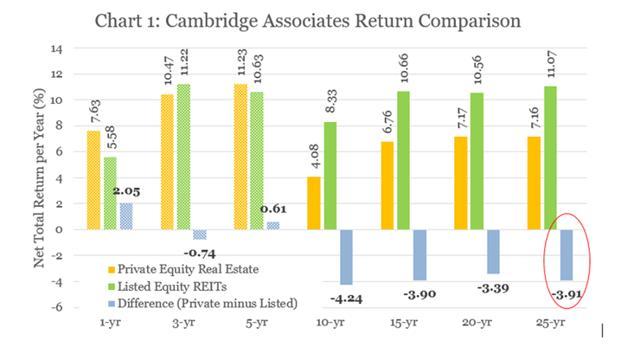

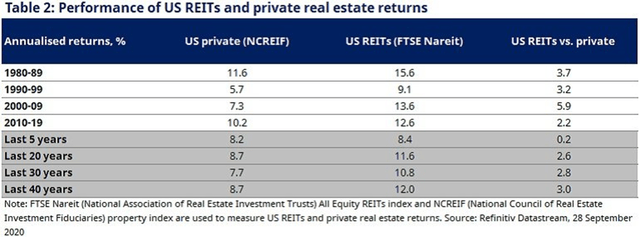

Past these strengths, there are several reports that conclude that REITs are more gratifying than rental houses in the very long operate. This makes feeling for the reason that REITs love enormous economies of scale, have entry to the finest talent, much better relationships, decrease expense of cash, and numerous other positive aspects:

EPRA Cambridge NAREIT

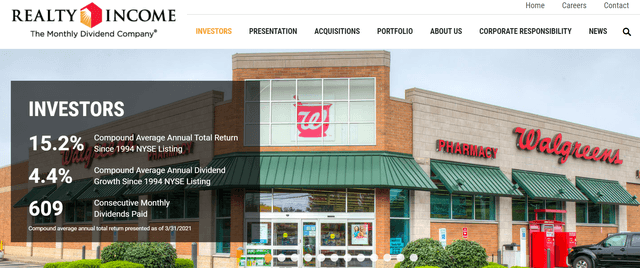

REITs also let you to make investments in true estate approaches that you couldn’t abide by on your personal. To give you an illustration, Realty Profits (O) purchases triple net lease properties that it leases to Fortune 500 organizations like McDonald’s (MCD), Walgreens (WBA) and Walmart (WMT) on a very long-expression basis. It is a straightforward method that has resulted in 15{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}+ normal yearly overall returns considering the fact that its inception, and it has hiked its dividend every solitary calendar year for nearly 30 many years in a row.

Realty Earnings

If you had acquired Realty Revenue just after a important crash when it was discounted, your typical yearly returns would have been nearer to 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} for every yr on ordinary.

Could you accomplish that by investing in rental qualities?

It is not likely simply because you absence scale and techniques, and rental attributes are seldom mispriced. This appears to be why Buffett favors REITs in excess of rentals in most cases, and it is also why I choose to make investments in REITs.

Now, primarily, it helps make very little perception to invest in rentals because REITs are intensely discounted following the latest marketplace selloff and give a great deal improved value than rental qualities.

Just to give you a fast case in point: Whitestone REIT (WSR) owns a portfolio of assistance-oriented, grocery-anchored shopping centers in fast increasing sunbelt marketplaces like Phoenix and Austin. Its rents are today expanding rapidly, but the enterprise is at present priced at a close to 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} discount relative to its NAV.

Whitestone REIT

Effectively, what this means is that you get to acquire true estate at 50 cents on the greenback and get the further benefits of liquidity, specialist management, diversification, and scale for totally free on leading of that.

The only cause why it is so heavily discounted is that the REIT market place is right now mispriced and briefly detached from the non-public real estate current market. It would not surprise me if Berkshire bought some much more REITs in the coming quarters.

Base Line

Buffett not often invests in genuine estate mainly because it isn’t really his specialty, but when he does, he tends to favor REITs around rentals.

I employed to function in private equity true estate, but when I arrived to the realization that REITs were being exceptional investments in most situations, I made the decision to develop into a REIT analyst and which is how I end up here on In search of Alpha.

These days, the the vast majority of my genuine estate money is invested in publicly stated REITs.