Luxury real estate to get special tax status under ‘blight’ statute

Council moves to create $277 million infrastructure fund and grant special tax treatment to lakefront properties

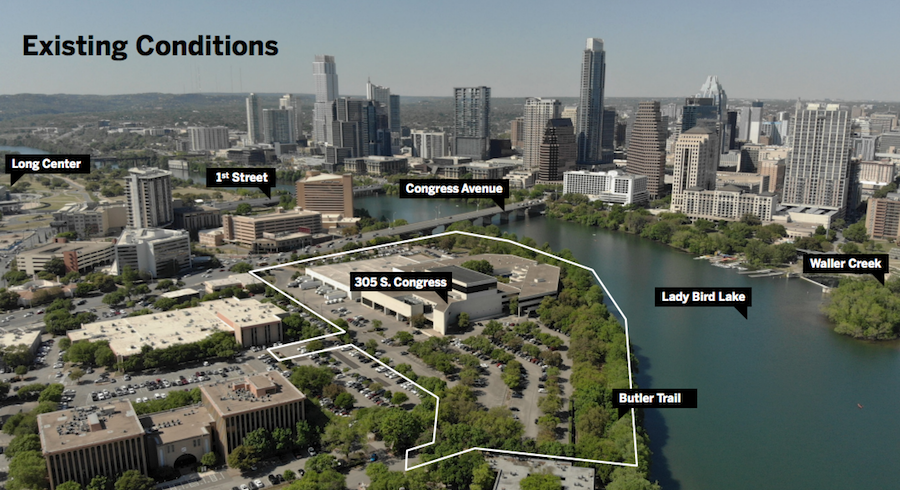

The Austin City Council took steps Monday to create a special tax zone to subsidize infrastructure development in a 118-acre area along Lady Bird Lake known as the South Central Waterfront.

Plans for the zone call for the creation of amenities including a waterfront boardwalk, streetside rain gardens, commercial plazas, sculptures, amphitheater, and a disc golf course, as well as sidewalks, trails, and a revamped street network, at a cost of $277 million.

A proportion of property taxes collected in the district would go to fund just those improvements, rather than the general fund. A draft ordinance posted with Monday’s council agenda put the proportion at 46 percent, though the council delayed a final decision on the exact increment.

The subsidies could supercharge the development of an area that already includes some of the most valuable real estate in Austin, including a stretch of the famed South Congress Avenue, the long-time Austin-American Statesman office and bat observation center, and the lakeside Hyatt Regency hotel.

Behind the plan is the Endeavor Real Estate Group, which built some of the city’s best-known luxury developments. One of them was The Domain, a high-end shopping center that got a sales-tax and property tax breaks worth an estimated $57 million to $65 million over two decades. Civic activist Brian Rodgers sued the City and Endeavor over that deal and in 2004 reached a settlement that stated the city wasn’t required to pay the Domain incentives, but could continue to do so voluntarily, which it did.

Endeavor has partnered with the Atlanta-based Cox family, owners of the 18.9-acre Statesman property, to develop that site and to lobby for a broader South Central Waterfront plan, including public financing.

The Cox family, which has a net worth of about $35 billion, according to Forbes, sold the Statesman in 2018 but held on to the newspaper’s property at 305 South Congress, next to the Congress Avenue Bridge. The property is the largest in the new South Central Waterfront zone, representing about a sixth of its total area.

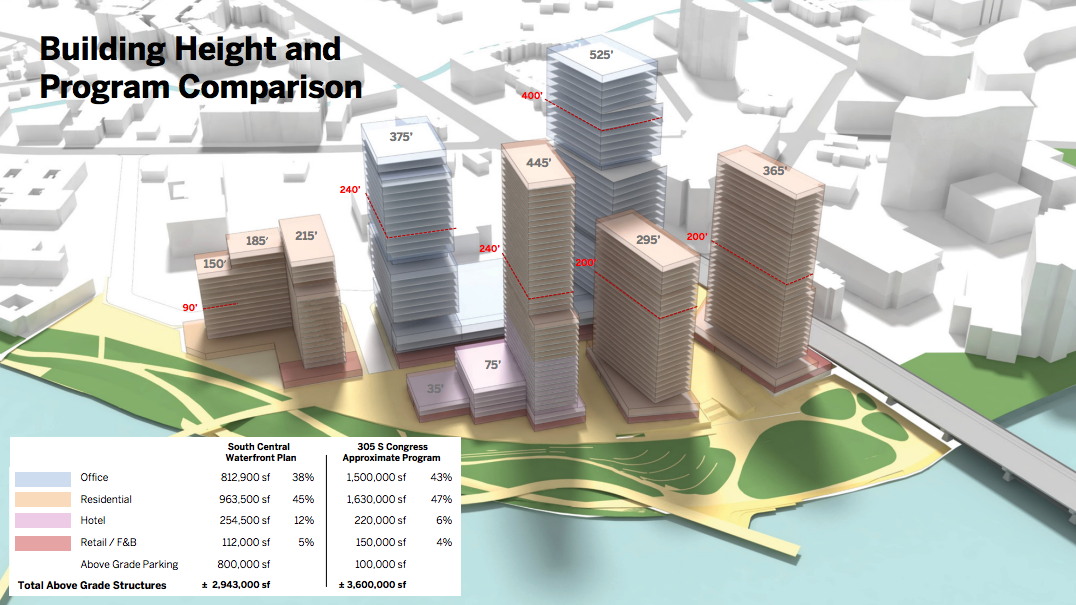

Endeavor hopes to put as many as six high rises on the property, including at least one that would be taller than Austin’s iconic Frost Bank Tower (the “owl building”). Many of the amenities proposed under the South Central Waterfront plan would lie in the shadow of these buildings.

Additionally, Endeavor itself owns at least two other properties in the district, a 1.5-acre, six-story apartment building on South First Street, which offers “modern luxury living,” and a 1.8-acre waterfront property on Riverside Drive that’s currently rented by the bar and game arcade Cidercade Austin.

‘Unproductive, underdeveloped, or blighted’

To authorize the infrastructure subsidies, the council invoked the Tax Increment Financing Act, which allows a city to create a Tax Increment Reinvestment Zone (TIRZ) in an area where development “would not occur solely through private investment in the reasonably foreseeable future.”

That law is authorized under a constitutional provision allowing cities to create reinvestment zones “to finance the development or redevelopment of an unproductive, underdeveloped, or blighted area.”

According to the tax law, the TIRZ area must constitute “a menace to the public health, safety, morals, or welfare,” or an impediment to “the sound growth of the municipality” because of the presence of deteriorating structures, a slum, unsanitary conditions, or certain other criteria.

In its ordinance creating the TIRZ, the council cited two such criteria: “faulty lot layout” and “defective or inadequate sidewalk and street layout.” Because of those conditions, the growth of the waterfront district is substantially impaired, the council stated in a list of findings.

‘Crony capitalism’

Critics of the plan say that it violates the law and represents a handout to developers. Attorneys Fred Lewis, Bill Aleshire, and Bill Bunch wrote a letter to the mayor and council saying the proposed TIRZ was “a gross abuse of the Texas Tax Code provisions for subsidizing development of blighted areas that would not otherwise develop on their own.”

“The subject property is the most prime development land in the entire city of Austin…Unless the plain language of the statute is meaningless, this property is nowhere near lacking in development potential as required.”

The lawyers pointed out that developers normally have to pay for new sidewalks, parks, and utility infrastructure in new developments. The new South Central Waterfront TIRZ therefore represents a departure from that practice that will pad the pockets of the developers behind the proposal. “This proposal is corporate crony capitalism at its worst and is the epitome of TIRZ abuse by wealthy developers,” they wrote.

Aleshire, Bunch, and Lewis recommended that the tax dollars instead be spent on “public improvements that benefit average Austinites or in reducing their heavy property tax burden.” (Disclosure: Attorney Bill Aleshire represents The Austin Bulldog in obtaining information through public information requests and assists in other legal matters).

Similarly, former Council Member Ora Houston issued a call-to-action to her followers, in which she mocked the idea that prime downtown real estate was “blighted” and wouldn’t develop without incentives.

The proposal was “welfare for the rich,” she wrote. “Remember, every dollar Endeavor Real Estate Group doesn’t pay in property taxes, is a dollar that will be made up through increases to your property taxes.”

During the public input portion of the council meeting, attorney Bunch pointed to the hundreds of cranes stretching across the downtown skyline, saying these threw into question the council’s justification for the TIRZ.

“There’s three words for this deal,” he said: “stink, stank, stunk.”

Public-private partnership

On the other hand, backers of the TIRZ contend that the area would not develop to the same extent without the new public amenities and infrastructure. Mayor Steve Adler said, “We have land that’s undoubtedly going to develop on the South Waterfront, but unless we put in a grid system of roads, it’s not going to develop the way that it should.”

Likewise, an analysis prepared for the city in September by Capitol Market Research stated, “Without the implementation of the district plan and supporting infrastructure investment, the area will develop in a fragmented manner at significantly lower densities and taxable value.”

The total taxable value of property in the district could explode from about $1 billion today to $7.9 billion by 2040, the study said.

Much of that growth, however, would be attributable to upzoning, not the TIRZ, said attorney Lewis.

“Your own data, your own plan, is legally insufficient, and you really are subjecting yourself to the prospect of property taxpayer… litigation,” he told the council.

Yet the developers say that the full value of the area can’t be unlocked without looking at the zone comprehensively, including through public investments in a smarter street grid and public green spaces.

“I’ll tell you what, we won’t build the plan if there’s no TIRZ. It just doesn’t work. It all fits together,” said lobbyist Richard Suttle at a December 14th hearing of the Planning Commission.

Suttle, who represents Endeavor Real Estate Group and the Cox family, is seeking approval from the Planning Commission for an upzone of the old Statesman site. His clients want to build six high-rise buildings containing 3.5 million square feet of space, including 1.5 million square feet of office space, ground-floor retail, a 275-room hotel, and 1,378 residences.

Four percent of the rental units would be affordable housing.

Suttle said that his clients were prepared to donate 3.7 acres of the Statesman property for right-of-way, 6.6 acres for parks, and 1.6 acres for parkland easement. However, a prospective Blue Line rail stop at the site could reduce the amount of usable parkland, he noted.

Austin’s famous bat observation area next to the South Congress bridge would become parkland under the proposal. That site is already effectively open to the public, but only because the current owner allows it to be.

Unlike the current Statesman structure, which is surrounded by acres of surface parking, the new development would have almost no surface parking. Ninety-five percent of parking would be underground—an arrangement that city zoning chief Jerry Rusthoven called “very, very expensive.”

Rusthoven recommended that the Planning Commission approve the Endeavor proposal, noting that the developer was willing to donate about a third of its property for parkland.

Buying influence

Suttle’s lobby firm, Armbrust & Brown, is a big donor to council members, as is Endeavor. As reported previously by the Bulldog, employees of those firms donated heavily to council candidates in the 2020 election cycle.

Although the city charter prohibits corporate contributions and limits campaign contributions from registered lobbyists to $25, Armbrust & Brown found a workaround by having dozens of non-registered attorneys and their spouses donate the maximum of $400 each.

A separate and subsequent analysis by the Austinites for Democracy PAC, which used a similar methodology but relied on a fuller dataset, found that “ten of the top 39 council contributors…worked for Austin’s leading developer lobby firm: Armbrust & Brown.”

Tallied together, employees of Armbrust & Brown and Endeavor contributed $92,814 to 2020 council candidates, including to winning candidates Greg Casar and Leslie Pool. Likewise, in 2018, Adler received several thousand dollars from employees of those two firms, as did Council Members Kathie Tovo and Sabino “Pio” Renteria.

This means that some of the same council members who are making decisions about the new tax zone have already benefitted substantially from campaign contributions from the firms that are lobbying for it.

Density boost

But council members may be supporting the new plan for other reasons too. The TIRZ is connected with a years-long planning process that culminated in a 114-page vision document adopted in 2016.

That document, the Austin South Central Waterfront Vision Framework Plan, reflects long-running council priorities, including a desire to boost mixed-use, pedestrian-friendly development. The area is one where significant density can be added without major pushback from nearby residents, of whom there are relatively few—in part because of the number of government and commercial buildings in the vicinity.

The Framework Plan calls for a “district-wide green infrastructure system paired with quality urban design and an interconnected network of public spaces.” Key components of that would be the existing Ann and Roy Butler Trail, which runs through the district along the lakeside, and new streets that would break up the current blocks.

The plan says, “The 118 acres of the South Central Waterfront covers the equivalent of 33 downtown blocks but are only divided into a handful of superblocks… The lack of a street grid hinders an orderly development of buildings within a patchwork of private parcels.”

“Over time, the existing superblocks will be broken up into a district of pedestrian-scaled blocks.”

During his presentation to the Planning Commission, Suttle played a polished promotional video produced for the occasion. A narrator in the video touts the site as a “multi-modal hub” accessible by trail, train, road, and bike: “We’re creating a new environment for people to walk, stroll, and hang out in a vibrant, diverse, and welcoming public space that embraces our city’s culture and honors the spirit of Austin.”

Potentially, the redevelopment could eventually even include a connection to the Rainey Street District via a pedestrian bridge across Lady Bird Lake, according to planning documents. The documents did not indicate how such a bridge would be financed.

As the area develops, it is likely to draw tenants who work in the Central Business District, the University of Texas at Austin, and the Capitol complex, according to the study by Capitol Market Research.

“It is also likely that a number of tenants or condominium buyers will be downsizing empty nester households from central and west Austin, and out of town, second home buyers,” the study said.

Background on TIRZ law

The general idea behind a TIRZ is that it creates a special benefit for a particular area. Unlike taxpayers in other parts of the city, whose taxes benefit the city at large, the TIRZ taxpayers effectively get to ensure that their tax dollars are spent locally.

On account of this preferential treatment, Texas’ first TIRZ statute was found unconstitutional in an attorney general opinion in 1979, because it violated the “equal and uniform” tax provision of the state constitution.

Rather than accept this, the legislature decided to offer a constitutional amendment that would expressly authorize the zones.

Ratified by voters in 1981, and still part of the constitution today, the amendment said that the legislature could authorize cities to create tax exemptions and bond taxes in reinvestment zones “to finance the development or redevelopment of an unproductive, underdeveloped, or blighted area.”

The Office of the Attorney General has interpreted this to mean that “a city may not designate an area as a reinvestment zone…unless the area is ‘unproductive, underdeveloped, or blighted’ within the meaning of article VIII, section l-g(b) of the Texas Constitution,” according to an on opinion issued under then-Attorney General John Cornyn in 1999 and reaffirmed subsequently.

Therefore, to ensure compliance with this requirement, Austin’s new TIRZ ordinance and the accompanying project plan emphasize that the South Central Waterfront zone is “underdeveloped” and “unproductive.”

The preliminary project plan states, “Portions of the property substantially impair and arrest the sound growth of the city because it is predominately unproductive or underdeveloped due to factors such as the lack and aging of public infrastructure.”

Likewise, the South Central Waterfront Vision Framework, which dates to 2016 but is included as an appendix to the project plan, mentions the need for “findings of blight” in order to authorize the TIRZ.

Both ‘luxury’ and ‘underdeveloped’

For an “underdeveloped” area, the South Central Waterfront is remarkably expensive for those who live and work there. For example, two-bedroom apartment at 422 at the Lake, a “luxury community” on South Congress, costs from $2,800 to $3,350, compared to a citywide average of about $1,500, according to listings on Apartments.com.

A studio apartment costs $1,922, more than some two-bedroom or even three-bedroom apartments elsewhere in the city. Similarly, a studio at The Catherine, a “luxury green apartment community” on Barton Springs Road, costs $2,520, according to listings on its website.

One-bedroom apartments at The Catherine Tower go for about $3,000 per month, and two-bedrooms cost about $5,500, according to its website.

In terms of property values, several properties in the district are appraised in the tens of millions, including The Catherine, which is valued at $122 million, and the Embassy Suites off Barton Springs Road, which is worth $39 million, according to appraisal district records.

Even small commercial properties in the TIRZ fetch a premium. For example, a two-story, 8,500 square foot property on South Congress built in 1936, which houses the flagship YETI store, is appraised at $8.9 million.

What’s next

The council’s vote Monday was unanimous, with Council Members Greg Casar and Leslie Pool off the dais. The action establishes the TIRZ, adopts a preliminary project plan and financing plan, and creates a fund to capture property tax from the zone.

But because the council didn’t set a capture rate, the new fund will be an empty shell until the council amends the financing plan to set a rate.

Tovo, the council member who represents the South Central Waterfront, said she wants to see action on the matter early next year. She suggested work sessions February 1st and February 17th, as needed, with final action March 2nd. “I think we should be scheduled for action,” she said.

Asked about the council’s decision to delay setting a capture rate, attorney Bill Bunch said that was likely only a temporary hold-up. “It’s never over until it’s over, but it’s likely over unless there’s an outpouring of outrage from taxpayer voters. And if there was ever a reason for voter outrage, this stinker is it.”

For his part, Adler stressed that Monday’s vote was not a final decision, saying, “We can certainly decide early next year whether or not to do a TIRZ at all, and if so, what that TIRZ should look like and include or not include.” But the mayor also said he was committed to “getting this question resolved, one way or another, as early as we can next year.”

At a previous work session in October, Adler had voiced urgency around the need to pass the TIRZ ordinance before the end of the year, saying that if council didn’t do so, the TIRZ would miss out on revenue capture until 2023. Hence why the council voted to create the zone before reaching consensus about the exact increment rate or the final project plan.

Further highlighting the political importance of the issue is the fact that the TIRZ was the only issue on the council’s agenda at the special called meeting December 20th, the final meeting of the year.

Administratively, the TIRZ will be run by staff of the Austin Economic Development Corporation. Their role now involves helping finalize the TIRZ project plan and financing plan to be approved by the council, according to Q&A posted with the council agenda. The board will consist of each of the sitting council members.

One matter they’ll have to attend to is finding a way to incorporate some funding for affordable housing into the final project plan. That’s required under an amendment to the TIRZ ordinance proposed by Tovo and adopted without objection. New housing could be set up at One Texas Center on Barton Springs Road, the only city-owned property in the TIRZ, according to council discussions, but there aren’t yet any firm plans around the idea.

The amount of available funding for projects will depend on the final capture rate. Once that rate is set, it will remain in place until 2042, or until all debt service issued by the city in connection with the TIRZ is fully satisfied. In other words, the subsidies for the South Central Waterfront could continue for a period of up to 20 years.

Law advice ignored

One outstanding issue that was tentatively resolved Monday was whether to include in the TIRZ a property known as the “Snoopy PUD,” so-called because it was formerly owned by Charles Schulz, creator of the “Peanuts” comic strip. The 1.3-acre plot on South 1st Street was home to a Hooters until 2019, when it was torn down to make room for a 15-story office tower.

Council members discussed the property extensively at a work session December 7th. At that meeting, Assistant City Attorney Leela Fireside cautioned the council against including the property because it was already recently redeveloped. Doing so might strain the legal analysis required to defend the TIRZ in court and to secure approval for bond issuance, which need to be approved by the attorney general.

“Part of the challenge with adding the Snoopy PUD…is if we can’t make the ‘but for’ analysis then we can’t use that to support the bonds,” she said.

Fireside was referring to the legal analysis required to show that development in the area would not take place “but for” the public infrastructure investments under the TIRZ.

“The attorney general’s office will look very carefully if the bonds and the improvements we’re putting in meet that ‘but for’ test. And the Snoopy PUD is already developing, so it’s very difficult to make that analysis. So that is why the economics of it and the legal analysis resulted in that exclusion.”

Likewise, Council Member Alison Alter opposed inclusion of the Snoopy PUD in the zone, saying, “I don’t really understand the argument of the ‘but for’. It’s built. It’s there.” Including it “may call into question the whole TIRZ and create other hassles,” she said.

The council Monday ignored these warnings. Council staff had posted to the agenda two options for the TIRZ: one that included the new office tower, and another that didn’t. On Adler’s motion, the council voted to include the new redevelopment within the proposed TIRZ.

The development, now known as RiverSouth, is owned by Dallas-based Stream Realty Partners. During its recent redevelopment process, it was represented by Richard Suttle of Ambrust & Brown.

Trust indicators: Bulldog reporter Daniel Van Oudenaren is a journalist with 13 years experience in local, state, and international reporting.

Trust indicators: Bulldog reporter Daniel Van Oudenaren is a journalist with 13 years experience in local, state, and international reporting.

Who funds this work? This report was made possible by contributions to The Austin Bulldog, which operates as a 501(c)(3) nonprofit for investigative reporting in the public interest. You can help support this independent coverage by making a tax-deductible contribution. Contributions made by December 31, 2021, will the TRIPLED by matching national and local partners.

Related documents

Draft council ordinance establishing TIRZ, December 20, 2021

Amendment to TIRZ ordinance, December 20, 2021

TIRZ draft preliminary plan, December 20, 2021

South Central Waterfront Vision Framework Plan, June 15, 2016