What I Wish I Knew Before Investing In Rental Properties

Feverpitched

Rental properties are some of the most frequently discussed investments on the internet. There are countless YouTube channels and blogs promoting their benefits and selling courses teaching you how to invest in them.

They are commonly promoted as a way to gain financial independence and their arguments are very convincing.

The whole idea of buying a property with the bank’s money and having it paid off by a tenant – while you wait for the property to appreciate – is very compelling. You may also earn positive cash flow while you wait and enjoy significant tax benefits.

It is also inflation-resistant… recession-proof… and everyone will always need a roof over their head… so the risk-to-reward may seem unbeatable. Property values are fairly stable and good locations tend to appreciate over time.

A lot of people have legitimately become wealthy by investing in rental properties so it can certainly be done.

Invitation Homes

But there is a dark side to all of this… an untold truth if you may.

It is not all sunshine and rainbows as all the YouTubers selling courses make it seem to be.

In fact, I would argue that the risk-to-reward of rental properties is actually quite poor and that there are far better alternatives that will provide you superior returns with less risk in most cases.

I like to think that I have a good understanding of this topic because I come from a family of real estate entrepreneurs, spent years studying real estate investing, and eventually went on to work in private equity real estate and even brought my own rental properties.

In what follows, I highlight 5 important points that I wish I knew before investing in rental properties. If I had known them, I probably wouldn’t have bothered:

Point #1: Your Actual Returns Are Much Lower Than You May Think

The simple math that most rental property investors are doing is this:

(Monthly rent x 12) / Purchase price

It is meant to give a rough idea of the yield of the property.

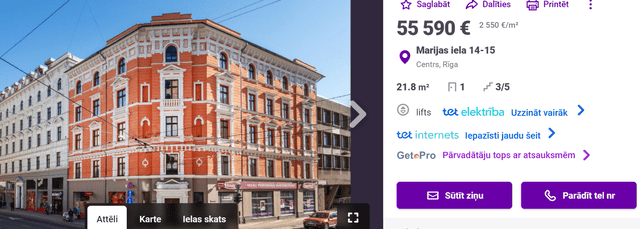

Commonly, you will end up with very attractive yields. As an example, I have recently been looking for opportunities in Riga, the capital city of Latvia, and I ran across this property:

City24

The developer is selling studios for ~€50k in a historic building that has been freshly renovated in the center of Riga. You could rent each for ~€400 per month and have a lot of rental demand for them.

That would get you to a near-10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} yield. Then taking this calculation a step further, if you financed 70{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of the purchase price with a mortgage, your return on equity would jump to over 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} after interest expense.

(400 x 12) – (35k x 0.04) / 15k = 22.6{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}

Sounds fantastic, right?

You could buy a package of 5 studios in the building to make the management more efficient and then own it all in a few decades after tenants have paid off your mortgage, providing significant cash flow and financial freedom.

The property will likely also appreciate over time and there are many tax benefits, especially in Latvia, which ranks #2 in tax competitiveness in the OECD.

But here’s where the calculation gets muddy.

The actual net operating income of the property is nowhere close to its gross rental income because there are a lot of operating expenses that need to be taken into account. A good rule of thumb that’s commonly used by experienced rental investors is “the rule of 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9},” which means that your NOI will be about half of your rental income.

So in this case, your NOI is actually just ~€200 per month after deducting all expenses, accounting for occasional vacancies, etc.

So your return on equity is already cut in half, but still quite attractive at 11.3{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}.

But unfortunately, it does not stop there.

We still haven’t accounted for the value of your time. Buying and managing rental properties is work-intensive, even if you delegate portions of it. Each property will take time and energy to find, negotiate, finance, buy, furnish, market, rent out, monitor, fix up, release, eventually sell, etc.

Some weeks, you will work less, others you will work more, but a rule of thumb that I like to use is that on average, it takes at least 3 hours per week when including also all the time spent actually looking for the property and completing its purchase.

If you value your time at €30 per hour, then that’s €90 per week and €380 per month of indirect cost that needs to be accounted for because you could have worked another job and earned this money.

Now you can see already that if you only owned 2 studios, you actually didn’t earn any return on your property. You only earned a return on the work/time that you put in. Even with 5 studios, the economies of scale are not significant enough to make it worthwhile yet as your return wouldn’t be particularly attractive.

Sure, you could use a property manager, but you would still have some work to do and then you would give up a large portion of the revenue, introduce new conflicts of interest, and the management would likely worsen and other expenses would also increase.

In short, my experience is that most rental properties aren’t nearly as attractive as they first seem to be. Once you properly account for all expenses and the value of your time, the returns end up in the 5-10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} range depending on how much appreciation you enjoy, which is still decent, but nowhere close to what you will commonly see advertised online.

Point #2: You Are Taking Enormous Risk Due To Liability Issues

So let’s assume that you are set to earn a 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} annual return after deducting all expenses and the value of your time.

Is this all worth it for the risk and effort?

No, it isn’t in most cases.

A rental property may give you a false sense of safety because it is not publicly traded and therefore, you think that its value is stable. Moreover, rental income does not change materially during recessions, and you have control over your property.

But in reality, this is a private, illiquid, concentrated, management-intensive, liability-filled, highly leveraged investment.

If it was a stock, it would be considered to be extremely risky and highly volatile, but because it isn’t traded you get a false sense of safety.

You will also personally sign on the loans, putting you at significant liability risk if things don’t work out. Also, landlords get sued by their tenants all the time. Using an LLC and getting insurance will help, but it does not remove all liability risks. This is why thousands of rental investors file for bankruptcy protection each year.

I would argue that the risk of having to potentially go through a legal battle with a tenant is enough to make most rental investments unattractive. It will bring so much negative energy and stress into your life that it isn’t worth it.

Besides, your 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} return will suddenly turn into a negative 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} return once you deduct the lawyer expenses…

Point #3: The Tax Advantages Are Way Overhyped

Rental investors are commonly able to defer taxation by depreciating their property.

That’s all great, but Uncle Sam doesn’t make gifts without taking something in return, and what rental investors appear to overlook is that once you have depreciated your property, you are also stuck with it.

If you sell it, you get hit with a huge tax bill since your cost basis is so low.

Sure, you could use a 1031 exchange to reinvest into another property, but you are still stuck with real estate. You are not able to get out of real estate if the market becomes unattractive. This loss of flexibility can cost you dearly.

Moreover, there is no guarantee that the 1031 rule will exist forever. A lot of politicians have tried to end this “loophole” for many years.

Point #4: Your Time, Energy, And Geographic Freedom Have Value

Your main earning power comes from your career and therefore, this should be your number #1 focus to increase your income and wealth.

But if you start investing in rentals, this will rapidly become a significant distraction to your career. It will become your second career as it demands a lot of time and energy.

This means that your primary career will suffer from it, lowering your chances of getting that promotion and growing your primary source of revenue.

You will also be stuck in one location. If you get a great job offer on the other side of the country, you may be reluctant to accept it simply because managing your properties would become a lot more difficult.

The loss in time, energy, and geographic flexibility will have a significant impact on your career, which is your primary revenue source. The returns are not compelling enough in most cases for it to be worth it.

Point #5: You Could Just Buy REITs Instead And Earn Better Returns With Less Risk, No Efforts, and Complete Freedom

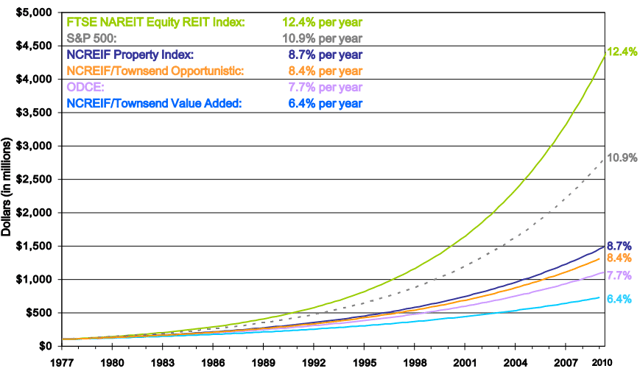

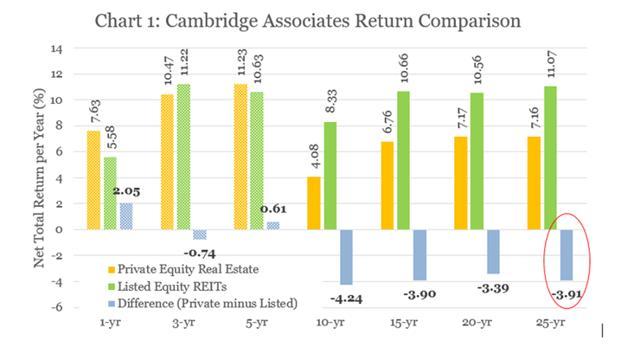

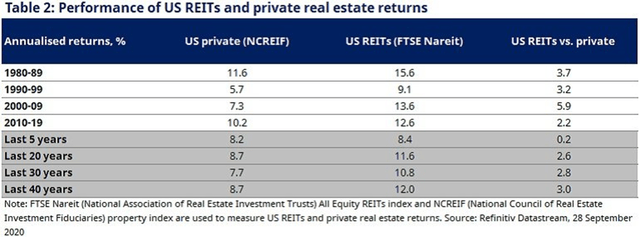

Last but not least, you could just buy publicly listed real estate investment trusts (“REITs”) to gain exposure to real estate and you will likely earn comparable returns or even superior ones with less risk and no effort.

Several studies have shown that REITs are actually more rewarding than private real estate investments once you deduct all expenses:

EPRA Cambridge NAREIT

There are 10 reasons why this makes sense and we discuss this topic at great length in a separate article that you can read by clicking here, but in short:

- 1) REITs Do Spread Investing to Compound Faster

- 2) REITs Can Enter Real Estate Related Businesses to Boost Returns

- 3) REITs Can Develop Their Own Properties

- 4) REITs Can Do Sale & Leaseback

- 5) REITs Enjoy Significant Economies of Scale

- 6) REITs Enjoy Stronger Bargaining Power With Tenants

- 7) REITs Employ The Best Talent in Real Estate

- 8) REITs Have a Total Return Approach

- 9) Most REIT Managers Are Well-Aligned With Shareholders

- 10) REIT Investors Pay No Transaction Costs

Especially today, it makes no sense to invest in rental properties because REITs are actually a lot cheaper.

Their valuations are historically low with many REITs priced at large discounts to the fair value of their properties, net of debt.

To give you a few examples:

AvalonBay Communities (AVB) owns Class A apartment communities in some of the best markets in the country, it has an A-rated balance sheet, and a fantastic track record of generating market-beating returns, and yet, it trades at a 20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} discount to net asset value (“NAV”).

AvalonBay Communities

STAG Industrial (STAG) owns e-commerce-focused warehouses and its biggest tenant is no other than Amazon (AMZN). It is growing rents by 15{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}+ at the moment as there is a lot of demand for warehouse space, and yet, the market is pricing it at an estimated 25{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} discount to NAV.

STAG Industrial

REITs and other listed real estate securities also allow you to invest abroad. Vonovia (OTCPK:VONOY/ OTCPK:VNNVF), the leading apartment landlord in Germany, is temporarily priced at just 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of its NAV because the market overreacted to the war in Ukraine and the energy crisis that it caused. It will negatively impact the company in the near term, but the long-term prospects are unchanged, and you now get the properties for 50 cents on the dollar while the Euro is cheap as well – a double discount. You get paid a 6.3{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} dividend yield while you wait for the recovery.

Vonovia

So put simply, you get the benefits of rental properties with the added benefits of liquidity, diversification, limited liability, and cost-efficient professional management through REITs – and all of it at a huge discount to fair value.

Higher returns with less risk and no effort. So again, why would you buy a rental property?

At High Yield Landlord, we have historically achieved ~15{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} annual returns by investing in undervalued REITs and we couldn’t achieve that with rental properties.