New report: What will luxury real estate look like in 2022?

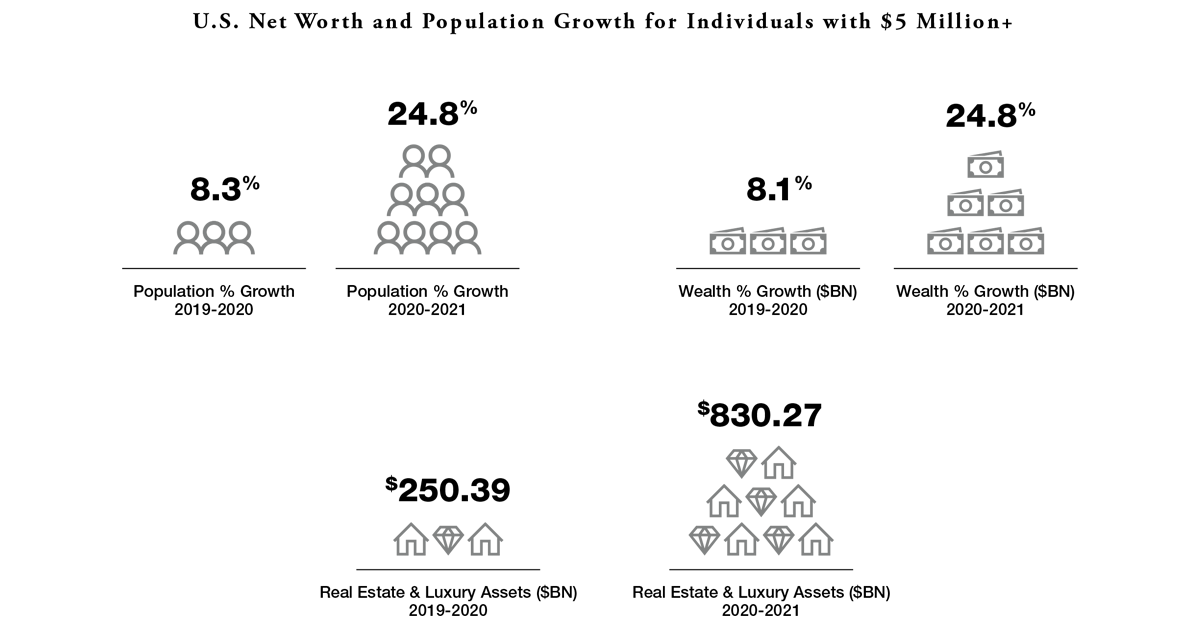

Driven by lower inventory, superior housing expenses, and inflated demand from customers for greater residences, luxurious genuine estate professional an marketplace-altering change that will influence the sector for the many years to appear. Soaring wealth also added to that equation in 2021. According to new findings from Wealth-X as commissioned by Coldwell Banker World Luxurious, world-wide prosperity for folks with a internet really worth of $5 million+ grew by 20.4{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in 2021, up from 2.1{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} the previous calendar year, when U.S. wealth rose by 24.8{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} from 8.1{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}. Even far more impactful was the increase in the populace of affluent men and women, which grew 19.8{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} globally in 2021 (up from 2.2{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in 2020) and rose 24.8{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} for the U.S., in contrast to 8.3{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} the preceding yr.

How did we attain this sort of staggering expansion in this sort of a quick period of time? And much more importantly, in which do opportunities even now lie in this marketplace?

Thanks to curated surveys from Coldwell Banker Worldwide Luxury Assets Professionals around the world and information compiled by Wealth-X and the Institute for Luxury Residence Advertising, Coldwell Banker World-wide Luxury’s The Report 2022 delivers an optimistic outlook as we target on key market developments and industry development possibilities to view in the new 12 months.

1. Global consumers are looking to the U.S. market

We might commence to see a increase in global investment as journey constraints loosen and overseas investors who have benefited from enormous wealth development glimpse to the U.S. for their serious estate investments. Around 83{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of Coldwell Banker International Luxury Property Experts foresee the return of intercontinental customers to the U.S. sector. Extravagant towns like Los Angeles, New York, and Miami remain favorites amid intercontinental traders, but suburban cities may possibly commence to see international financial commitment as consumers seek out solitary-spouse and children homes, bigger spaces, and greater privacy.

2. Suburban metropolitan areas can be expecting new faces

Work-from-dwelling options and low tax states have prompted quite a few U.S. individuals to relocate through the place. Per our first Possibility Index, the markets with the highest obtaining likely for solitary-family members homes contain Staten Island, Delaware’s Sussex County Coastal, Cincinnati, Charlottesville and Napa County. Meanwhile, Cincinnati, Lake Norman, N.C., California’s Marin County, Better Seattle, and Coastal Pinellas County, Florida, may perhaps still have space to improve for hooked up homes.

As consumers relocate to new marketplaces, agents have to recognize their client’s needs, be well-informed on their new neighborhood, and conscious of their way of living. “It employed to be that agents only experienced to know their area current market, but with so significantly motion going on in luxury, they want to be capable to speak about other marketplaces from a put of expertise,” notes Liz Gehringer, President of Affiliate Business and COO of Coldwell Banker Real Estate.

3. Increasing serious estate footprint

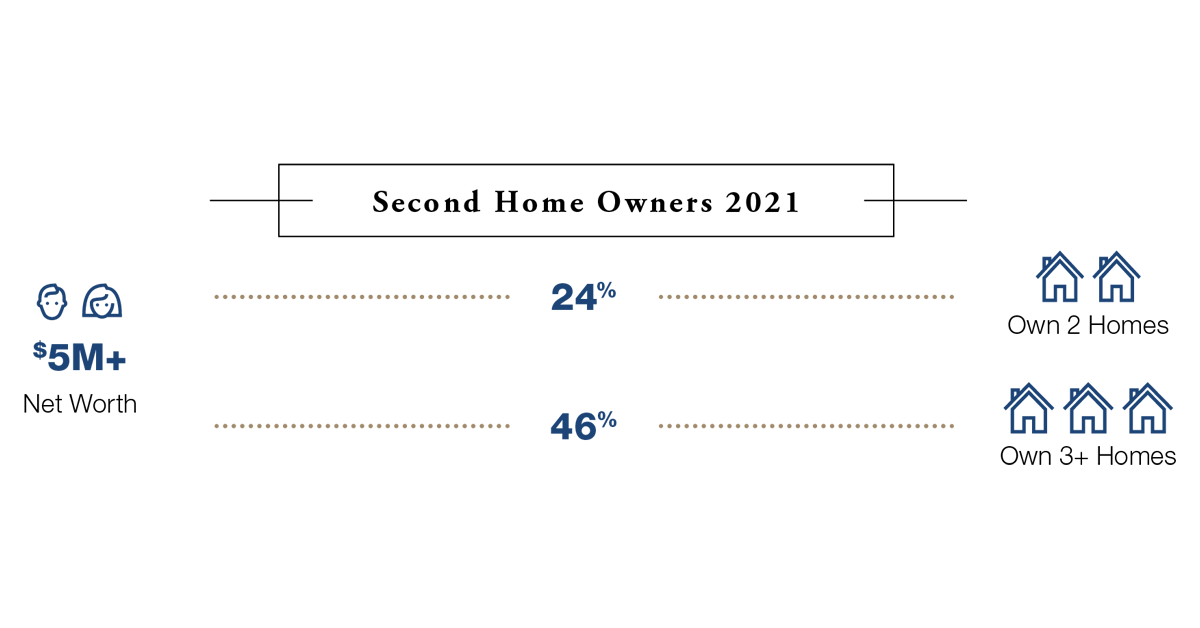

No matter if it is because of wealth generation, shifting life-style tastes, local climate improve considerations or economics, we are going through a rise in world consumers who individual many houses. Just about 70{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of men and women with a internet really worth of $5 million+ now own two or additional houses, per Coldwell Banker World Luxury’s most new “A Look at Wealth” report. According to a new evaluation by Prosperity-X from 21 big towns exterior the U.S., the major spots with the best authentic estate footprint, which considers all qualities owned by affluent people with a net worth of $5 million+ contain: London, Paris, Singapore, Geneva, and Beijing.

4. Will offer fulfill desire?

A deficiency of inventory remains a major challenge for 2022, in accordance to 73{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of Coldwell Banker Global Luxurious Home Professionals surveyed for The Report. Even so, a forecasted design increase might ease some inventory problems in the new 12 months. As the demand for houses proceeds to rise and the improvement of new households grows, we may perhaps see the housing inventory and listings raise as properly. Luxury real estate selling prices skyrocketed, but we may begin to see all those rates arrive at their restrict as dwelling sellers know the best price tag probable could have been attained.

5. Agents at the forefront

An increase in actual estate price ranges and market place competitiveness usually means the advice of a trusted agent is even additional essential to consumers in search of their dream property in 2022. Tim Foley, Executive Vice President of Functions of Coldwell Banker Realty, notes, “As agents gain from streamlined and far more thoroughly integrated transactional tools and procedures, they will have more time to have interaction in the broader existence of their consumers.” Electronic resources, social media platforms and area abilities have fostered quality engagement among an agent and a homebuyer, but luxury brokers will also require to have a deeper knowing of the newest current market and client insights, way of living developments and economics to support affluent clientele.