Why Buying A Rental Property In 2022 Could Be A Smart Investment

LifestyleVisuals/iStock by means of Getty Visuals

If you have followed my article content for a though, you most likely know that I am usually in opposition to the idea of buying rental attributes.

I feel that most investors undervalue risks, overestimate returns, and forget to take into consideration the destructive affect that owning a rental house can have on your lifestyle, occupation, and even your overall health.

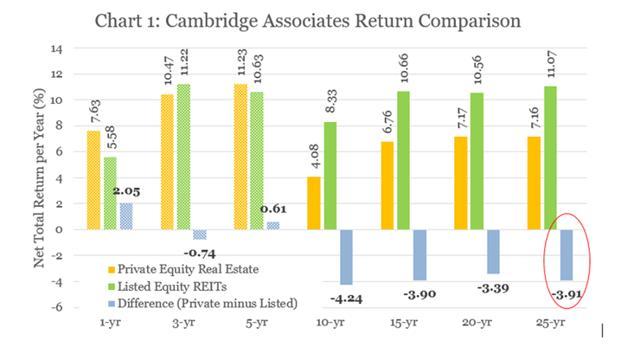

Over and above that, quite a few reports have shown that publicly mentioned REITs (VNQ) outperform non-public genuine estate more than multi-ten years time periods, and this makes perception when you look at that REITs appreciate significant economies of scale, are managed by the brightest in this business, have much better funds, interactions with tenants, and I move on numerous other reasons:

REITs outperform non-public true estate (OTC:EPRA) REITs outperform private actual estate (Cambridge Investigate through NAREIT)

(To discover a lot more about why I frequently favor REITs in excess of rentals, you can click below to go through my hottest short article on this subject matter.)

But this does not imply that all rental property investments are poor for each se.

In fact, supplied the latest environment situations, I imagine that getting a rental residence may possibly even make a wonderful investment decision in 2022.

Lately, I even bought one particular myself. It is not just a rental home because I will use it as my most important home, but I manufactured the purchase mainly because of the similar rationale.

Below, I existing 3 explanations why you may perhaps want to acquire a rental property in 2022, and following that, I existing a few REIT solutions for people of you who you should not want to deal with the unpleasant 3 Ts: tenants, toilets, and trash.

Reason #1: Hugely Leveraged Bet on Inflation

These days, we have extremely low curiosity costs, but unusually substantial inflation.

This blend strongly favors highly leveraged, inflation-protected real asset investments like rental qualities.

This is the most effective form of surroundings to be a landlord/borrower simply because you are purchasing belongings that respect in benefit with personal debt that’s depreciating in price.

Let us look at a simple illustration:

-

You obtain a rental assets for $200,000.

-

You finance $160,000 (80{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}) of it with a 30-year mounted-level mortgage loan.

-

Your desire fee is 3.5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and your regular rental money is $1,200.

In a very low inflation entire world, this investment decision wouldn’t be anything extraordinary. I would argue that this is a inadequate investment decision the moment you thoroughly account for all the bills and the worth of your time.

But in a significant inflation world, it is a really diverse story.

Today, inflation is at 7.9{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and housing is appreciating by even a lot more than that in most well known and rising metropolitan areas. Assuming your rental home gains 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in value, then you essentially attained a 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} return on fairness for the reason that of your mounted-charge property finance loan. The asset improves in serious value, but the debt is lowering in true price, resulting in exponential equity benefit advancement.

Now, your loan-to-benefit also drops from 80{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} to 73{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, which lowers threats and may perhaps allow you to refinance to pull equity out of the assets and reinvest it in other places.

In that feeling, getting a rental house with a fastened-price mortgage is basically a leveraged bet on inflation, and offered the present-day environment get, it is an expense that may make a whole lot of feeling. Even if you consider that inflationary pressures will neat down, it may perhaps make feeling as a hedge in your portfolio in scenario you are completely wrong and inflation stays elevated for decades to occur. As I reveal in a current short article, a rental house is a much greater inflation hedge than gold.

Purpose #2: War Or Not – People Have to have Housing

Russia’s invasion of Ukraine is causing excessive uncertainty.

It is not only a humanitarian crisis, but also an financial crisis, and the outcomes are nevertheless quite a lot unknown to most of us.

Companies around the world are now struggling the pain, and this could be just the beginning. To give a couple illustrations:

McDonald’s (MCD) experienced to quickly shut ~1,000 restaurants in Russia and Ukraine but will continue on to shell out its workforce. These outlets depict practically 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of the company’s revenue so it is major.

MCD is not an isolated circumstance. KFC (YUM), Starbucks (SBUX), Coca-Cola (KO), PepsiCo (PEP), Fb (FB), Netflix (NFLX), Visa (V), Mastercard (MA), etcetera… are all using the very same techniques to protest versus Russia’s war crimes.

Russia is a major sector and so this is a good deal of dropped income and financial gain for these organizations. Past that, the disaster is creating a spike in the price tag of most organic means, which will also impact businesses.

Could this be ample for the inventory market to crash?

I will not know. I never assume that anyone appreciates.

But what I know is that housing is a safe and sound haven in this crisis due to the fact individuals even now have to have a roof above their heads and what’s happening in Eastern Europe has little effect on housing in the US.

In that feeling, shopping for a rental residence in the US might provide as a hedge in opposition to the war in Ukraine. You get to secure virtually-totally free money by means of a long-dated preset-fee home finance loan and obtain a defensive, inflation-protected asset that ought to go on to improve in benefit about time and throw off rental cash flow irrespective of the war.

Motive #3: The Diversification Advantages Are Starting to be Progressively Important

Now much more than at any time, buyers will need to make sure that they are properly diversified.

Bonds (LQD) and Treasuries (IEF) generate close to almost nothing even as inflation is surging and stocks (SPY) have become particularly risky. For superior or even worse, REITs have also come to be ever more volatile, which may well flip off several buyers.

Adding a rental assets to your portfolio may well assist you diversify pitfalls and sleep improved at evening realizing that you don’t have all your income at the risk of a stock sector crash.

To be crystal clear, it does not suggest that a rental really should be viewed as a safe investment. But having some belongings out of the inventory sector can lower your portfolio threat through times of extreme uncertainty like currently.

Obtaining a Rental vs. Buying REITs: Which is Better?

REITs are publicly detailed true estate financial commitment firms that permit you to make investments in genuine estate by buying shares. In that feeling, they take pleasure in all the exact rewards of leverage and inflation protection. You supply the equity by shopping for shares, and the REITs then include home loans on your equity to get qualities and share the monetary reward with you.

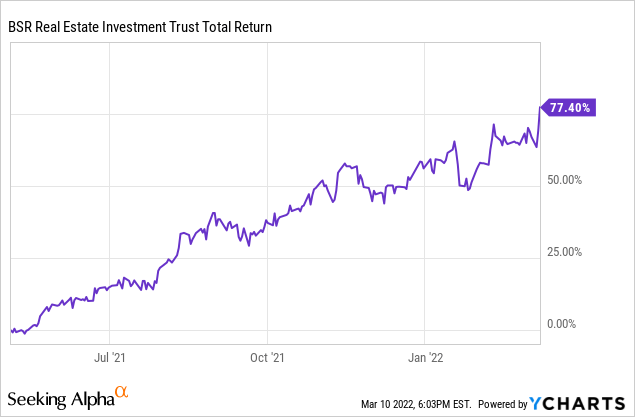

To illustrate this point, consider our current financial investment in BSR REIT (OTCPK:BSRTF), an apartment REIT that focuses on Texan marketplaces. We invested in the company in Might 2021, and in considerably less than a person calendar year, it has already produced a close to-80{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} return:

It was so worthwhile since its equilibrium sheet is about 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} leveraged and its houses liked significant lease development and appreciation.

In that sense, REITs are not unique from rental homes, but in addition, you also get qualified management, diversification, liquidity, and very likely outstanding extensive-term returns. For this reason, I favor REITs in excess of rentals nine moments out of ten. They merely supply superior threat-and-trouble-modified returns in most scenarios.

Even then, supplied what is actually taking place in the planet appropriate now, there is a potent circumstance to be built for also investing in non-public real estate for the further diversification, control, and peace of intellect that can arrive with it.

It is not for every person, but if you have the capacity to borrow at a reduced fee in a secure way, then it can give you a great hedge against inflation and also the war in Ukraine.

You could of program also get this hedge by the REIT marketplace, but you won’t be able to be as well diversified in this sector. Russia’s invasion of Ukraine does not just effect Europe, but the entire earth and its REITs.

Generally, it is a excellent matter to be publicly stated because it enables you to easily and cheaply invest in/market investments. But for the duration of instances of extreme uncertainty like now, it is excellent to also have some assets that are not vulnerable to the mood of the inventory industry. That is wherever rental homes appear in.

Base Line

Get equally: REITs and rentals.

In most situations, I would favor REITs, but provided modern extreme uncertainty, I would suggest investing in non-public rental homes for extra diversification.

Now, I have 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of my web worth in REITs/Rentals and about 90{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of that is in REITs and 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in rentals. Which is the best combine for me.