Your 2023 Business Depends On Nailing This Seller Conversation

To flourish as the market changes, you must be able to persuade your sellers to price their homes correctly for market realities. Author and trainer Bernice Ross offers strategies and a script you can use to have difficult, but necessary, conversations.

CBS News recently warned that home prices could drop another 20 percent in 2023. To survive in today’s plunging market, you must master two critical types of conversations. First, you must be able to persuade sellers how to price their property correctly and second, show buyers how to obtain their mortgage and their home at the best terms possible.

Regardless of whether the prices, the interest rates, or the inflation rate is increasing or decreasing, life forces people to move. Your role as an agent is to help each seller and buyer you represent obtain the best possible terms for their transaction, no matter what the market does.

Persuading sellers to price realistically in today’s market

There are two key components for attracting buyers in a declining market: the price plus other terms or incentives. In previous downturns, a third popular strategy was to increase the commission rate paid to the buyer’s agent and or even to offer a car or trip to Hawaii.

In other words, you must be able to not only persuade the seller to come up with the right price, but also be prepared to discuss additional incentives that can help your seller’s listing stand out from the competition.

The pricing challenge in a rapidly declining market

In a declining market, your starting place is still reviewing the most comparable sales, however, in today’s market you must also factor in the rate of decline. This is never an issue in a seller’s market because the buyers usually bid the property up to market value.

To determine how much your market has declined, examine the comparable sales prior to when the interest rates and inflation started to increase (prior to June 2022). As we wrap up 2022, a simple way to do this will be to compare the average price increase from 2021, with the average change in prices from the last six months of 2022.

A quick way to discover how much properties increased in value in your state is to check the Advisor Channel’s chart that provides the average 2021 increases on a statewide basis. You can also check your local MLS statistics for this number.

Tap into Realtor.com’s new RealEstimate for a property-specific evaluation

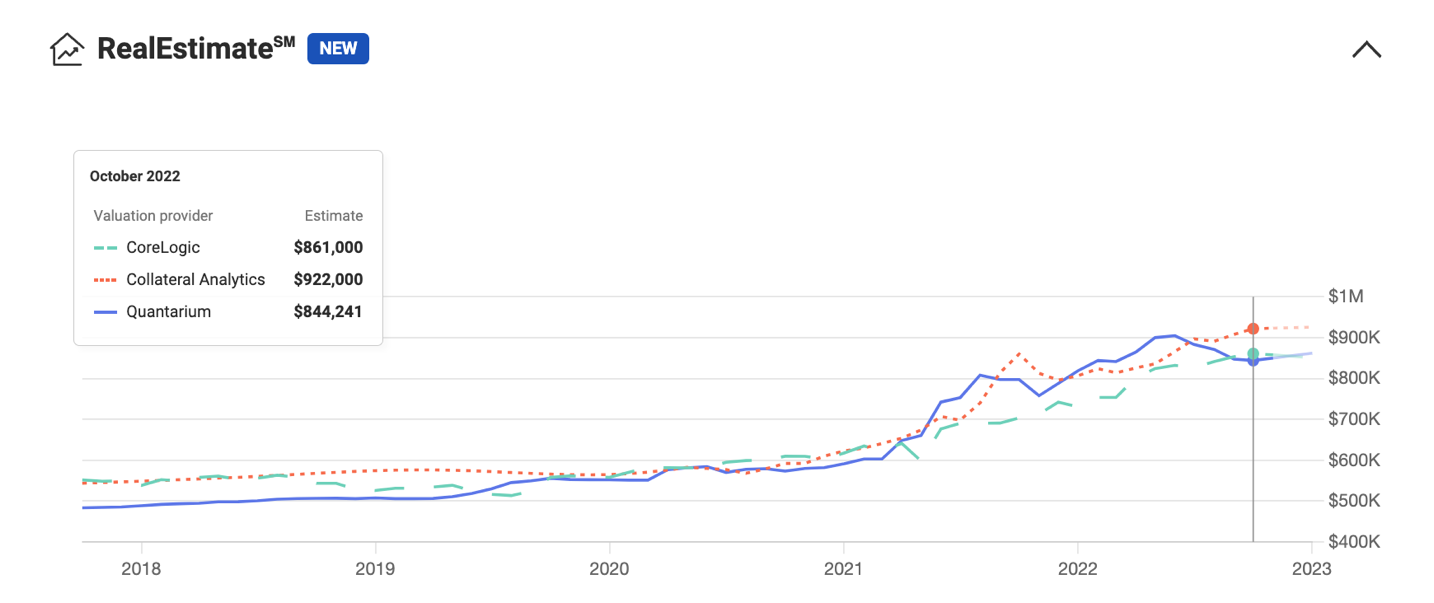

To use this tool, click on “Home Value” on the home page of Realtor.com and enter the property address. This provides a chart like the one below that tracks how a specific property has changed in value during any given interval of time. In addition, it also shows what the value of this property would be through January 2023. Please note that this AVM estimate will normally be at least 60 days behind what is currently happening in the market.

Here’s a case study of the current statistics on a property that was appraised two weeks ago and is set to close in early November.

Here’s the current RealEstimate chart for this property:

Please note that two of the AVMs (CoreLogic and Quantarium) have similar values ($861,000 and $844,241.) My own CMA came in at $840,000. If you have three values clustered fairly closely together, calculate the average of these three numbers. In this case it was $848,000.

Next, search your local MLS or Google for the average amount prices have decreased in 2022 (or within the last few months would be even better). This property is located in Austin where home prices have declined by 10.3 percent from June 2022 to September 2022.

Taking a 10.3 percent decline in value on a home valued at $848,000 results in a decline in value of $87,344. That translates into the value of the property being $760,656. The appraisal came in last week at $775,000. Since prices are declining, the listing price should be close to these numbers.

Determine the rate of decline

Given the numbers above, how much did this property decrease on a monthly basis between June and September (four months)? Dividing the total decrease of $87,344 by four months, that turns out to be $21,836 per month.

Even with this big drop, Austin owners who sell now are still way ahead of the game, since prices had skyrocketed by 30 percent in 2021.

Closing sellers on listing their property at less than what the comps suggest

Here’s the script:

Agent: Mr. and Mrs. Seller, whether the prices are increasing or decreasing, the comparable sales on all listings lag at least 60-90 days behind the actual values. Prices here in Austin have declined by 10 percent during the last four months. In other words, your home that was worth $848,000 in May of 2022 declined $21,386 per month between June and September 2022, making it currently worth approximately $762,500.

The sooner you sell the better, because each day you fail to sell, your property is declining at approximately $713 per day. To illustrate this point, if you sell after being on the market for less than 30 days, you may be able to get close to your home’s current value of approximately $762,500.

If your property takes 60 days to sell, your house will have decreased in value by $42,772. If the prices continue to fall and it takes 120 days to sell because you overpriced your home, it will have declined by $85,544.

If you really want to drive how expensive not selling quickly is, add the carrying costs (mortgage payment, taxes, insurance, and HOA dues if applicable) to your calculations.

Very few markets have undergone the huge price increases Austin experienced. By the same token, they’re also not experiencing as steep of a decline. Nevertheless, even if your prices are only falling $5,000 per month, selling in 30 days as opposed to 90 days saves the seller about $10,000.

Seller incentives

Builders have used incentives to attract buyers in slow markets for decades. For example, at the end of 2020, the developer of our subdivision only had three condo units left to sell. Here’s a list of concessions that we received for purchasing by 12-31-2020 and closing within 30 days.

- $10,000 purchase price reduction.

- Washer, dryer, and refrigerator included in the purchase price.

- Payment of the Homeowner Association dues for one year (about $6,000).

- Artwork, leather chairs for the kitchen island, dining room set, Keurig coffee maker, plus other decorating items that were in the unit as part of the model.

Would you like to know more about seller concessions as well as specific strategies for helping your buyers get off the fence and under contract with down payment assistance, interest rate buydowns and other tactics? If so, don’t miss “9 steps for getting buyers the best deal in a down market” coming up next week.