Huge sections of Richmond are unaffordable for buyers

Households in substantial swaths of the Richmond region are no for a longer period inexpensive for the normal Richmonder to purchase.

Driving the information: Overall home sale rates have surged in recent a long time, but the boosts have been the highest and most remarkable in the after most inexpensive pieces of Richmond, Chesterfield and Henrico, a 3-yr research of Richmond’s genuine estate industry unveiled last week uncovered.

- Institutional buyers have driven considerably of the boost in Richmond’s formerly reasonably priced neighborhoods, snapping up as significantly as a quarter of each and every dwelling sale in excess of the previous 3 yrs.

- In the meantime, property finance loan programs have been denied at a bigger price in these parts than in other areas of town.

Why it matters: Richmonders who make the area’s median family cash flow of $66,719 a year or a lot less can’t afford to pay for to purchase a property in most of the town.

- The market is even considerably less reasonably priced for Black and Latino homebuyers due to the fact of present racial pay back disparities, for each the review.

What they are saying: “We are speaking about average-revenue people — not poor folks — who have nowhere to go,” an writer of the research, Ira Goldstein of Reinvestment Fund, reported in a presentation of the information.

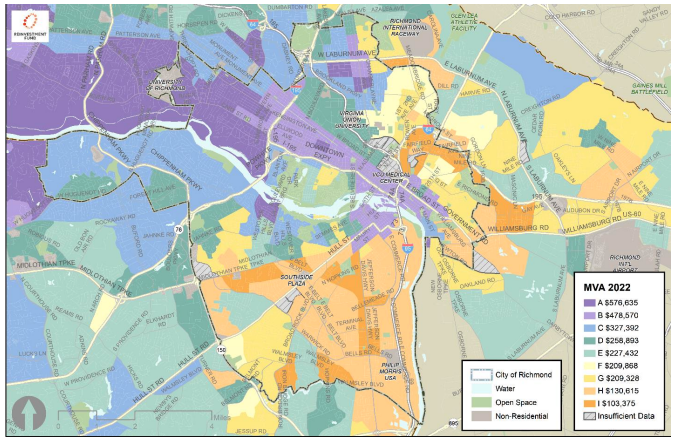

What is actually happening: A coalition of nonprofit fairness and housing groups analyzed a few a long time (2018-2021) of residential serious estate transactions in Richmond, Henrico and Chesterfield, in addition census and other community details to develop the 2022 Richmond Marketplace Benefit Evaluation.

- An MVA is a type of in-depth genuine estate research used by communities throughout the region to determine essential characteristics of an area’s housing sector for area policymakers and housing leaders.

The 2022 Richmond MVA was produced by a few mission-driven nonprofits — PlanRVA, Richmond Memorial Wellbeing Foundation and the Philadelphia-centered Reinvestment Fund — with funding from Virginia Housing.

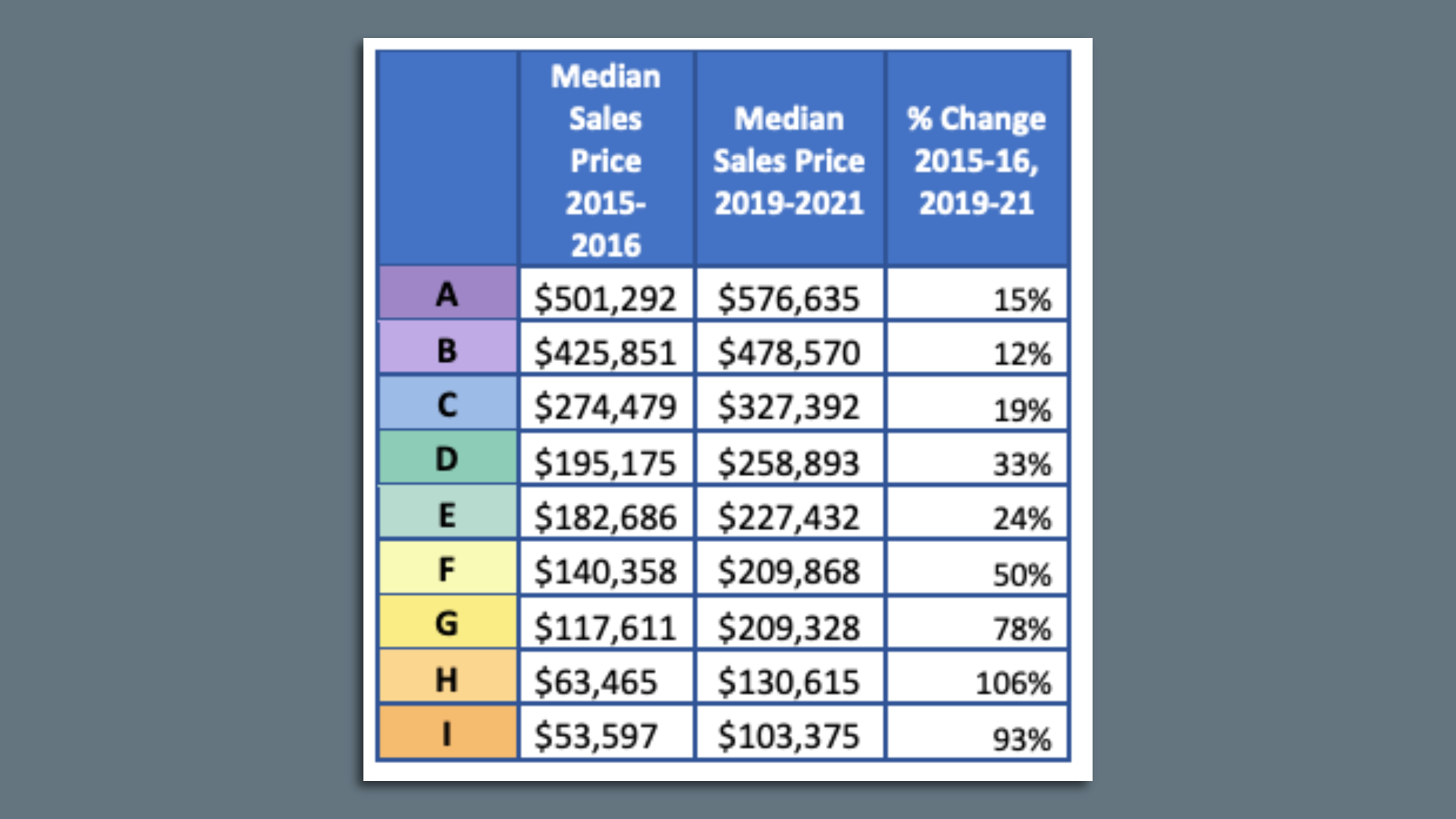

Zoom in: Home sale rates have risen higher than wages in Richmond, Chesterfield and Henrico in the past five many years, the review found, but sections of South Richmond, the East Stop and Highland Park saw the biggest bounce.

- Seeking at districts labeled by colour and letter in the previously mentioned chart, which breaks Richmond down into 9 districts dependent on housing characteristics, product sales costs jumped the most in the F, G, H and I districts among 2015-2016 and 2019-2021.

Of observe: Districts F, H and I also experienced a substantially greater share of revenue wherever house owners offered to investors, symbolizing 13{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, 18{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and 25{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} respectively of all residence revenue there in 2018-2021.

- Comparatively, districts A, B and C observed 3{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9}, 5{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} and 3{d4d1dfc03659490934346f23c59135b993ced5bc8cc26281e129c43fe68630c9} of people income go from house owner to investor.

Threat amount: The superior proportion of revenue to buyers from home owners in the the moment most cost-effective sections of town implies those house owners may not becoming acquiring the very best cost for their household, but relatively are staying specific and maybe taken gain of by traders, the analyze mentioned.

- Further, individuals neighborhoods are also household to primarily Black and Latino Richmonders, putting these people at higher risk of achievable displacement as growing residence values result in increased taxes, the review observed.