REITs Vs. Rental Properties: Which Is The Safest To Own?

ejs9

In a the latest Twitter thread, I explained why I feel that real estate investment trusts (“REITs”) (VNQ) are additional rewarding investments than rental homes. I mentioned the next 10 factors:

-

REITs have greater obtain to funds

-

The management of REITs is particularly price tag-effective

-

REITs delight in large economies of scale also on other stages

-

REITs can do spread investing to supplement their natural and organic development

-

REITs are able to acquire their personal attributes

-

REITs can skip brokers and do sale-and-leaseback transactions

-

REITs can enter further true estate-associated company

-

REITs have the most effective talent and do a greater occupation of aligning pursuits

-

REITs are highly tax economical

-

REITs are ready to commit in a lot more gratifying specialty property sectors.

All of these advantages have traditionally resulted in larger returns for REITs as when compared to rental properties.

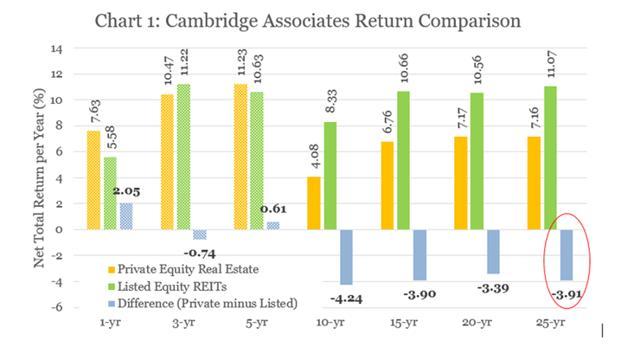

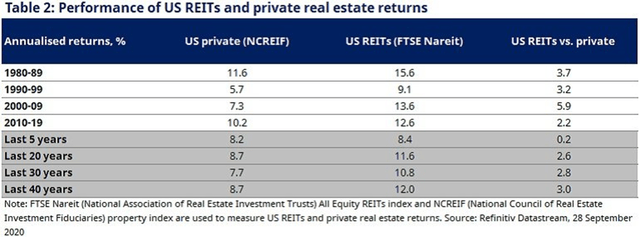

Listed here are 3 scientific tests that come to the exact summary:

EPRA Cambridge NAREIT

But absolutely, these greater returns ought to be the final result of bigger possibility, proper?

The productive sector theory teaches us that you can only assume to make bigger returns if you acquire bigger threats.

I have had lots of rental residence investors comment on my REIT posts and tweets that REITs are riskier than rental properties simply because they are volatile and trade like stocks. They argue that rental attributes have to be safer due to the fact their benefit is extra stable.

But I strongly disagree with this level and basically assume that rental attributes are far riskier in most instances.

In this article are 5 explanations why:

Purpose #1: Rental Homes Use A Great deal Extra Leverage

Most REITs finance their attributes with a ~30-40{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} bank loan-to-value, or LTV in small. Good examples consist of Spirit Realty (SRC), AvalonBay (AVB), or even Prologis (PLD). They made use of to use a ton extra leverage, but they figured out their lesson from the wonderful monetary disaster and are today a large amount far more conservative.

Rental house investors will frequently use double that. Their LTVs are nearer to 80{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} in most circumstances. Normally, that also success in a whole lot extra hazard.

Rental home traders assume that their equity is not unstable due to the fact they are not viewing a day-to-day estimate, but just for the reason that you absence details does not mean that your fairness isn’t really changing in value.

Picture you set your residence on the market. You would be acquiring lots of distinctive gives, each and every varying by 5-20{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}. If you are 80{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} leveraged, a 5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} reduced give would reduce your equity price by 25{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}. A 10{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} decrease present would consequence in a 50{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} decrease equity worth. So, your equity value would basically be exceptionally risky if it was quoted day by day, but given that you are not observing it, you sleep greater at night.

What you see quoted in the REIT marketplace is their equity worth, not their full asset worth. It is leveraged, but considering the fact that REITs use a lot less leverage than rental traders, their fairness is less risky in most circumstances.

Motive #2: Rental Homes Expose You To Liability Chance

When you spend in a REIT, you appreciate the confined legal responsibility of getting a minority shareholder of a publicly outlined enterprise. This indicates that you can’t reduce more than you commit. You are not signing on any of the financial loans and tenants, contractors, etcetera., is not going to sue you for becoming a shareholder.

But when you make investments in rentals, there are significantly greater legal responsibility risks. In most conditions, you will need to have to individually ensure the financial loans, which places you at high risk because you will also use substantial leverage. Also, your tenants, brokers, contractors, and many others. will be brief to sue you. In some cases, they may possibly sue you even if you did practically nothing wrong, just to choose gain of the courtroom program.

Certainly, you can seek out some safety with insurance and an LLC, but it is a myth that individuals items will beautifully protect you from liability risk.

Cause #3: Rental Homes Usually are not Diversified

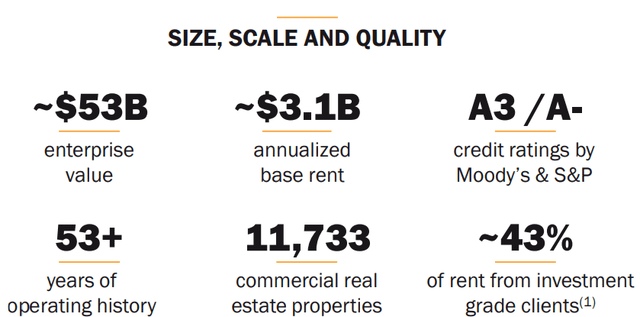

When you devote in a REIT, you are investing in a portfolio of 100s or even 1,000s of qualities. REITs are typically perfectly-diversified by geography as perfectly so you won’t rely on a solitary road, city, or even point out. To give you an example: Realty Earnings (O) owns 11,000+ qualities and its portfolio is diversified across pretty much each state in the country.

Realty Cash flow

Rental assets buyers will be a good deal far more concentrated. In most cases, they won’t possess more than a couple of houses and will be totally exposed to just one particular metropolis. If the overall economy of that metropolis turns south and people today begin leaving it to find greater chances elsewhere, your fairness might never get better. If you come to a decision to spend out of point out, then you would also be introducing other threats since administration would be pretty complicated.

Purpose #4: Rental Properties Place The Life Of People today In Your Fingers

There are also social threats in dealing with rental attributes. Men and women are pretty much putting their life on your residence and people today can modify for the worst.

You will have to deal with individuals and that is a threat on its personal. I have listened to quite a few experiences of landlords remaining threatened by their tenants.

You could use a assets supervisor to shield your self from the operations but then you will want to monitor your assets manager, who may well or may perhaps not do a good task and they will try to eat a large chunk of your returns. House supervisors are in the company of producing dollars off costs by handling as many properties as they probably can. The natural way, the administration will then put up with because their passions are various from yours.

REITs will do a superior career handling your houses mainly because they have equity in the activity and salaries are tied to functionality indicators these types of as the development of funds from functions (“FFO”) per share. The interests are better aligned and you are totally detached from the operations of the assets.

Cause #5: Rental Homes Are Illiquid

Last but not least, rental attributes are personal property, and this suggests that they put up with illiquidity threat. Providing your home could be pretty difficult, high priced, and time-consuming. If things definitely head south, you may perhaps not uncover any customer for a long time, forcing you to stay the operator and continue to offer with all the problems that come with it.

REITs are community and liquid so you will never have that issue. Liquidity is commonly ample, specially for lesser personal shareholders.

Reward Purpose: Margin Of Basic safety

These days specifically, REITs are a whole lot safer for the reason that their valuations are a whole lot decrease than people of rental homes.

REIT share costs have dropped a ton in 2022 together with the rest of the stock industry (SPY), but real estate price ranges have however to regulate lower in any meaningful way.

As a consequence, you can now obtain REITs at a low cost to the value of the true estate they own, which offers margin of safety and draw back security.

To give you an example: BSR True Estate Investment decision Rely on (OTCPK:BSRTF) is a REIT that owns apartment communities in rapidly rising Texan marketplaces. Its belongings are extremely appealing, it is increasing rents rapidly, and it has a small 35{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} LTV and robust administration. Nevertheless, it is currently priced at a near 40{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} discount to its web asset worth, providing a significant margin of protection even if asset values declined a little bit heading forward.

Owners of rental properties don’t appreciate the exact same margin of safety. Valuations are traditionally large nowadays, and affordability is at a close to-all-time lower.

Base Line

REITs are not just extra worthwhile, they are also a large amount safer than rental qualities, and primarily now.

This is eventually why I resolved to close my vocation in personal equity serious estate and became a REIT analyst. Right now, the large vast majority of my genuine estate investments are in REITs, and not in personal homes any more.